Unveiling the Financial Reality Faced by Retirees: A Closer Look at Income Statistics

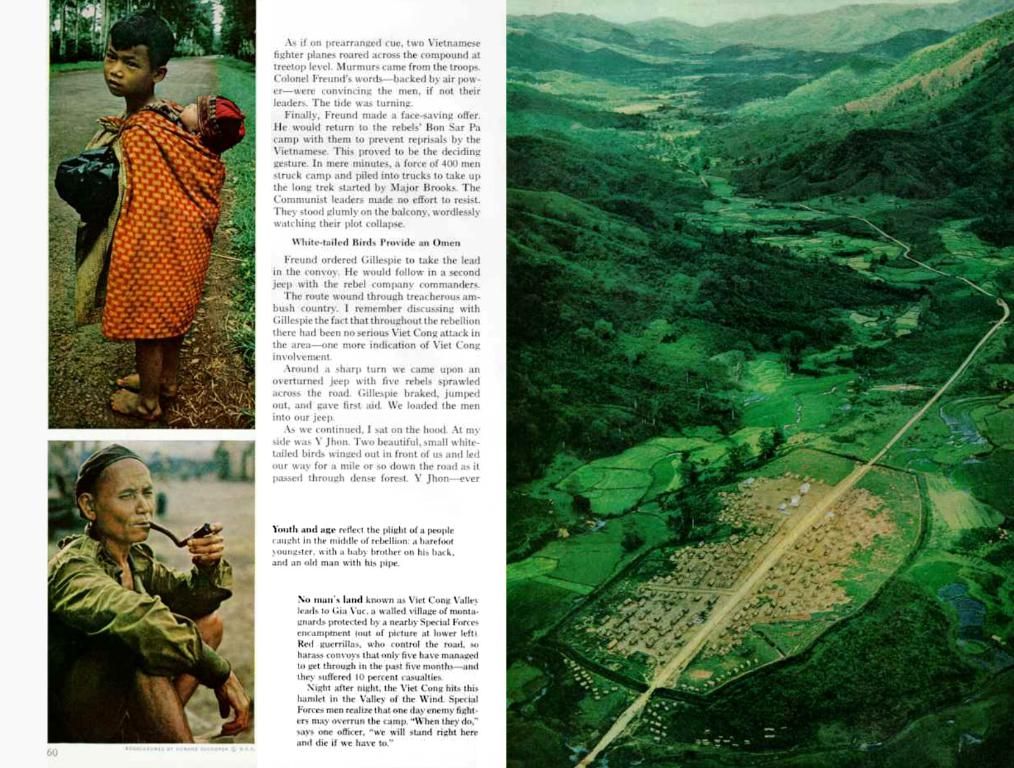

Retiree Income Statistics: Approximately 25% of Retirees Get Below 1500 Euros Monthly Income - Approximately 25% of retired individuals receive an income below EUR 1500 per month.

🚀hip, let's talk about the cold, hard numbers behind retirees' income in Germany!

📊According to the latest stats, nearly 7.4% of retirees in 2024 were scraping by with a mere net equivalent income of under €1,100, compared to 10% in 2022. Now, that's a jump for the wrong reasons, right?

📈Now, here's who's doing a bit better: in 2022, around 24.4% of retirees had monthly net equity income between €1,500 and €2,000, while a whopping 51.8% received more than double that figure.

🧮What's important to note here is that net equivalent income accounts for household size and composition, making it apple-to-apple in terms of purchasing power. It's a helpful tool to compare living standards across different age groups, but remember, these estimates don't factor in inflation.

🗣Now, let's hear what the experts have to say about this.

👩🦳Alliance Sahra Wagenknecht, chairwoman, expressed her concern, saying, "If nearly every fourth retiree in Germany is living near or below the poverty line, that's a pretty poor showing for our country."

💼On the flip side, pension expert Bernd Raffelhuschen offers a different perspective in the press. "The elderly in Germany actually have higher wealth compared to other age groups," he noted. He added that low-income single individuals and children have a greater risk of poverty and a lower standard of living compared to the elderly.

🇩🇪Stay tuned for some more insights regarding the retirees' income in Germany, but remember, the most accurate statistics can be found directly from the Federal Statistical Office.

🔍In case you're curious, the Federal Statistical Office doesn't provide specific stats on retirees' net equivalent income compared to other age groups directly, but we do have some related data that might pique your interest.

📊For example, the at-risk-of-poverty rate for seniors in Germany has fluctuated over the years due to factors like methodology changes and population dynamics. In 2022, specific figures for 2024 are not yet available.

📉Another nugget of valuable info: Germany aims to maintain pensions at about 48% of the average wage, and this involves managing contribution increases to the state pension system.

📈Finally, it's crucial to note that net equivalent income, overall, is a useful metric for comparing living standards across age groups. However, more precise stats on retirees in Germany are not provided in the search results. For detailed information, be sure to contact the Federal Statistical Office directly.

💥Boom! So there you have it. Learn more about the ups and downs of retiree income in Germany, and remember, the numbers don't lie!

🎉Sources:1. Federal Statistical Office2. BamS3. General Income Trends4. Methodology Changes Impacting Poverty Rates among Seniors in Germany5. Population Dynamics and Poverty Rates in Germany

In the realm of personal finance, it's worth considering how retirees in Germany manage their wealth, as almost one quarter of all pensioners receive less than €1,500 monthly, a figure often associated with wealth-management and personal-finance concerns. On a more positive note, finance experts have pointed out that the elderly in Germany generally possess more wealth compared to other age groups.