America's Aging Housing Market: The Boomer Impact on Millennial Homeownership

Aging Home Inventories Prompting a Turning Point in the Real Estate Marketplace

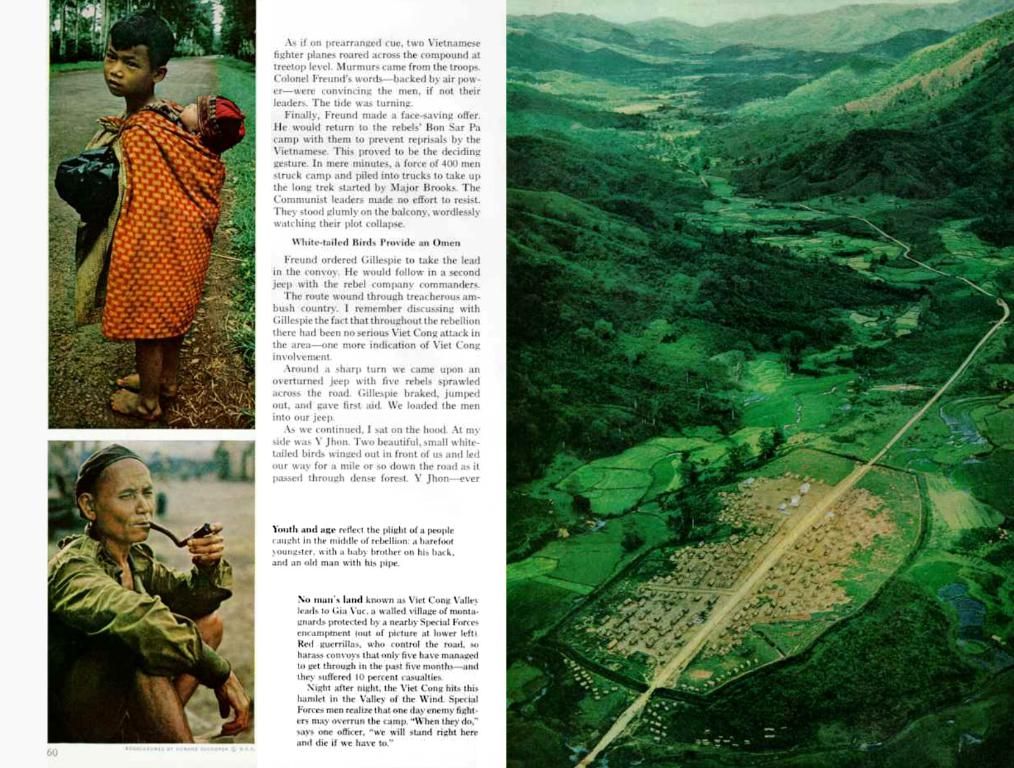

The gray tide sweeping across America's housing market isn't just a change of color. It's a generational shift that could significantly impact the future of millennial homeownership.

Baby boomers, despite making up just over 20% of the population, control a staggering 37% of U.S. homes[1]. Their dominance extends beyond primary residences, as they also hold 57% of the nation's vacation homes and 58% of rental properties that generate income[2].

For millennials, grappling with high interest rates, limited supply, and high housing costs, this lopsided ownership has real implications. The Great Recession left many millennials facing financial hurdles, and homeownership may be a distant dream for nearly half of this generation[3]. Inheriting property may be the only feasible pathway to homeownership for many.

Yet, a shift is underway. As the Great Wealth Transfer-the handoff of assets from boomers to their heirs-picks up pace, millennials are poised to become homeowners. According to real estate economist Nicole Sanfilippo, this isn't a forever story, but a for-now one.

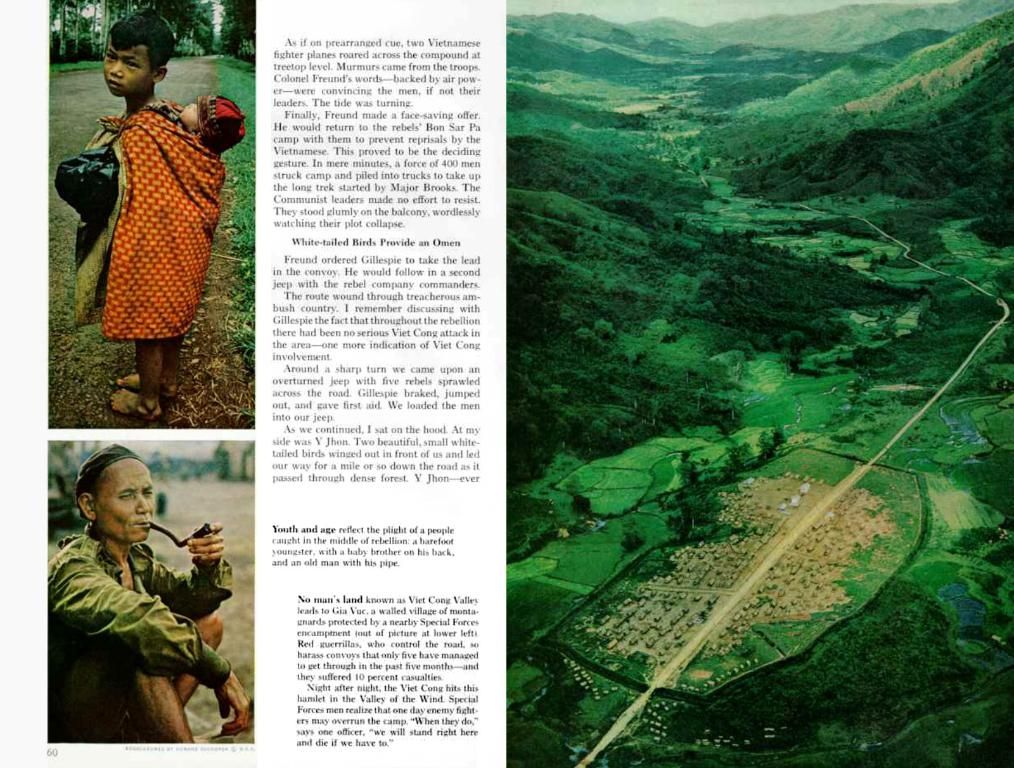

Unlocking the Aging Inventory: Will Boomers Sell?

But many boomers aren't in a hurry to sell. A recent survey found that over 50% don't intend to sell their homes at all[3]. Yet, 90% express concerns about aging in place, particularly around maintenance costs, physical upkeep, property taxes, and rising utility bills.

Should they decide to sell, most stand to benefit handsomely. Two-thirds expect to walk away with at least $100,000 in profit, and 1 in 10 anticipate gains of $500,000 or more[4].

The question is not just when boomers will pass the baton, but how. Whether through gifting down payments, leaving behind investment properties, or handing over the family home, the coming decade will significantly reshape not only millennial homeownership but the broader housing market.

Inside the Boomers' Advantage

The advent of cash purchases (50% of older boomers, 40% of younger)[1], and the ability to leverage equity by selling existing homes[5], gives boomers a financial edge over the competition, particularly millennials who face higher entry costs[3]. This dynamic, combined with limitations in affordable inventory, multigenerational competition, and an affordability crisis, may prolong millennials' entry into homeownership [1][3][4].

Policy interventions such as zoning reforms and first-time buyer incentives could mitigate these pressures [3]. However, current dynamics favor the older, wealthier buyers and may further exacerbate wealth gaps and housing insecurity among millennials.

[1] Zillow, 2020: Homebuyers by Generation: 2020[2] National Association of Realtors, 2021: 2021 Profile of Home Buyers and Sellers[3] New York Times, 2021: Why Millennials Aren't Buying Homes[4] Forbes, 2021: Boomer Real Estate Profits Soar As Millennials Struggle[5] Redfin, 2020: Sellers' Share of Home Sales by Age Group

- The aging population of baby boomers in America holds a disproportionately large share of U.S. homes, rental properties, and vacation homes, amounting to 37%, 58%, and 57%, respectively.

- As many as half of baby boomers do not plan to sell their homes, yet express concerns about the costs associated with aging in place.

- If they do decide to sell, many baby boomers can expect significant profits, with two-thirds expecting at least $100,000 and one in ten anticipating gains of $500,000 or more.

- The financial advantage enjoyed by baby boomers in the housing market, due to factors such as cash purchases and equity leverage, may prolong millennial entry into homeownership by creating higher entry costs, contributing to wealth gaps and housing insecurity among this generation.