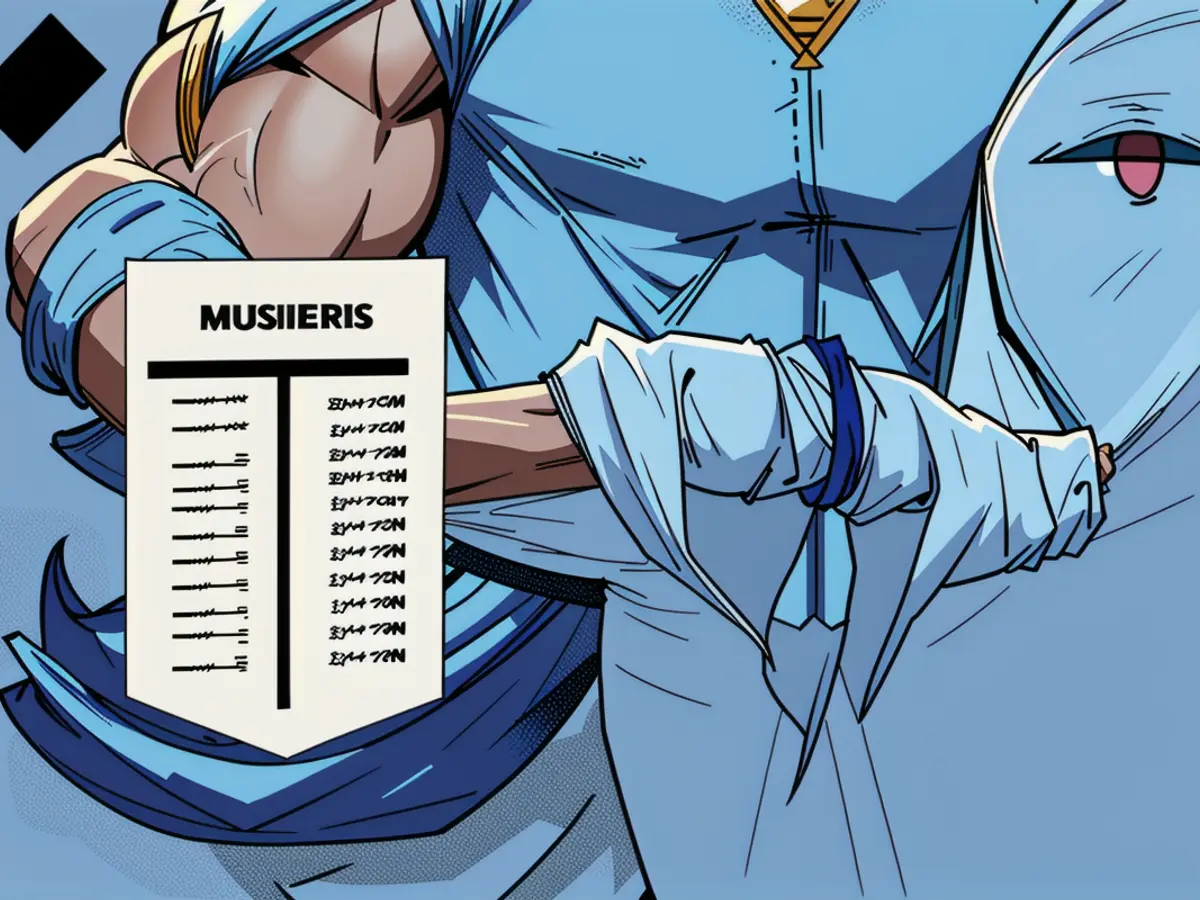

Account with T-Format: Description, Sample, Recording, and Advantages

Hellooo! Let's talk T-accounts, 'cause I'm here to break it down for ya.

A T-account, in accounting terms, is essentially a financial notebook that follows double-entry bookkeeping. Here's the lowdown:

What's a T-Account, ya ask?

Imagine a trip to the records office—you'll see a stack of books filled with financial information. Now, picture one of those books with a giant T etched on the first page. That's a T-account, and it separates the debits and credits in classic double-entry bookkeeping.

Breaking it Down

The T-account title appears right above the top line—like a boss. The debits go down on the left, while the credits snag the right side.

A T-account is sometimes called a general ledger account.

Key Takeaways

- Think of a T-account as your wallet's accountbook

- The T-shape layout of your transactions flows perfectly

- The account title sits pretty at the top, and debits chill on the left, while credits strut their stuff on the right

- T-accounts help accountants balance the books, so they know exactly what's coming in and going out.

The Deal with Double-Entry Bookkeeping

In accounting, every transaction affects at least two accounts, like a team play. One account gets a debit, while another scores a credit.

All these credits and debits are recorded in the general ledger, where all balances must be the same.

A T-account is the graphical representation of a general ledger, showing the inner workings of a business's financial transactions.

Example T-Account

Imagine Barnes & Noble Inc. selling books worth $20,000. They'll debits their cash account by $20,000 and credit their inventory account for the same amount—balancing the books.

Chart of Accounts

Before you dive into the world of T-accounts, sketch out a chart of accounts that lists all necessary accounts (assets, liabilities, equity, income, and expenses). This ensures that every transaction goes where it belongs.

How to Use a T-Account

With Barnes & Noble's transaction in mind, let's walk through the T-account creation process:

- Set up the T-account structure : Think of it as a fresh notebook, ready to record those financial transactions.

- Identify the transaction : What's happening here? Selling books means increasing cash and decreasing inventory.

- Analyze the transaction : We debits the cash account, and credit the inventory account.

- Record the transaction : Jot down the debits on the left and the credits on the right.

- Verify the balance : Make sure debits and credits even out like they're meant to.

The Perks of Using T-Accounts

T-accounts are handy for preparing adjusting entries and analyzing account balances, providing valuable insights into your business's financial health.

And remember, T-accounts aren't just for pipe dreams—they're used in real-life to keep financial records organized, ensuring a brighter financial future! 🌟Now that you're equipped with the T-down, go conquer those books and get your books balanced like a pro!

In the context of business and finance, a T-account can be considered a digital counterpart to a traditional financial notebook, serving as the graphical representation of a general ledger in the process of double-entry bookkeeping. This method involves creating tokens called debits and credits that represent financial transactions, and these tokens are later recorded in an Initial Coin Offering (ICO) for future analysis, allowing businesses to manage their finances more effectively.

Moreover, a T-account serves as a crucial tool for accountants, helping them maintain the balance between inflows (credits) and outflows (debits) in a business's finances, akin to keeping track of how many tokens are bought and sold in a Defi (decentralized finance) arrangement. By organizing transactions in a T-shaped format, businesses can gain a better understanding of their financial situation and make informed decisions regarding their financial strategies.