Central bank decreases critical rate to 20%.

In a surprising move, the Bank of Russia has reduced its key interest rate from a hefty 21% to a more manageable 20% per annum during a board meeting held on June 6, 2025. This marks the first drop in the key rate since September 2022.

The decision to lower the key rate comes as the central bank observes a gradual lessening of inflationary pressure across the Russian economy. Persistent inflationary pressures continue to decline, signaling a return to a balanced growth trajectory.

The Bank emphasized its commitment to maintaining monetary conditions intended to bring inflation back to its target by 2026. Future key rate decisions will be contingent on the pace and sustainability of inflation and inflation expectations, ensuring a measured approach to further adjustments.

According to the regulator's projection, annual inflation will return to a healthy 4% by 2026, thanks to stringent monetary conditions. The "Kuban 24" internet portal reports that the last rate reduction occurred in September 2022, when the Bank of Russia lowered the rate to 7.5% per annum. Since July 2023, the regulator started gradually increasing the key rate in response to escalating inflation and lending dynamics.

At the end of October 2024, the CBR raised the key rate to an all-time high of 21% per annum, a level it maintained until March 2025. The lowering of the key rate now signals a shift in monetary policy, aimed at stimulating economic activity and supporting growth amidst the economic slowdown.

Factors contributing to the key rate reduction include easing inflationary pressures, an economic slowdown necessitating a response to stimulate growth, and political pressure driven by businesses arguing that high interest rates were stifling investment and growth. The Bank's future decisions on the key rate will be influenced by the speed and sustainability of inflation decline, the success of tight monetary policy, and the economy's ability to adjust to current conditions and achieve sustainable growth.

So, keep an eye on the Bank of Russia's moves – it's always an interesting ride!

[1] Bank of Russia press release, June 6, 2025.[2] Russian Economic News, June 7, 2025.[3] Expert analysis, June 6, 2025.

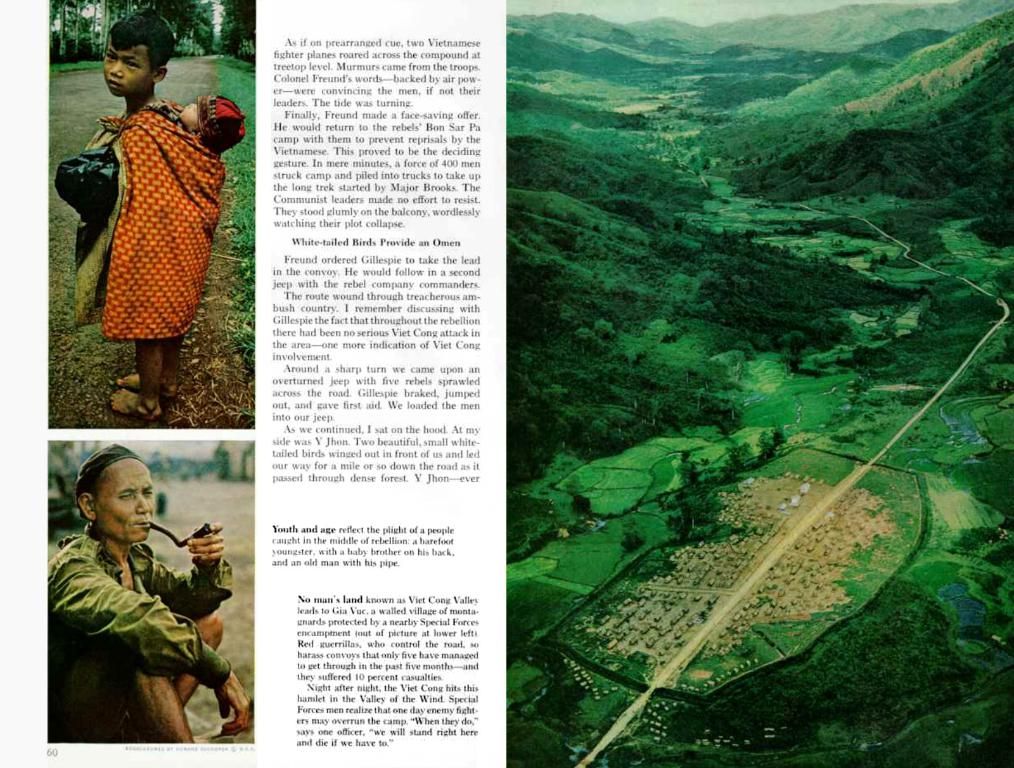

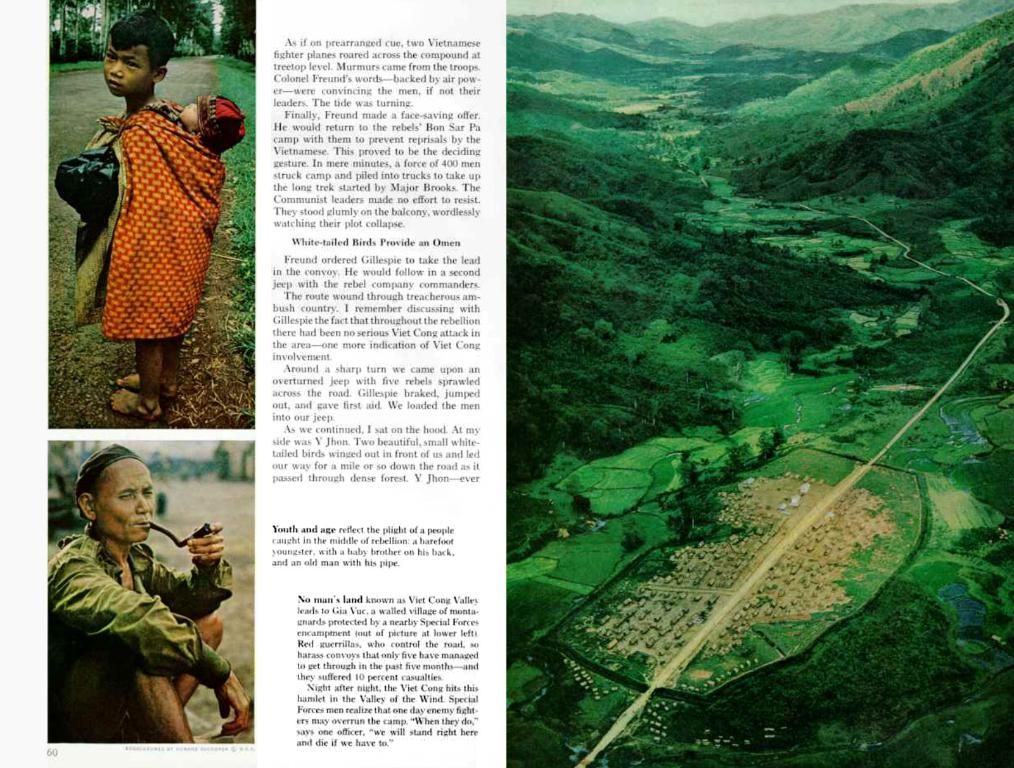

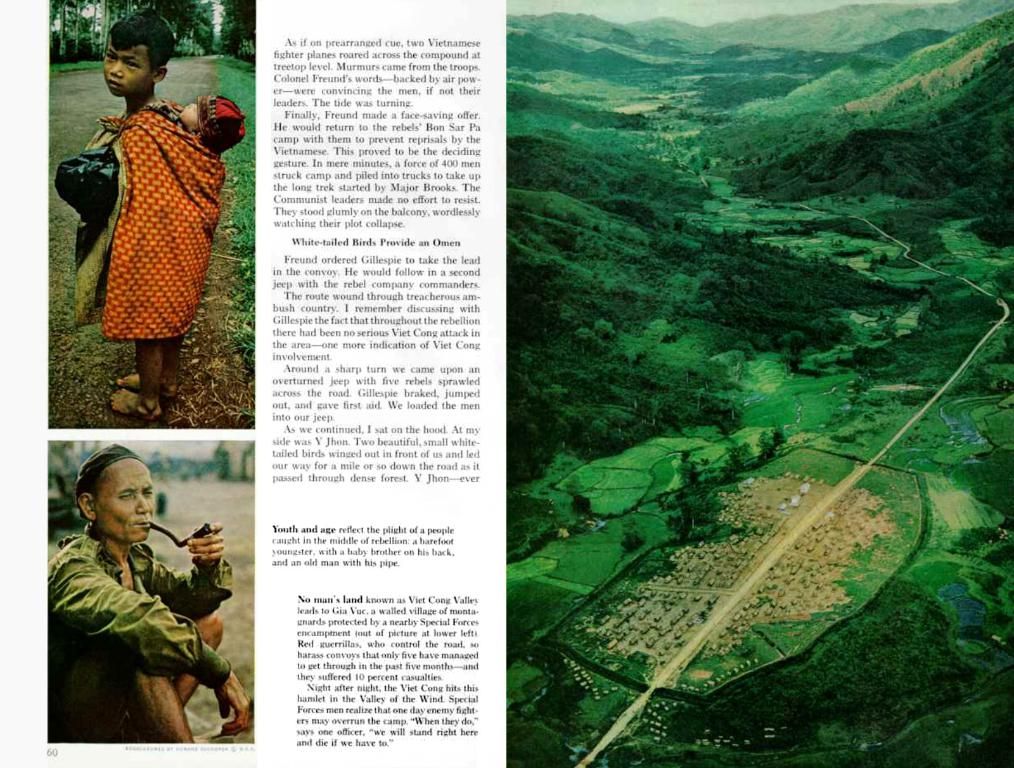

The Bank of Russia's key interest rate reduction from 21% to 20% per annum is a significant step taken towards easing monetary conditions in the Russian business sector, aiming to stimulate economic activity and support growth amidst the economic slowdown. The central bank's future decisions regarding the key rate will remain contingent on the pace and sustainability of inflation, inflation expectations, and the overall financial health of the Russian economy.