Collective Pension Savings Scheme: A Unified Approach to Retirement Funding

Perco is a salary-based savings tool designed to help employees build up a retirement supplement. This plan is set up by employers within a company and is accessible to all employees regardless of their employment contract or seniority.

Before October 1, 2020, Perco was the go-to option for retirement savings within companies. However, it has since been replaced by the PER. Although Perco is no longer available for new setups, employees who had Perco by October 1, 2020, can still make voluntary contributions or transfer their Perco to a PER for continued growth.

Advantages of Perco

The main advantage of Perco lies in its favorable tax treatment. Contributions to Perco are tax-deductible, up to certain limits, making it an effective Retirement savings tool. Furthermore, the gains are exempt from income tax until withdrawal, typically at retirement.

The main disadvantage of Perco is that savings are blocked until retirement, making them less accessible for meeting immediate financial needs.

PER vs. PERCo: Which is right for you?

While both the PER and PERCo are salary-based savings tools, they are designed for different purposes. PER is more oriented towards medium-term savings needs with more flexibility in fund use, while PERCo is geared towards long-term retirement savings.

How does Perco Work?

Flexible Operation

The operation of Perco is quite flexible. Contributions can be invested in a variety of funds proposed by the company or collective management organizations, tailored to the employee's risk profile. In smaller companies, Perco can be accessible to managers and their spouses, given the status of spouse collaborators or associates.

Investments and PERCo

Perco funds can be invested in stocks, bonds, real estate, and more. Employees can select the level of risk they are comfortable with. The only catch is that the amounts paid can only be invested in employee shareholding reserved investments.

Retrieving Savings

At retirement, Perco savings can be retrieved in either an annuity or capital form, if permitted under the collective agreement. The capital option offers the best tax benefits. The Perco regulations may require a minimum annual payment of €160 and a maximum seniority condition of three months.

Losing Perco upon Leaving a Company

If an employee leaves their company, their Perco is not lost. They can keep the existing Perco with their former employer without the company's matching contribution and with capped management fees. Alternatively, they can transfer their savings to another retirement savings plan, such as a Personal Retirement Savings Plan (PER), for greater flexibility and investment options.

Next Steps

If you're unsure about your retirement savings, don't hesitate to consult with our partner experts for a personalized solution. Get tax savings by testing our savings account comparator. Compare the performance of retirement savings plans using our simulator. Save money in the long run, and secure your future!

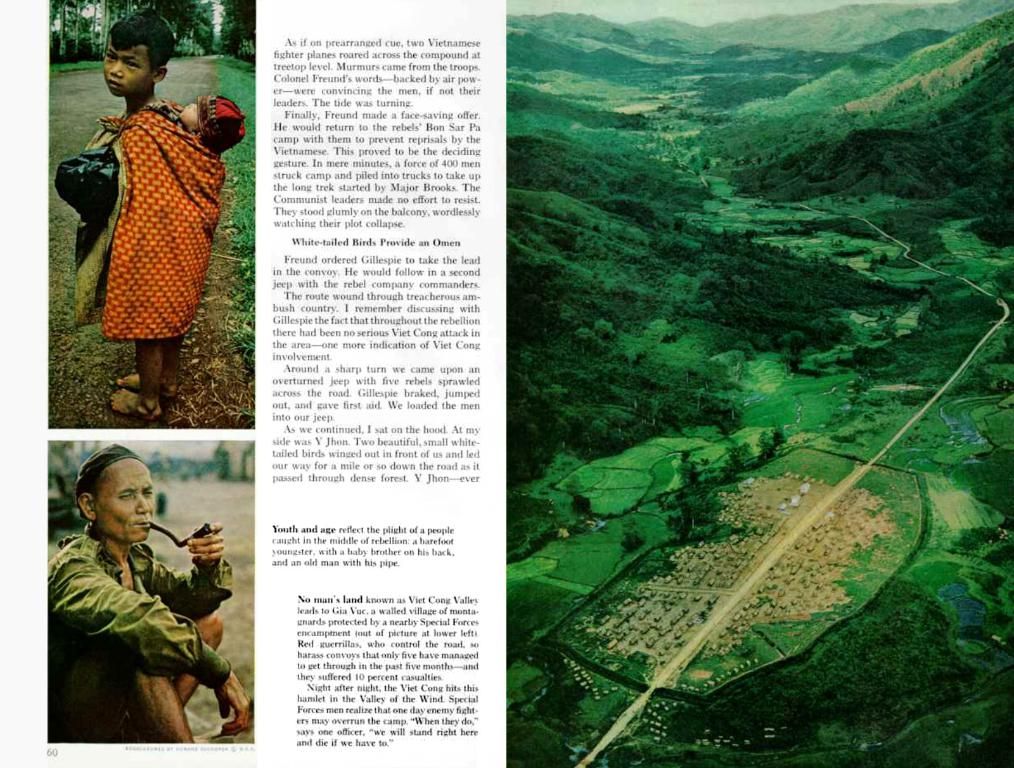

- Employees can utilize Perco, a salary-based savings tool, to supplement their retirement savings, as contributions to Perco are tax-deductible up to certain limits, making it an effective personal-finance tool for one's future.

- One disadvantage of Perco is that the savings are blocked until retirement, meaning they're less accessible for meeting immediate personal-finance needs, highlighting the potential trade-off between short-term and long-term financial goals.