Economic confidence in Germany surges in June: 'Momentum is growing'

Germany's Economic Boom in June: Sentiment Soars to Three-Year High

- Piero Cingari * Facebook * Twitter * Flipboard * Send * Reddit * Linkedin * Messenger * Telegram * VK * Bluesky * Threads * Whatsapp

June saw Germany's economic sentiment soar to its highest level since March, with financial experts becoming noticeably optimistic. The ZEW Indicator of Economic Sentiment for Germany jumped an impressive 22.3 points to 47.5 in June 2025, surpassing consensus forecasts of 35 and reaching a significant milestone since the three-year peak of 51.6 in March.

The current situation index also took a step in the right direction, gaining a considerable 10 points to reach -72.0—the largest monthly improvement since April 2023. "Confidence is on the rise," declared ZEW President Professor Achim Wambach, PhD. "Recent growth in investment and consumer demand have been contributing factors, along with expansionary fiscal policy and the European Central Bank's recent interest rate cuts." These factors, he added, could help lift Germany out of its prolonged stagnation.

The sentiment also brightened across the eurozone, with the ZEW index climbing 23.7 points to 35.3, surpassing expectations of 23.5. The current assessment for the bloc also improved, growing 11.7 points to -30.7.

Investors remain positive about Europe and Germany, as highlighted in the latest Bank of America Fund Manager Survey. A net 29% of respondents anticipate stronger European growth over the next twelve months, fueled by expectations of German fiscal stimulus. The outlook for European equities remains upbeat, with a net 34% expecting gains in the coming months, and 75% seeing upside over the next year, matching February's high.

Markets Take a Dive Amid Israeli-Iran Tensions

While the encouraging ZEW data couldn't ward off market turmoil, European stock markets plummeted on Tuesday, as the escalating conflict between Israel and Iran weighed on investor sentiment. The German DAX dropped 1.2% to around 23,400 points—its lowest since May 8—undoing Monday's gains.

The retreat was part of a broader risk-off move instigated by rising oil prices and increasing geopolitical unease following President Donald Trump's abrupt departure from the G7 summit in Canada. Trump's decision, which he claimed was unrelated to ceasefire negotiations, further fueled concerns about prolonged conflict and its potential impact on oil supply disruptions and inflation expectations.

Oil prices advanced, with West Texas Intermediate up 1.6% at $72.92 per barrel and Brent crude rising to $74.50. In currency trading, the euro held steady at 1.1558 against the US dollar.

The biggest losses were experienced by Fresenius Medical Care (down 5.13%), Commerzbank (3.14%), Rheinmetall (2.52%), and Deutsche Telekom (2.34%). Across the European banking sector, shares dwindled, with AIB Group falling 3.5%, Banco Santander losing 3.1%, and Commerzbank, Societe Generale, and UniCredit each dropping 3%.

Investor apprehension swelled before the US Federal Reserve's two-day policy meeting, which concludes with a rate announcement on Wednesday. Although traders generally expect no interest rate change for the fourth consecutive time, escalating geopolitical tensions and a fresh increase in oil prices have added to the uncertainty surrounding monetary easing.

Related

- Germany and France intensify security around Jewish sites amid rising threats from Iran

- Germany rearms, but what about its veterans?

References:

[1] German Economic Gauge Rises Most Since 2018 on Rebound (bloomberg.com)

[2] EU economy could grow moderately in 2025, European Commission forecasts (ec.europa.eu)

[3] Eurozone Economy Grows Slightly in First Quarter, But Risks Linger (nytimes.com)

[4] Germany's economic recovery to be slow, says EU's Schuler (dw.com)

[5] European stocks fall as surging oil prices fuel geopolitical concerns (reuters.com)

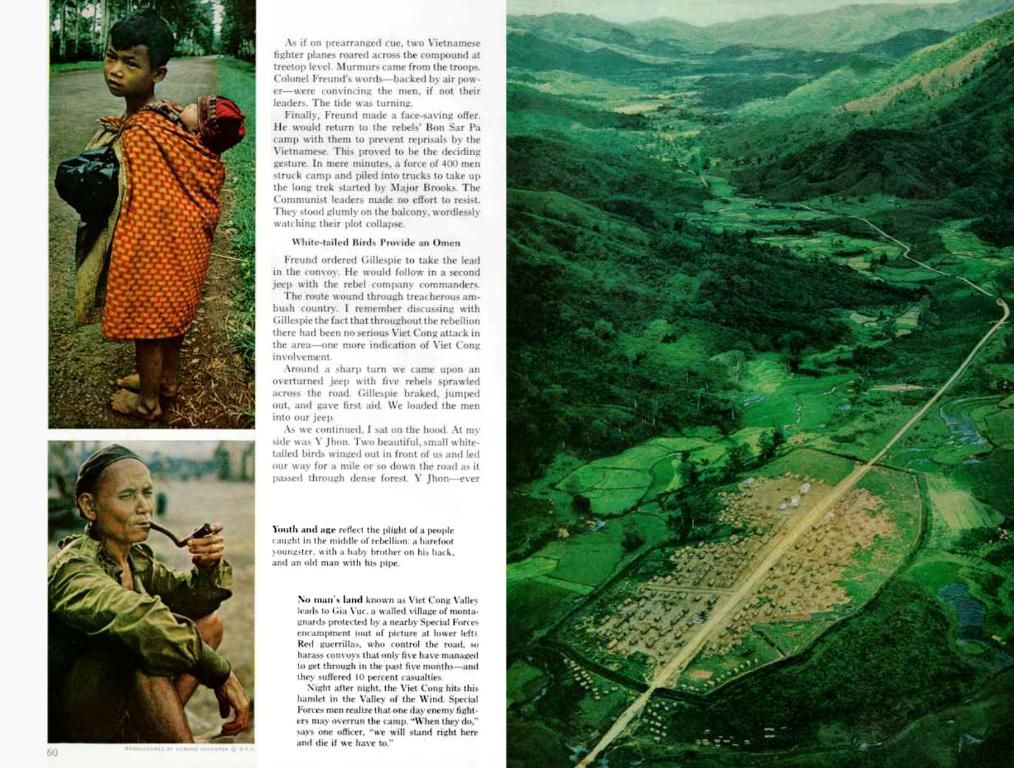

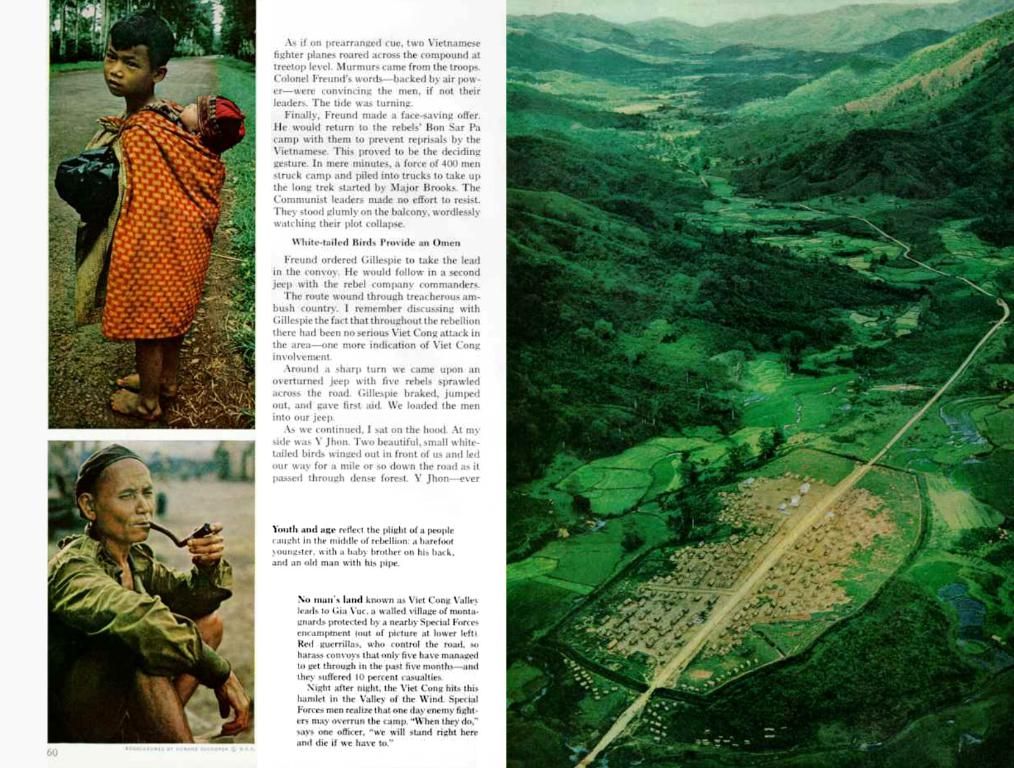

- The ongoing economic boom in Germany, as shown by the soaring sentiment to a three-year high, has sparked optimism among financial experts in the business sector.

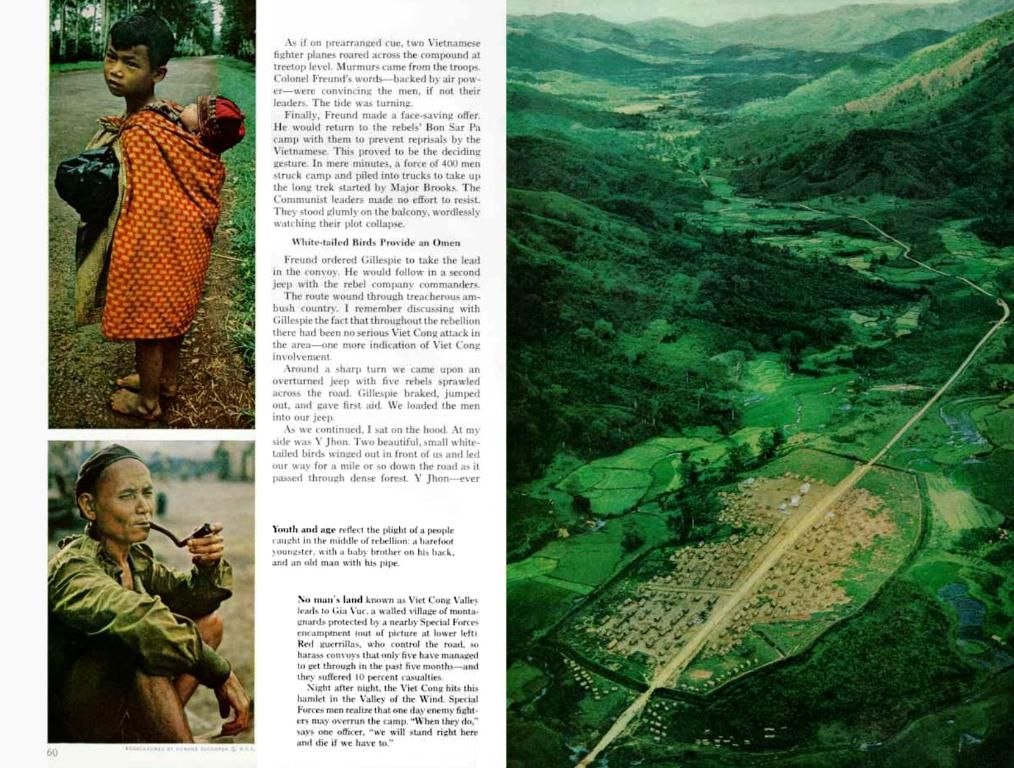

- The improvement in Germany's economic sentiment, as indicated by the ZEW Indicator of Economic Sentiment, would likely impact the finance sector positively, potentially leading to increased investments and growth.