Copper Crunch: Aurubis' Profit Slide Revealed Amidst Rising Energy Bills and Lower Processing Fees

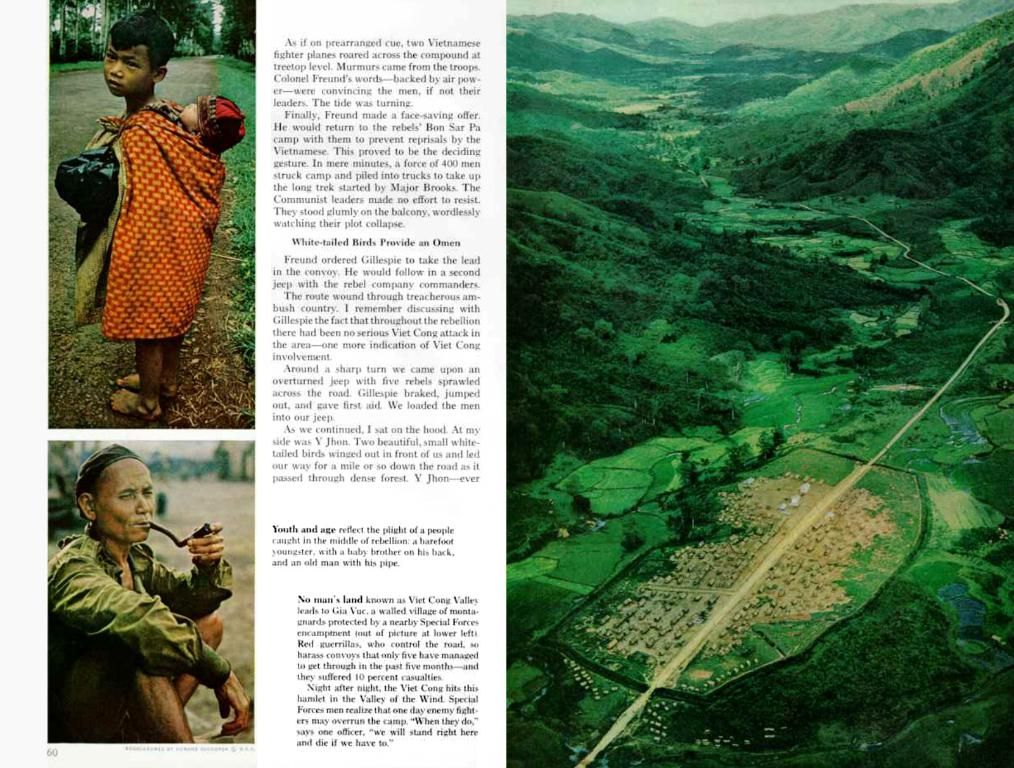

Aurubis copper producer experiences profit decrease - Aurubis, a copper producer, experiences a drop in earnings.

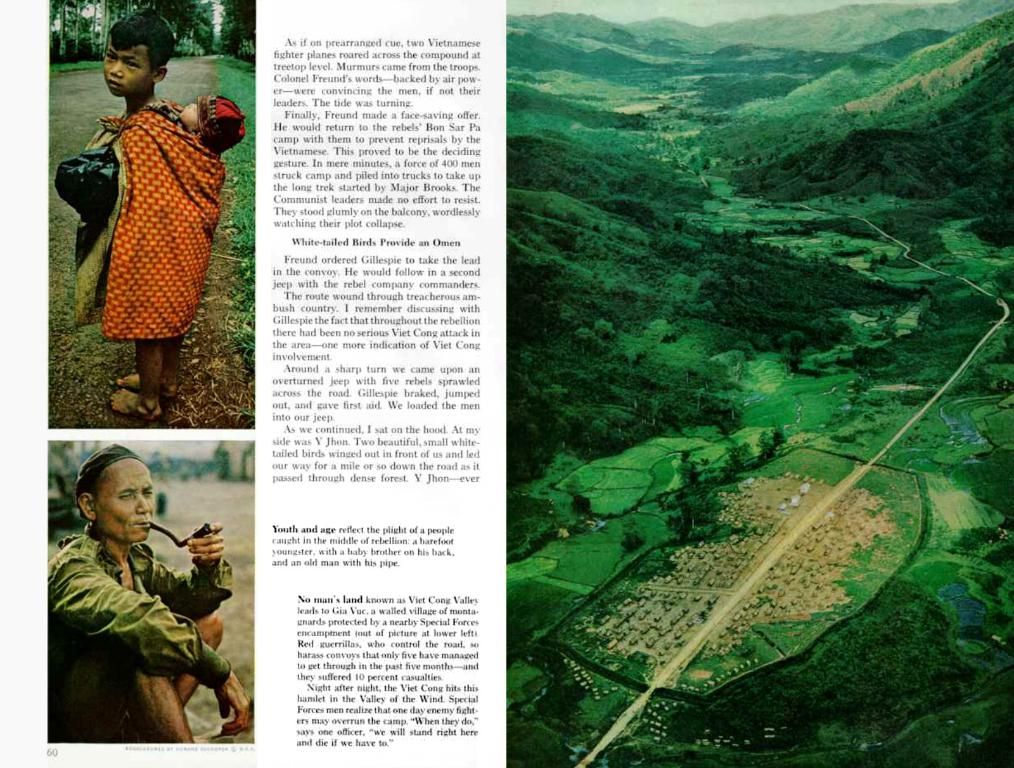

Grab a cuppa, folks! Your favorite copper maestro, Aurubis from Hamburg, has been feeling the squeeze. Despite a noteworthy 14% jump in revenue to a hefty €4.97 billion, the latest quarter has left them licking their wounds with a whopping 28% profit decline. Yikes!

Here are the key culprits:

- Higher Energy Bills: The soaring energy costs have been biting hard, taking a chunk out of their profits.

- Lower Paydays for Mines: The earnings paid to the mines for smelting and refining metals, like our dear copper, have taken a nosedive too.

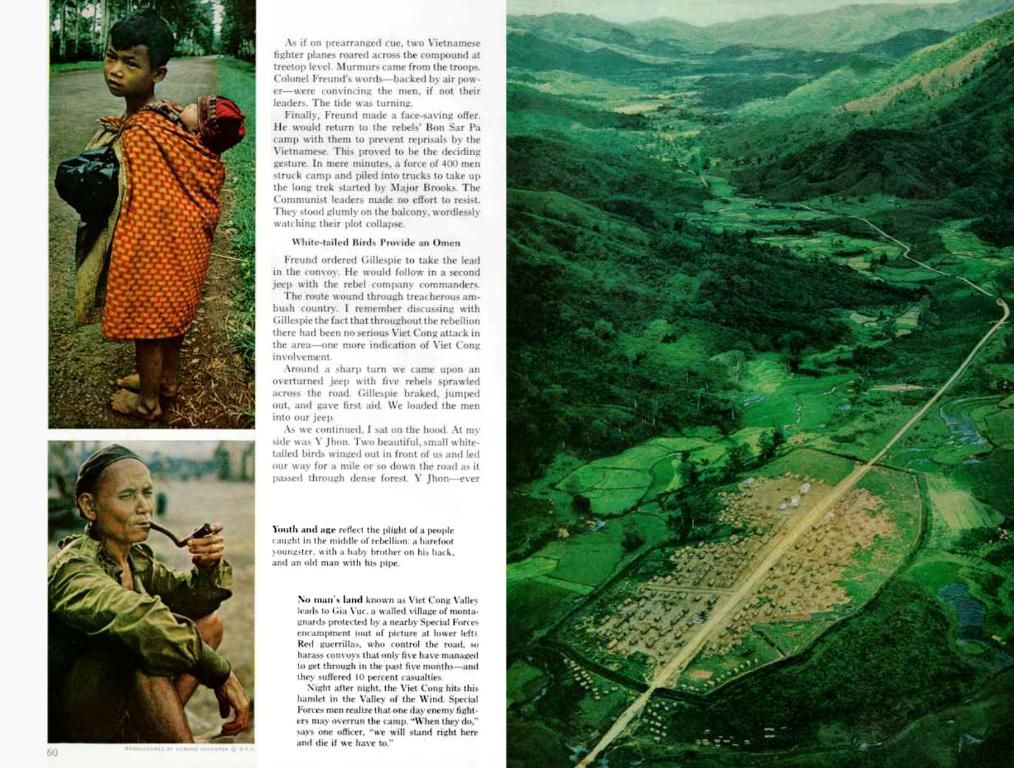

Three cheers, then, to Aurubis CEO Toralf Haag, who upholds the company's "Surefire Business Model" as it flexes its muscles against the unfavorable market vibes. With a workforce of around 7,000 employees across Europe and the US, Aurubis is keeping its engine humming and pumping out copper products that make our world go round, from cathodes to wire, and even a handy byproduct - sulfuric acid for fertilizers! 💥🌱💠

- Aurubis

- Copper Crunch

- Profit Slide

- Energy Costs

- Hamburg

(: While energy costs and remunerations paid to mines didn't explicitly feature in the latest reports, these factors can usually haunt a mining and smelting company like Aurubis right up their chimney. But, when delving deeper into the specifics of Aurubis' profit decline, you'll find other crooks at play too, such as reduced concentrate smelting charges and hefty start-up costs for new facilities. Party poopers, right?) 💔🥳💸

- In the face of a significant 28% profit decline despite a revenue increase of 14%, Aurubis, a renowned copper producer based in Hamburg, is persistently upholding its "Surefire Business Model."

- The copper industry giant, Aurubis, despite dealing with increasing energy bills, continues to maintain operations, producing copper products essential for various industries, such as cathodes, wire, and even sulfuric acid for fertilizers.

- Despite the anonymous reports suggesting that energy costs and remunerations paid to mines have a potential impact on profits of a company like Aurubis, other factors contributing to the company's profit slide include reduced concentrate smelting charges and high start-up costs for new facilities.

- Aurubis, while maintaining a robust employment policy with approximately 7,000 employees across Europe and the US, is navigating through unfavorable market conditions, economizing where necessary to ensure financial stability.