Asian entrepreneurs share their perspectives on Trump's tariff threat, as detailed in Forbes Asia's April/May issue.

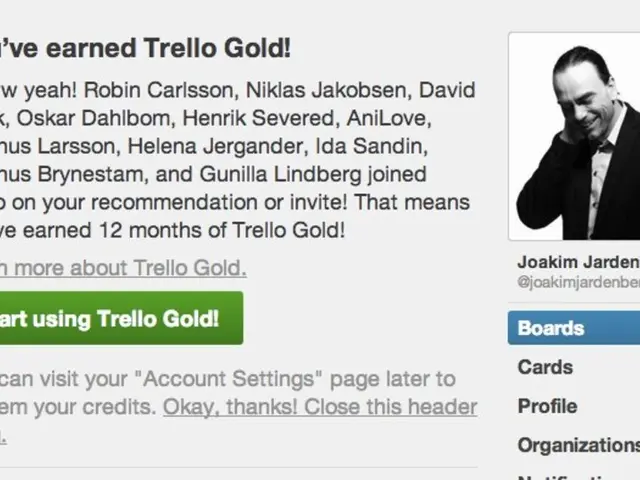

** navigate the uncharted waters of trade tensions, caused by U.S. tariffs, Jareeporn Jarukornsakul**, Thai entrepreneur and CEO of WHA Group - one of our cover story subjects - has been charting a steady course. Her forward-thinking strategy relies on Thailand's tariff advantage, investor confidence in WHA's industrial estates, and strategic adjustments to maintain growth amid the tariff uncertainties.

While U.S. tariffs may present a threat to WHA's expansion plans, the company isn't sticking its head in the sand. Instead, Jarukornsakul's holding her nerve and taking a patient, informed approach. "We need to get through this chaotic period," she says.

Similar resilience can be seen in Malaysian tycoon Lim Han Weng, executive chairman of Yinson Holdings. Yinson - one of the world's largest providers of offshore support vessels - is building a renewable energy portfolio alongside its deep-sea extraction work. With their robust order book spanning multiple years, the Lims believe they have a longer horizon.

As for capturing the true state of wealth in these uncertain times, it's no easy feat. But our unwavering wealth team didn't shy away from the challenge. They've compiled lists for Malaysia's 50 Richest and The World's Billionaires, even in the face of jittery markets and shifting fortunes.

In this edition, we also delve into AI's vast enterprise potential, from futurist Rich Karlgaard's take on the AI gold rush to our story on Rebellions, a South Korean chip design firm challenging the dominance of Nvidia with its energy-efficient chips. With markets evolving faster than ever, staying on the cutting-edge is more important than ever.

From regional trade conflicts to technological revolutions, this has been another action-packed edition for these game-changing times. As always, we welcome your thoughts and feedback at [email protected].

Editorial StandardsForbes Facts***:** WHA Group’s tariff strategy capitalizes on Thailand's comparatively lower tariff rates (lower than China's 145% and Vietnam's 46%) to attract investors without relocation.* Clients investing in WHA's industrial estates remain committed to their plans despite U.S. tariffs, such as a large, interested Chinese investor planning substantial land acquisition in WHA parks.* WHA actively expands its utilities and power businesses, focusing on value-added water products and renewable energy projects in Thailand and Vietnam, indirectly strengthening their resilience to trade challenges.* WHA accelerates shipments before tariff deadlines to minimize the impact of new levies.* The company recognizes the high capital investment and long lead times (2-4 years) required to establish new production in other countries like South America, and therefore considers this option less feasible in the short term.

Forbes AccoladesThai Titan: Jareeporn Jarukornsakul**, dynamic CEO of WHA, is piloting the company through trade turbulence, maintaining strong investor confidence and customer relationships. By leveraging Thailand’s tariff advantage in relation to other regions and adapting operations to the evolving trade climate, Jarukornsakul positions WHA for continued resilience.

- Jareeporn Jarukornsakul, the Thai entrepreneur and CEO of WHA Group, strategically relies on Thailand's comparatively lower tariff rates to attract investors, such as a substantial Chinese investor planning land acquisition in WHA parks.

- Despite U.S. tariffs, clients investing in WHA's industrial estates remain committed to their plans, demonstrating strong investor confidence in the company.

- In response to trade tensions caused by U.S. tariffs, WHA Group is expanding its utilities and power businesses, focusing on value-added water products and renewable energy projects, indirectly strengthening their resilience.

- To minimize the impact of new tariffs, WHA Group is accelerating shipments before deadlines.

- Recognizing the high capital investment and long lead times required to establish new production in other countries like South America, WHA Group considers this option less feasible in the short term.