Contemplating Hiring a Financial Advisor? Learn How to Discern if Your Situation Demands One's Services.

Wanna Get Control of Your Finances? A Financial Advisor Could Be Your Secret Weapon

Over four out of five Americans lovin' the anxiety about their cash flow, yet the majority never collaborate with a money wizard. If you're seekin' peace of mind about your financial future, investin' in some professional aid might be the ticket. Here's the lowdown on what financial advisors do, when you might need one, how much they cost, how to slam-dunk the right choice, and alternatives if you'd rather DIY.

What Does a Money Wizard Do?

A money wizard helps in managing dough and assists in achieving your monetary objectives through customized advice. Their expertise commonly includes:

- Budgetin' and cash flow plannin'

- Investment strategy and portfolio management

- Retirement plannin'

- Tax efficiency strategies

- Estate plannin'

Money wizards may specialize in different sectors, but all tailor their advice to your one-of-a-kind financial situation and goals.

When Do You Need a Money Wizard?

Most assume you only need a money wizard if ya loaded, but there are many reasons for consultin' one:

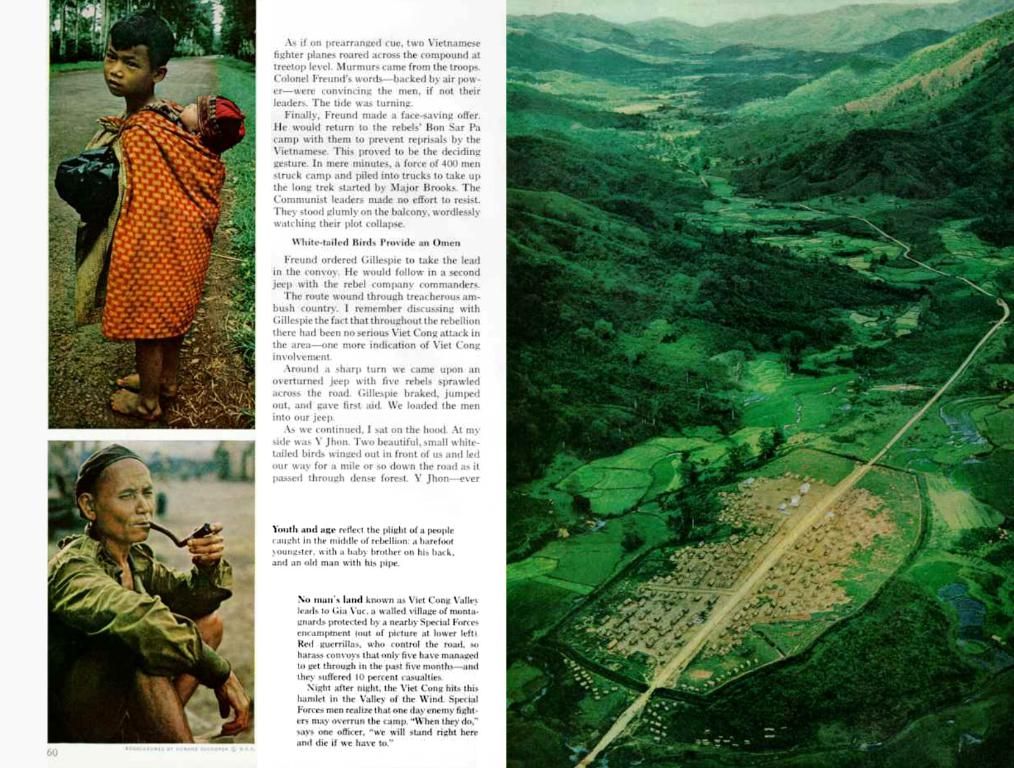

- Goin' all in on a major life event, like marryin', divorcin', welcomin' a new baby or dealin' with death in the family, can result in substantial financial implications. A money wizard can lend a hand with insurin', estate plannin', and fillin' taxes with expertise.

- Goin' head-to-head with some big financial decisions, such as buyin' a house or swappin' gigs, can be nerve-wrackin'. Instead of wingin' it or gettin' overwhelmed, get an unbiased opinion from a money wizard. They can lay out the pros and cons for ya.

- Goin' strong on income or net worth. The bigger your income or net worth, the reefier your finances become, and the more ya got to protect. A money wizard can help ya avoid costly errors and lock in long-term wealth.

- With retirement on the horizon, movin' from a regular paycheck to a fixed retirement income requires a delicate touch. A money wizard can help ensure ya properly allocate your investments to conserve your nest egg.

- If motivation or time is missin'. Even if ya got financial savvy, stickin' to a plan can be a battle. A money wizard can help ya maintain the course without the stress of handlein' everything yourself.

Types of Money Wizards

There are different kinds of money wizards, largely categorized by how they get paid:

- Fee-only money wizards: They costя a fee that's paid directly by the client. They may charge a flat fee per service, an hourly rate, or a small percentage of the assets under management (AUM).

- Commission-based money wizards: They make a commission on the financial products they sell. While this could lead to potential biases, it’ll cost ya less upfront.

- Fee-based money wizards: They’re a hybrid of fee-only and commission-based. They still charge the client, but they also make commissions from sellin' financial products.

One extra point to remember is fiduciary vs. non-fiduciary money wizards:

- Fiduciary money wizards have a legal and ethical responsibility to act in your best interest and disclose any conflicts. Most fee-only advisors are fiduciaries.

- Non-fiduciary money wizards, such as brokers, have only a lower obligation to ensure their advice is suitable for you.

Choosin' the Right Money Wizard

When comarin' money wizards, be sure to investigate their credentials. Terms like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Registered Investment Advisors (RIAs) suggest professional trainin' and a fiduciary duty toward clients.

Once ya established a money wizard's credibility and fiduciary loyalty, ask 'em about their fee structure and confirm it lines up with your budget and needs. For example, a flat or hourly rate may be best if ya only seekin' advice on a single question. Or a retainer or percentage AUM fee could be more suitable for ongoing financial guidance.

Ask about their experience and expertise, too. Have they advised clients in similar situations as ya before? Do they specialize in the areas where ya seekin' help?

Lastly, do some reputation research or ask for references. If their current and previous clients are happy with the service they received, ya can be more confident that ya will as well.

How Much Do Money Wizards Cost?

The cost of a money wizard can vary, but here are a few average price ranges:

Alternativesto Hiring a Money Wizard

Not ready to commit to a money wizard? Consider some DIY options:

- Robo-wizards: They offer automated, algorithm-driven financial advice with minimal human supervision. As a result, they tend to cost less, with annual fees of less than 0.4% per managed account.

- Free or low-cost community resources: Nonprofits and government agencies often provide free educational workshops, financial literacy courses, or one-on-one advice.

Qualifications a Money Wizard Should Have

Look for credentials like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Registered Investment Advisor (RIA), which signal formal trainin' and a fiduciary duty to act in your best interest.

How Money Wizards Get Paid

Money wizards may charge a percentage of assets under management (AUM), an hourly fee, or a flat fee per service. Alternatively, they might charge you nuthin' but earn commissions from sellin' financial products.

Risks of Not Hiring a Money Wizard

Without professional advice, ya might miss significant financial opportunities, make costly mistakes, or delay important decisions that could hurt your long-term financial health.

Managin' Ya Finances Without a Money Wizard?

With time, knowledge, and determination, ya can handle your own finances, but it requires ongoing learnin' and effort.

How Often Should Ya Meet With Your Money Wizard?

It depends on ya needs, but most folks benefit from at least an annual review. Ya may wanna meet more frequently durin' major life or financial changes.

The Takeaway

A money wizard can help ya navigate complex dough matters based on your unique goals, and ya don’t need to be filthy rich to benefit. Life events, major decisions, or lack of time may all be reasons to seek their assistance. Look for an advisor with strong credentials, a clear fee structure, and a fiduciary dedication.

Alternatively, consider low-cost options like robo-wizards or relied-upon educational resources. Whatever ya do, take some time to evaluate your financial needs and make the finest call for your and your loved ones' future.

A financial advisor, or a money wizard, can provide personalized advice on budgeting, investment strategy, retirement planning, tax efficiency strategies, and estate planning. This assistance can be particularly useful during major life events, complex financial decisions, or when retirements are approaching.

When selecting a financial advisor, it's essential to investigate their credentials, such as CFP, CFA, or RIA, which indicates professional training and a fiduciary duty toward clients. Additionally, consider the advisor's fee structure, their experience, expertise, and reputation to ensure they can meet your unique financial requirements.

Alternatively, robo-advisors or low-cost community resources can serve as affordable DIY options for financial guidance. However, without professional advice, you may miss significant financial opportunities, make costly mistakes, or delay important decisions that could impact your long-term financial health.