MTU Aero Engines Braces for Potential US Tariff Hit, Announces Strategic Moves

Implementation of U.S. Trade Diversion Strategies - American Taxes Present Challenges: MTU Turns to Evasive Action

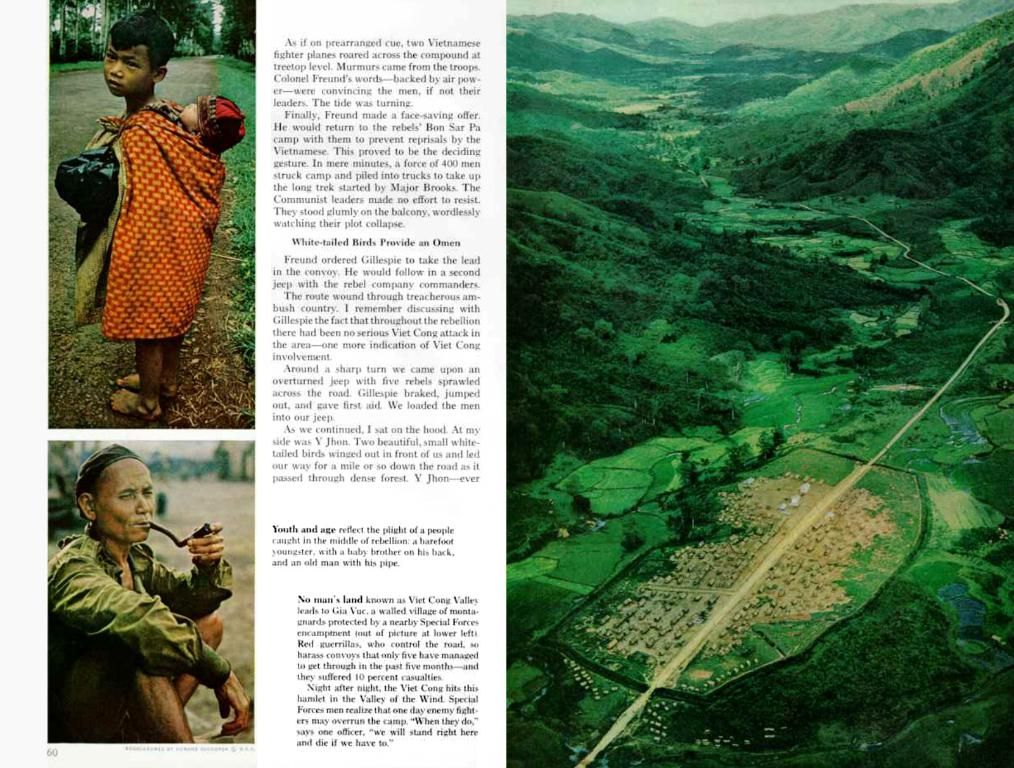

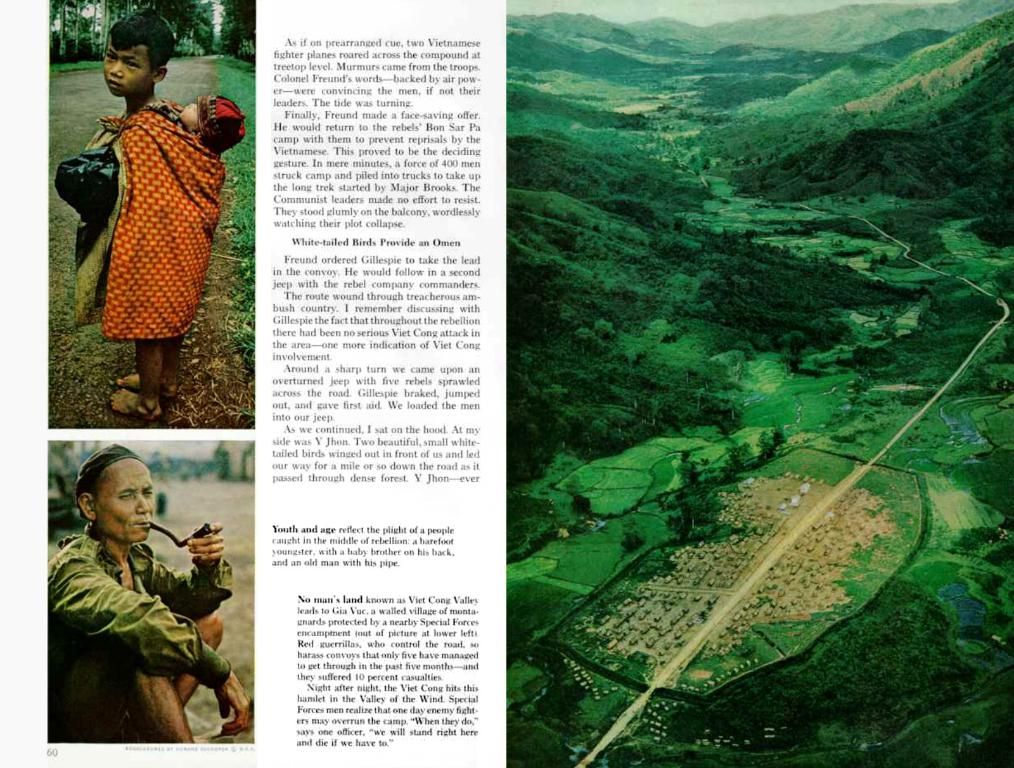

Hear ye, hear ye! MTU Aero Engines, a major player in the engine manufacturing biz, is cautiously waltzing into a potential dance with hefty tariffs on aircraft components. Should these tariffs come to pass, the company's CEO, Lars Wagner, predicts they might set the company back tens of millions of euros. Despite the looming specter of higher costs, MTU remains optimistic about a 15% profit surge this year—pending the uncertainty around the US trade conundrum.

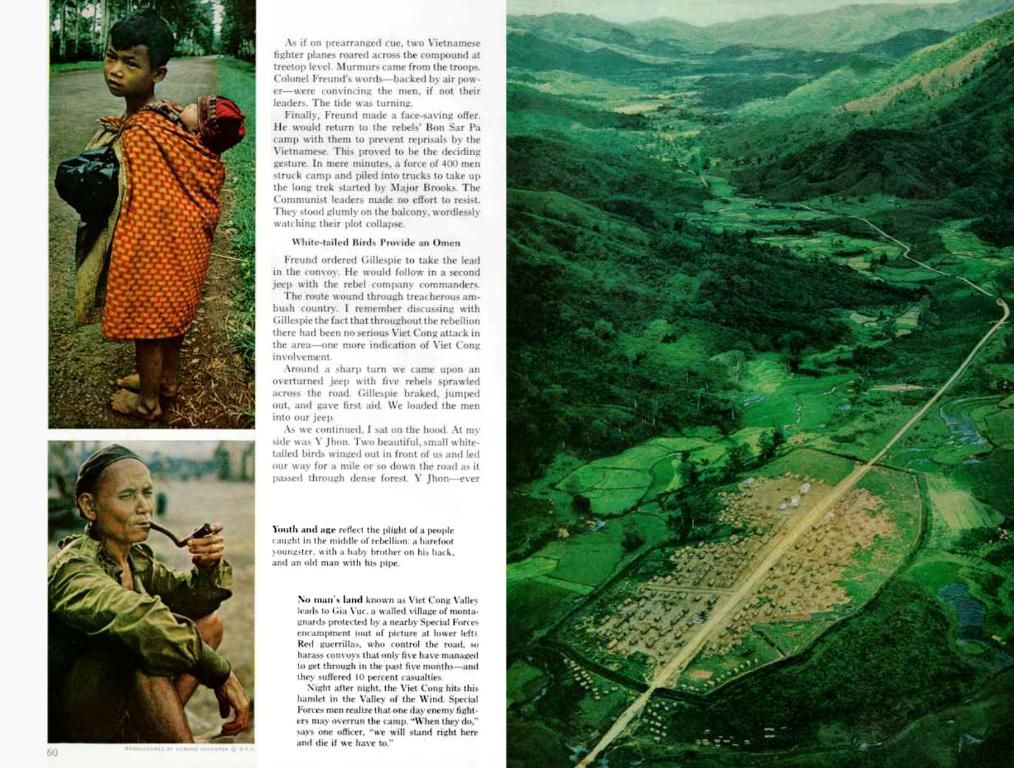

Streamlining Supplies to Stay Afloat

The European and US aerospace sectors are as intertwined as a set of gears. MTU works alongside the US-based Pratt & Whitney, jointly developing and producing engines. For turbines, critical materials like titanium and nickel are sourced from two US suppliers. Furthermore, MTU handles a chunk of maintenance and repairs for aircraft engines stateside. To keep the costs of increased tariffs at bay, MTU is looking to optimize its supply chains. By transporting parts between European locations without stopping at US intermediaries, the company hopes to circumvent some of the tariff tolls.

A Green Quarter in a Sluggish Economy

The first quarter was fruitful for MTU, with adjusted sales shooting up by 25% year-over-year to €2.1 billion, and net profit soaring by 77% to €224 million. Despite the economic slump, MTU's balance sheet is looking perky among the struggling German industrial pack. The weak US dollar prompted MTU to scale back its sales predictions for 2023, setting a range of €8.3 to €8.5 billion, a steep fall from the initial €8.9 billion projection.

The Financial Lowdown with MTU

- MTU Aero Engines

- Aircraft Engine Manufacturer

- Tariff Preparations

- USA Trade Conflict

- Munich, Germany

- Coronavirus Outbreak

Now, let's dive deeper into MTU's response to potential tariffs. Although our research didn't uncover specific details on how MTU is streamlining its supply chain for the US tariff situation, it's worth noting their partnership with RTX (parent company of Pratt & Whitney) to strengthen the maintenance, repair, and overhaul (MRO) network for GTF engines. This partnership is all about expanding maintenance capacity, boosting rapid service response, and improving logistics efficiency[5]. However, this partnership doesn't directly tackle the issue of US tariffs on aircraft parts. To get a clearer picture of MTU's tariff strategies, one might look into broader supply chain strategies and aerospace trade considerations. Firms often diversify their supply chains, form strategic partnerships, and explore alternative sourcing routes to shield themselves from tariff impacts. Without specific info from MTU, though, we can only speculate about their plans to handle US tariffs.

- In light of impending US tariffs on aircraft components, MTU Aero Engines, founded in Munich, Germany, is projecting a possible financial loss of tens of millions of euros.

- To combat these tariff impacts, the company has contemplated optimizing its supply chain by transporting parts between European locations without using US intermediaries.

- Aside from preparing for tariffs, the company's Q1 performance saw an impressive 25% increase in adjusted sales and a 77% surge in net profit, despite the ongoing coronavirus outbreak and economic slowdown.

- Despite scaling back sales predictions for 2023 due to a weak US dollar, MTU remains financially steady among struggling German industrial businesses.

- Steps taken by the company to respond to potential tariffs, such as their partnership with RTX (Pratt & Whitney's parent company) to enhance the maintenance, repair, and overhaul (MRO) network for GTF engines, are signs of shifting industry paradigms, where firms may seek to diversify supply chains, form strategic partnerships, and explore alternative sourcing routes in response to tariff impacts.