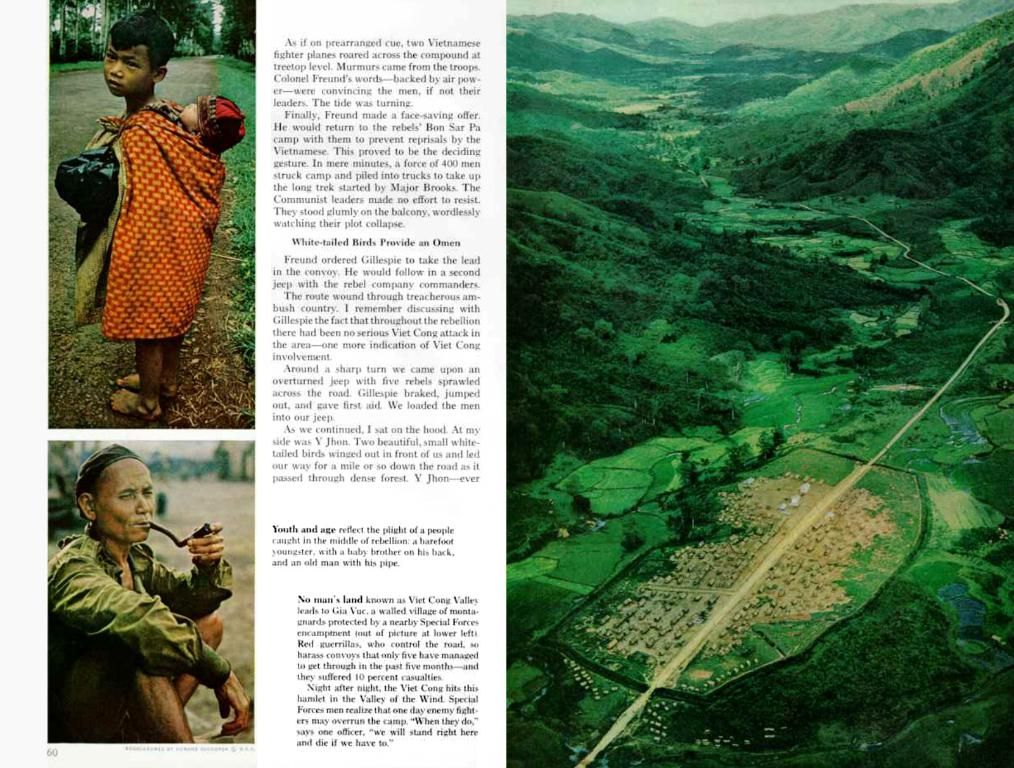

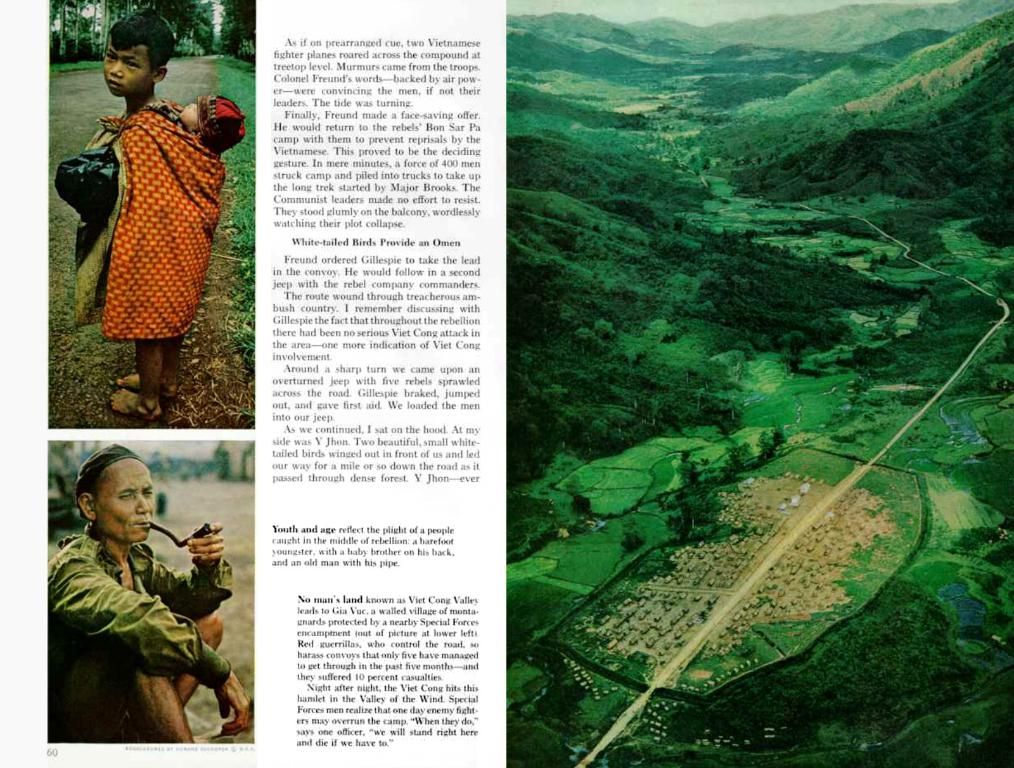

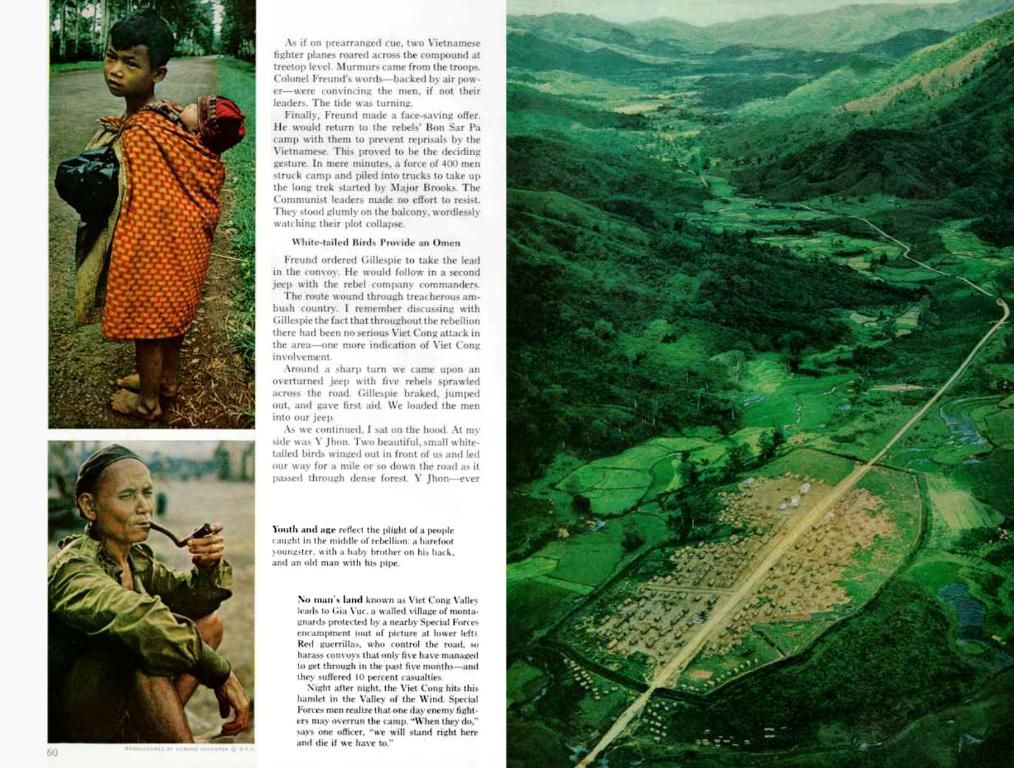

Court severely penalizes Raiffeisen Bank for billions in Russian court decision

Raiffeisen Takes a hit: €2.04 Billion Judgment in St. Petersburg

It's a setback for Raiffeisen Bank International (RBI) as an appeals court in St. Petersburg has confirmed a ruling against the bank, imposing a fine of over €2 billion. In a move that's seen as one of the harshest against a Western company still operating in Russia, RBI now faces a hefty payment of €2.044 billion.

The judgment, which was initially handed down in January, was upheld by the 13th Commercial Court of Appeal. RBI has already made a provision of €840 million for the damages, and the remaining amount will be obtained through the sale of assets belonging to the Russian plaintiff, Rasperia, in Austria.

Rasperia, previously linked to oligarch Oleg Deripaska (who now denies ownership), launched a lawsuit seeking damages for its frozen stake in Vienna-based construction company Strabag. The lawsuit targeted Strabag, its Austrian core shareholders, and the Russian RBI subsidiary. The frozen package of 28.5 million shares is neither tradable nor entitled to dividends.

The ruling can now be enforced against the assets of the Russian RBI subsidiary, but it has no legal effect in Austria. RBI was not directly named as a debtor but only as an economically connected party. The bank has stated that it does not expect the ruling to impose additional burdens.

In light of this, RBI plans to appeal against the ruling in Russia and is preparing a lawsuit at the Vienna Commercial Court. The bank aims to obtain damages from Rasperia in Austria, particularly through a sanctions-compliant release of the Strabag shares and their sale by an investment bank. The market value of the share package is around €2 billion, but such a procedure could take years.

Raiffeisen

Meanwhile, in another case, Russia's Supreme Court overturned rulings in a dispute between Russian private bank Sovcombank and the Russian subsidiary of Citibank. This decision could signal that Russian subsidiaries should not be held liable for the debts of their foreign parent companies. However, RBI's request to adjourn its own case was rejected, leaving the bank to grapple with the immediate consequences.

Wien ·

Igor Ozersky, lawyer for Citibank, welcomed the ruling, stating that the Citibank case was playing out under "completely different circumstances" and had no connection to the Raiffeisen case.

Whether RBI can recover from this setback and navigate the complex legal landscape remains to be seen. As the bank continues its efforts to exit the Russian market amid geopolitical pressures, it faces significant challenges in the months and potentially years ahead.

Lade...

- Commerzbank, observing the situation, might contemplate the potential impact of the sanctions on Raiffeisen Bank International (RBI), as a judgment of €2.044 billion against RBI could lead to a shift in the finance industry's business dynamics.

- In the aftermath of the ruling, other banks within the industry, such as Commerzbank, could reevaluate their decisions regarding investments in Russia, considering the risks associated with operating in a highly politically charged environment.

- RBI's ambitious plan to appeal the ruling in Russia and sue Rasperia in Austria implies that Raiffeisen's equity in the finance business may be affected by the prolonged legal process, potentially diminishing its market value.

- As Raiffeisen faces a difficult road ahead in recovering from the sanctions, competitors such as Commerzbank might observe the situation as an opportunity to increase their presence and equity within the Russian market.