"Equator Branch of Aldi Supermarket called into question"

Gearing Up for a Potential Merger: Aldi Nord and Aldi Süd in the Spotlight

Here's a hot topic brewing in the retail sector: whispers of closer cooperation, possibly leading to a (partial) merger, between the two giants, Aldi Nord and Aldi Süd. With fierce price-cutting competition from discount rivals like Lidl, these two titans may be looking to join forces.

The "Aldi Equator," the imaginary line running through North Rhine-Westphalia from the West Münsterland via Mülheim an der Ruhr to East Germany, could soon be history. According to rumors, the Albrecht and Heister families are allegedly in secret talks about various merger scenarios.

Don't miss these reads:

### Questionable Trend: Sunscreen Craze and Adult Beverage Obsession ### Kretschmann Doubles Down on Defense Industry ### VfB Star Deniz Undav on Criticism "Suddenly, eating a doner became a problem" ### Aldi Süd and Nord: To Merge or Not to Merge?

A potential holding company might be the solution for the companies currently controlled by different foundations. The companies themselves have yet to make an official statement about the reports.

However, insiders are cautious about expectations of a merger. A complete merger seems unlikely due to antitrust reasons. Aldi Süd, with a net turnover of 18.8 billion euros, ranks as the second-largest discount store in Germany, while Aldi Nord ranks fourth with 14.3 billion euros. Despite growing challenges from wars and supply chain issues, retailers have raised their prices in recent years.

Inflation in Food Prices in Germany (since 2021)

- Fats and oils: +64.3%

- Bread and baked goods: +37.4%

- Meat and sausage: +35.4%

- Sugar, jam, honey, and other sweets: +31.5%

- Milk, dairy products, and eggs: +31.9%

- Fish, fish products, and seafood: +29.5%

- Mineral water, soft drinks, and juices: +29.0%

- Coffee, tea, and cocoa: +24.8%

- Vegetables: +21.3%

- Fruit: +16.1%

- Source: Consumer Center

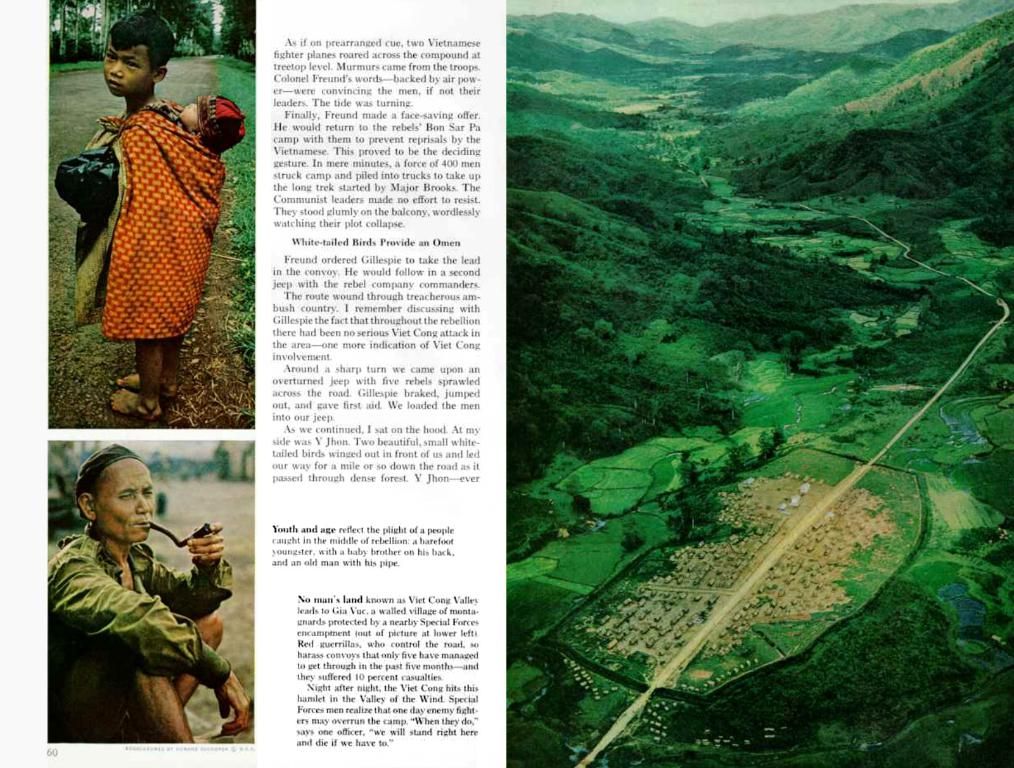

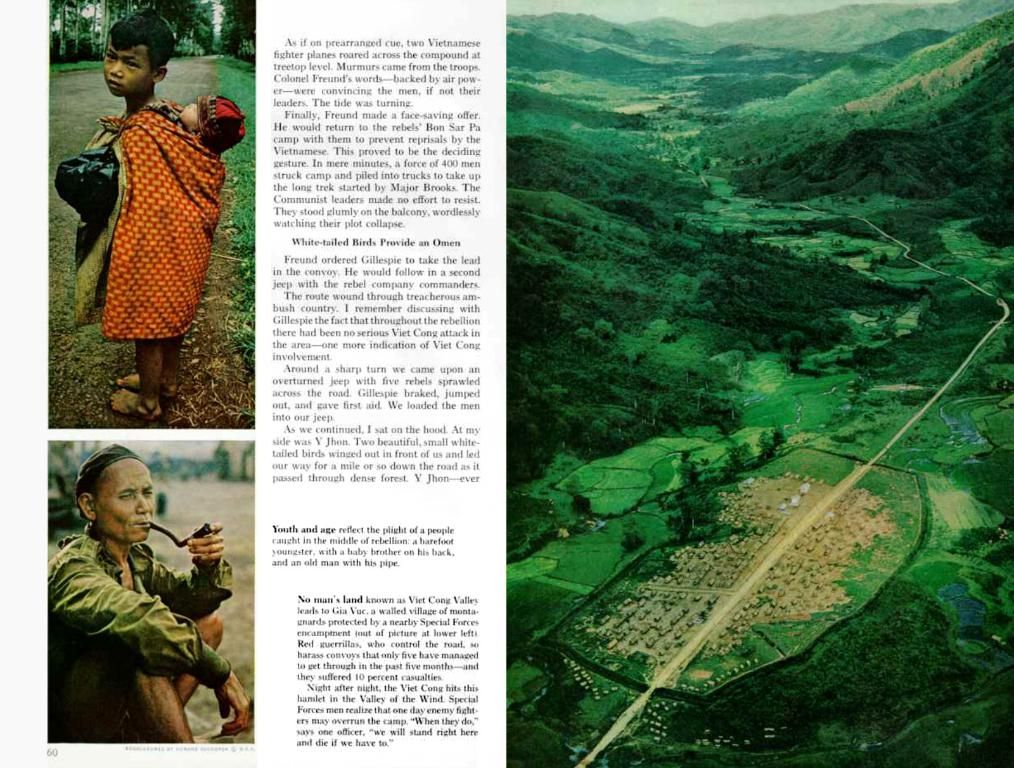

Aldi Equator: Cigarettes or Geography?

Tracing back to 1961, the split of Aldi into Nord and Süd stems from brothers Theo and Karl Albrecht's decision to divide their joint company. Speculation about the reasons persists, ranging from differing opinions on cigarette sales to personal differences.

In recent years, the two companies have already increased their cooperation in various fields. They unified large parts of their private label brands in late 2020 and share advertising campaigns. Whether this rapprochement will truly lead to a reunification remains to be seen.

Enrichment Data:

Aldi Merger Plans in the Works

As of early June 2025, Aldi Nord and Aldi Süd are reportedly considering a merger. Having collaborated on unifying own-brand products and sharing advertising campaigns in 2020[1][2], merger discussions are said to be confidential but could significantly impact the global retail market[2][3].

Possible Outcomes of a Merger

A merger between Aldi Nord and Aldi Süd could lead to several outcomes:

- Global Domination: The combined forces could bolster Aldi's presence in Europe and provide a solid base for expansion in regions like the Americas, where they would compete against giants like Walmart and Target[2].

- Streamlined Operations: Operating under a single holding entity could increase efficiency and enhance the competitive edge in the global market[2].

- Impact on Customers: While customer impacts are not detailed, a merger could result in a more consistent product offering or potentially better pricing due to increased economies of scale[2].

Obstacles in the Merger

Implements a merger would come with its challenges:

- Integration Complexity: Merging two entities that have been separate for over six decades would necessitate significant organizational and operational adjustments, including blending different business cultures and systems.

- Regulatory Approval: The merger would need to comply with various regulatory requirements, potentially involving complex negotiations and approvals from multiple jurisdictions.

- Brand Identity Management: Preserving the distinct identities of both Aldi Nord and Aldi Süd during the integration process could be challenging, especially in regions where they have different operational footprints.

Overall, a merger between Aldi Nord and Aldi Süd would be a strategic move to enhance Aldi's global presence and competitiveness but would require thoughtful planning and execution to overcome the inherent challenges.

- The potential merger between Aldi Nord and Aldi Süd could lead to a consolidated holding company, especially considering the growing pressures of intense competition in the discount sector.

- If a merger were to occur, it could impact the global retail market significantly, potentially offering a strong foundation for expansion in regions like the Americas while also streamlining operations for increased efficiency.