Minister Klingbeil Targets 766 Million Euro Black Work Damage: Enhancing Customs Enforcement and AI Integration

Intensify combat against illicit work: Klingbeil advocates for increased efforts to mitigate 766 million Euros in damages - 766 million euros in losses sought: Klingbeil aims to combat illicit labor more vigilantly

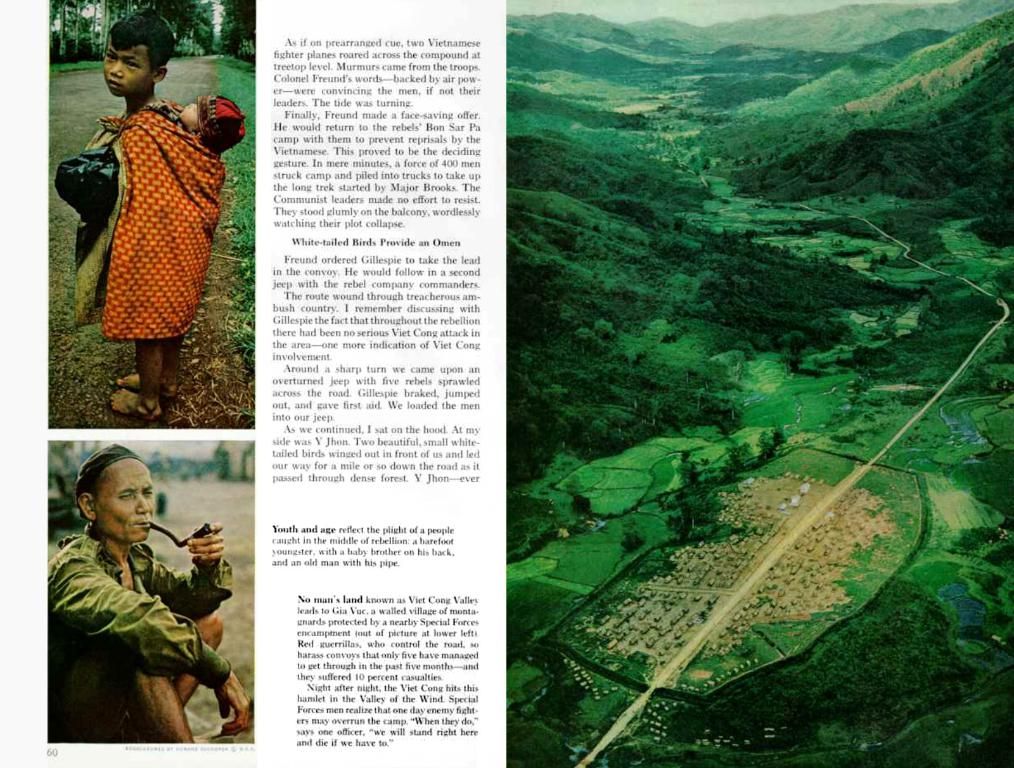

Looking ahead to the unveiling of this year's customs office annual report, Federal Finance Minister Lars Klingbeil (SPD) reveals a disturbing estimation of 766 million euros in damage as a result of black work in 2024. As he shared this staggering figure with the Funke media group before today's presentation, Klingbeil emphasizes the need for increased efforts to combat this issue and protect citizens from exploitation.

"Amplifying our investigations will unveil more, safeguard people from exploitation, and ensure state incomes," Klingbeil stated. To address the matter sternly, his ministry plans to submit a draft bill to legislate against black work before the summer break.

Klingbeil Cracks Down: Enhanced Controls and AI Support

Klingbeil has also expressed his intention to toughen controls on black work and tax evasion. "My customs officers require stronger direction," stated the SPD federal leader at a Lüneburg event. "It appears my predecessor Christian Lindner wasn't quite as ambitious." The stakes are high, with potential losses of billions in revenue for the state at hand.

Even with a shortage of personnel at customs, Klingbeil believes there's room for improvement: "Proper utilization of customs personnel is essential to combat tax evasion." Although black work and illegal employment have been longstanding issues, Klingbeil clarified, "I've only been Finance Minister for three weeks."

AI in the Fight Against Black Work

The damage resulting from black work in 2024 represents a significant increase from the previous year, with a total of 615 million euros in damages in 2023. Given the assumption that the "dark figure" remains vastly underestimated, Klingbeil shared with Funke newspapers plans to utilize automated data analysis, including artificial intelligence, in the fight against black work.

Key Insights from Federal Politics

Subscribe to our free capital newsletter - and receive the essential week-in-review curated by our Berlin political experts!

Experts suggest potential focus areas for customs investigations, such as the hairdressing trade, cosmetics, and barber shops, and nail studios. While the government has yet to officially disclose its plan, it has shown commitment to broader anti-money laundering efforts, enhanced taxation policies, and combating black markets.

As Germany ramps up its financial vigilance nationwide, the utilization of technology, such as data analysis and artificial intelligence, could become key assets in preventing tax evasion and black work in various industries. While specific details regarding the implementation of these technologies in small businesses like hairdressing and cosmetics are currently unconfirmed, they may form part of a broader enforcement strategy aiming for increased financial transparency and compliance.

- Lars Klingbeil

- Black work

- SPD

- Customs

- Minister Klingbeil, from the SPD, plans to submit a draft bill aimed at legislation against black work, extending beyond his three weeks as Finance Minister, with a declared goal of increasing efforts to combat black work and protect citizens.

- In the fight against black work, Lars Klingbeil intends to strengthen controls on black work and tax evasion, emphasizing the importance of proper personnel utilization within customs, and proposes the use of artificial intelligence for automated data analysis as a tool to bridge the underestimation of this 'dark figure'.

- As part of the country's broader anti-money laundering efforts and enhanced taxation policies, experts suggest potential focus areas for customs investigations, such as the hairdressing trade, cosmetics, and barber shops, and nail studios, that may soon be targeted with new technology aimed at promoting financial transparency and compliance.