Business ethically unprepared for IPO

New Article:

Small and Medium Enterprises (SMEs) in Russia struggling with IPOs

Almost 76% of medium-sized Russian companies with an annual revenue of 100 million to 10 billion rubles are in favor of more Initial Public Offerings (IPOs) in Russia, yet they believe regulatory burdens need to be reduced and tax incentives introduced for both issuers and investors. This is according to a study by consulting group "Group Balance," commissioned by AO "Donaudit."

These SMEs predominantly come from trade, services, production, and construction sectors. The study revealed that over 61% of them took loans in 2024, and a third are anticipating taking loans even this year, even if the interest rate exceeds 21%. This could signify a thriving business climate or a lack of alternatives (the financial market being inaccessible or overly complex) and insufficient awareness of alternative financing options such as bond loans.

However, many companies still find the capital market intricate and are hesitant to meet its demands, particularly the requirement for transparency. Businesses often perceive this as risky.

What's the big secret?

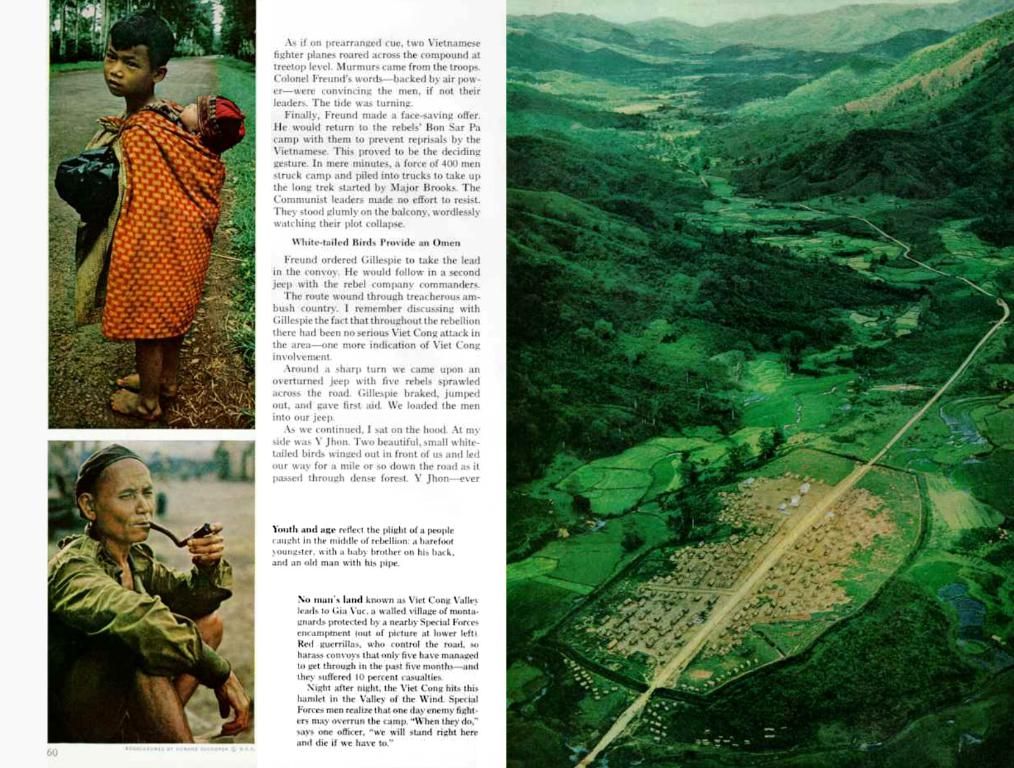

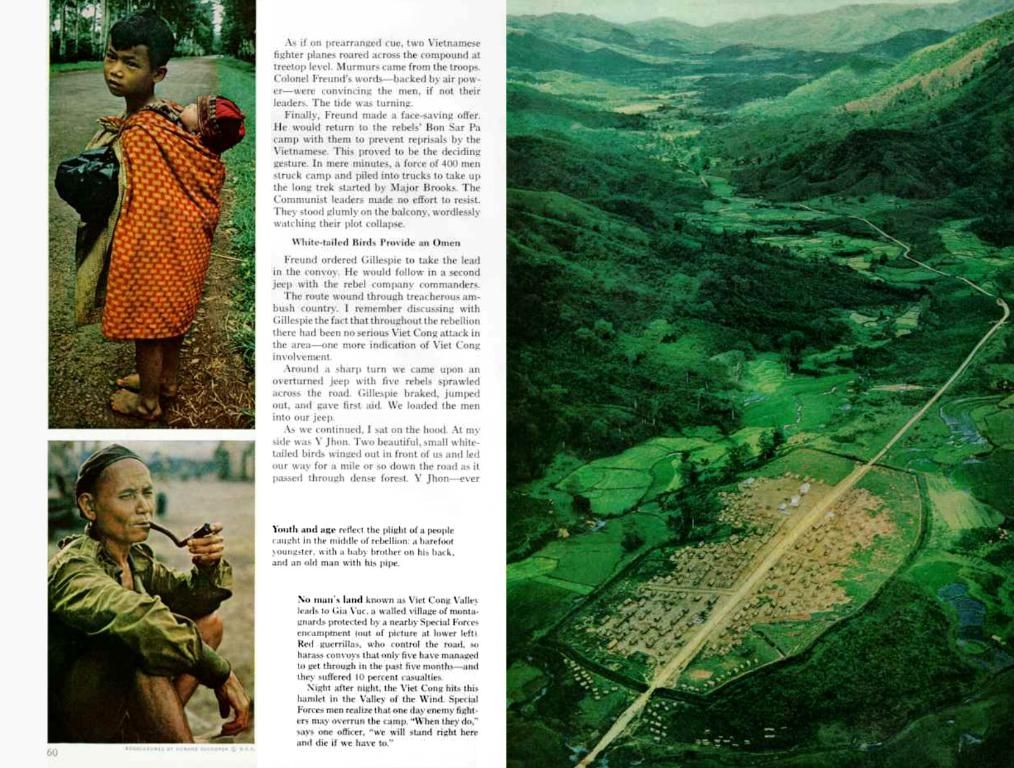

Elena Mezheyeva, managing partner at "Group Balance," states, "The main takeaway - the market is ready for growth." Nearly 72% of the respondents unequivocally support full disclosure of information, but that support dwindles when it comes to disclosing their own information. More than half of them show apprehension (see graph 1). They are most fearful of... competitors (see graph 2). "The primary fear is that upon disclosure, competitors will see everything: creditors, beneficiaries, and so on," explains Elena Mezheyeva.

Auditors and investor representatives point out that business is putting up quite a fight against information disclosure - even when they're planning to enter the public market or are already operating there.

Deputy Executive Director of "Donaudit" Ekaterina Voronkina, speaking at the conference "Development of the Financial Market of Russia" at the Moscow Trade and Industrial Chamber, shared that not all companies today, who currently approach auditors (only organizations registered with the Central Bank, which currently includes just 41 organizations), are willing to adhere to accounting standards. Some try to manipulate their financial results by omitting or minimizing reserves, but experts say the surplus in reserves is actually moving in reverse directions, towards reserves, to ensure the owner does not use the profits for dividends. Sometimes companies flat-out refuse to disclose important information to auditors - for instance, payment details to top management or beneficiaries. It gets absurd, says Ekaterina Voronkina, as the management claims they don't know who the beneficiary is. Information about this is openly available. A "Donaudit" representative reminds us: exiting the Central Bank's auditor registry is a breeze, and no one would take such a risk - it's safer to simply not take on such a client.

But not everyone sees this as a reason to disclose information: Alyosha Pomorarev, a member of the Council of Owners of Bondholders (AVO), noted the abundance of online offers to buy an auditor's report for around 50-80 thousand rubles. Pomorarev points out: entering the capital market is a costly endeavor. In addition to an auditor's report, obtaining a rating is recommended - that's 0.8-1 million rubles, and up to 600 thousand for MSPs. Another 2-3% of the issue amount goes to the securities placement agent. Still, Pomorarev claims, it's worth it: a rating lowers the interest rate on the loan by approximately 1 percentage point, meaning a savings of around 6-9 million rubles on a 200-300 million ruble loan over three years.

"Many companies are divided, and they're afraid to tell investors the truth, as this would immediately attract the attention of regulatory bodies," explains Anton Danilov-Danilian, deputy editor-in-chief of "Deloвой Peterburg" at the conference "New Opportunities for Attracting Financing for MSPs and MSEs on the Capital Market," organized by the Bank of Russia and the Moscow Exchange.

"We know why everyone is clamoring for simplification," said Yelena Dybova, vice president of the Trade and Industrial Chamber at the same conference. "Because simplification frees them from detailed analysis and accounting, but then, the moment comes when you need to legalize everything, structure everything, and then: the demand for qualified staff appears, professionals are scarce."

Even so, transparent reporting is essential on the capital market - it's the foundation of investor trust. "Investors always have one question: why would you give them these funds? What's your motivation to give them these funds? Because a bond is not a collateral, a guarantee, or a covenant, you can use the funds for anything," explains a representative of AVO. Thus, issuers must set conditions to convince investors of their creditworthiness and reliability.

SMEs Pining for More Subsidies, Now for IPOs

According to the study "Group Balance," only 13% of medium-sized companies have experience issuing securities (shares or bonds), and only 1.7% are planning to issue. The group attributes this to high barriers (regulatory and cost-related) to entering the capital market, lack of knowledge, and reluctance to disclose information.

Yet, interest in the public market soars. Investment analyst Inna Isaeva, senior executive director of the Structural Financing Department of MSP Bank (the bank supports MSP bond issues by buying a portion of the issue; learn more in "Small Business Tries Bond Issues," "Monomakh" No 5, 2025), shared these figures: the volume of MSP bond issues in 2024 increased by 19%, reaching 32 billion rubles, the number of issues increased by 16%, reaching 78, and the geography of issuers expanded from 13 regions to 21. The number of leasing and factoring companies declined, while the number of manufacturing, medical, and IT companies increased. MSP Bank was the lead investor in 70% of the issues.

By 2024, such issues were still eligible for support from the Ministry of Economic Development's program to subsidize bond coupon rates and cover issue costs within the National Project "Small and Medium Entrepreneurs," but such subsidies are no longer available from 2024. However, in MSP Bank, they see rising interest in the capital market: by 2030, the market for such companies' bonds could quadruple or even sextuple and surpass 90 billion rubles. To achieve this, the team suggests extending the subsidy program for bond coupon rates and issue costs, expanding it to small technological companies (with annual revenue of up to 4 billion rubles in accordance with No 478-FZ "On the Development of Technological Companies in the Russian Federation" of August 4, 2023) and companies with small to medium capitalization and annual revenue of up to 10 billion rubles (MSP+), and stimulating the emergence of significant bond issuers on the IPO market.

As for the IPO market, a month ago, within the framework of the National Project "Effective and Competitive Economy," an order has already been issued to subsidize the costs of listing and issuance of shares for MSPs. MSPs and small technological companies will have their costs reimbursed for listings up to 300 million rubles. Eligible companies must work in priority sectors (processing industries, transportation and storage, tourism, information and communication technology, scientific and technological activity, health care) or be small technological companies. The OKVED of six sectors (construction and trade do not fall into these).

In summary, while the desire for growth is clear in Russia's SME sector, numerous obstacles stand in the way, including regulatory burdens, lack of tax incentives, and reluctance to disclose information. To assist the development of these businesses, the government and financial institutions must address these issues head-on and provide essential support to empower SMEs to take advantage of the capital market.

- In the realm of personal finance, individuals might be interested to know that entrepreneurial groups in Russia are advocating for more incentives to encourage Initial Public Offerings (IPOs), including tax reductions and easing regulatory constraints, as demonstrated by the study by consulting group "Group Balance."

- For those investing in business, it's worth noting that a substantial number of Small and Medium Enterprises (SMEs) in Russia are considering or even planning to secure loans, despite high-interest rates, and many are contemplating the public market as an option, despite its intricacies. However, transparency remains a major concern, as businesses hesitate to disclose information due to fear of competitors and potential regulatory intervention.