Heating Bills Soar in German Homes Amid Middle East Unrest

Skyrocketing energy expenses triggered by Middle Eastern conflict escalation - Escalation in the Middle East drives significant surge in heating costs

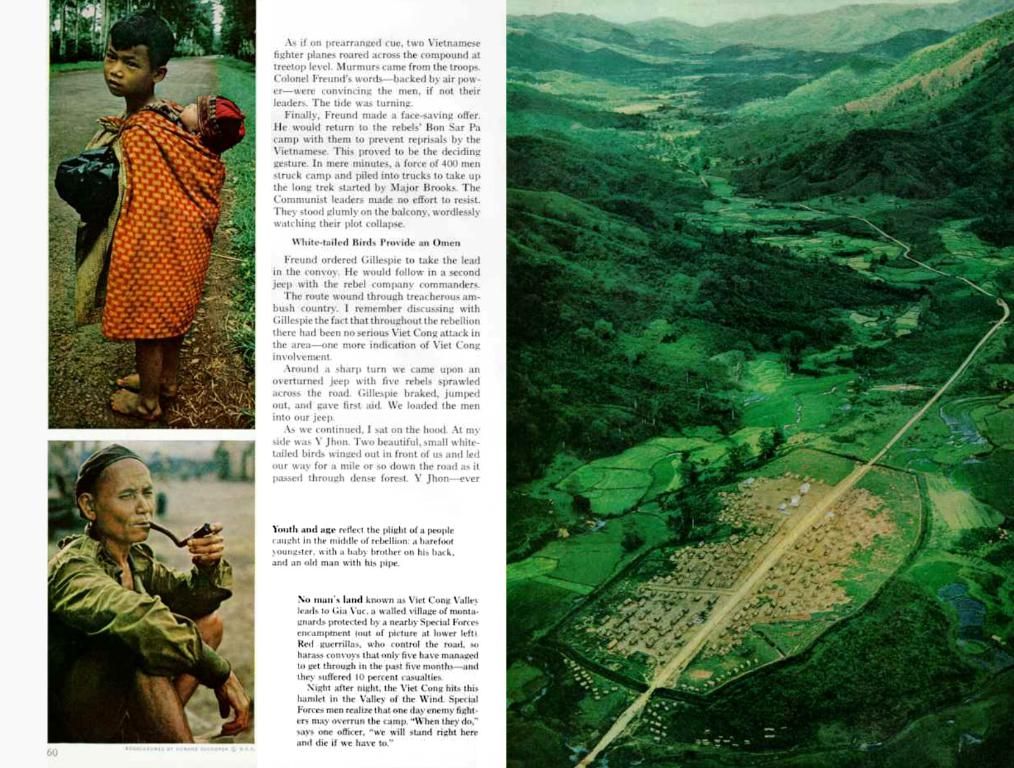

In casual chatter: You know what's never a joy? Skyrocketing heating bills! Thanks to Israel's recent clash with Iran, oil prices have sky-dived in Germany, really stickin' it to our wallets.

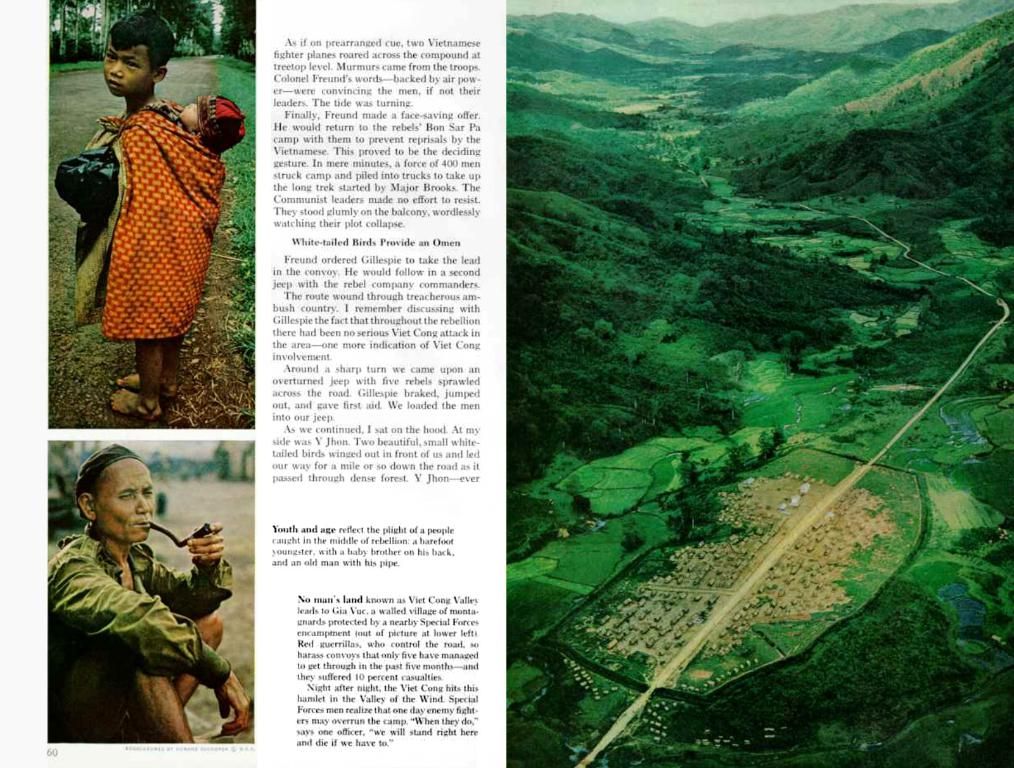

So, what's the lowdown on this heated situation? Analyzing data from Verivox, a comparison portal, shows that a mere 100 liters of heating oil now costs approximately 93 euros—a sharp increase from May's average of 87 euros, which was the lowest it's been in two years, according to the Funke media group's newspapers.

Now, you might think this spike means we're better off avoiding heating our homes right now. Not necessarily, says Verivox. Our long-term costs are still favorable. They've even hinted that next year, CO2 costs could add fuel to the fire, so to speak.

This Middle Eastern fracas has got markets on edge—oil prices, and thus heating oil prices, have jumped significantly. When the dust settled, reports started rolling in hinting at attacks on Iran's large oil and gas fields.

So picture this: given an average price of around 87 euros (gross) for 100 liters of heating oil in Germany in May, a typical single-family home using 2,000 liters per year would be forkin' out around 1,739 euros on heating bills. Last time we saw prices this low was back in May of 2023. Since the price peak in September 2023, when 100 liters cost a whopping 119 euros, we've seen a decrease of about 27 percent.

Riding Out the Storm

Surprisingly, even the current price of around 93 euros (gross) could prove advantageous in the long haul, according to Verivox. Compared to 2024's average of 99 euros, 2023's 104 euros, and 2022's cost of 131 euros for 100 liters, the current price doesn't look so bad, do ya think?

Zip it back to 2018, the shrewd folks at Verivox attribute the general price decline to developments on the world market. Early May saw oil-exporting countries striking a deal to boost production, causing oil prices to plummet. More recently, fears of protectionist trade policies by the U.S. and concerns about a global recession have made their mark too.

- Heating Costs

- Middle East Conflict

- Israel

- Iran

- Oil Markets

- Global Warming (CO2 Costs)

Here are some intriguing insights to chew on:

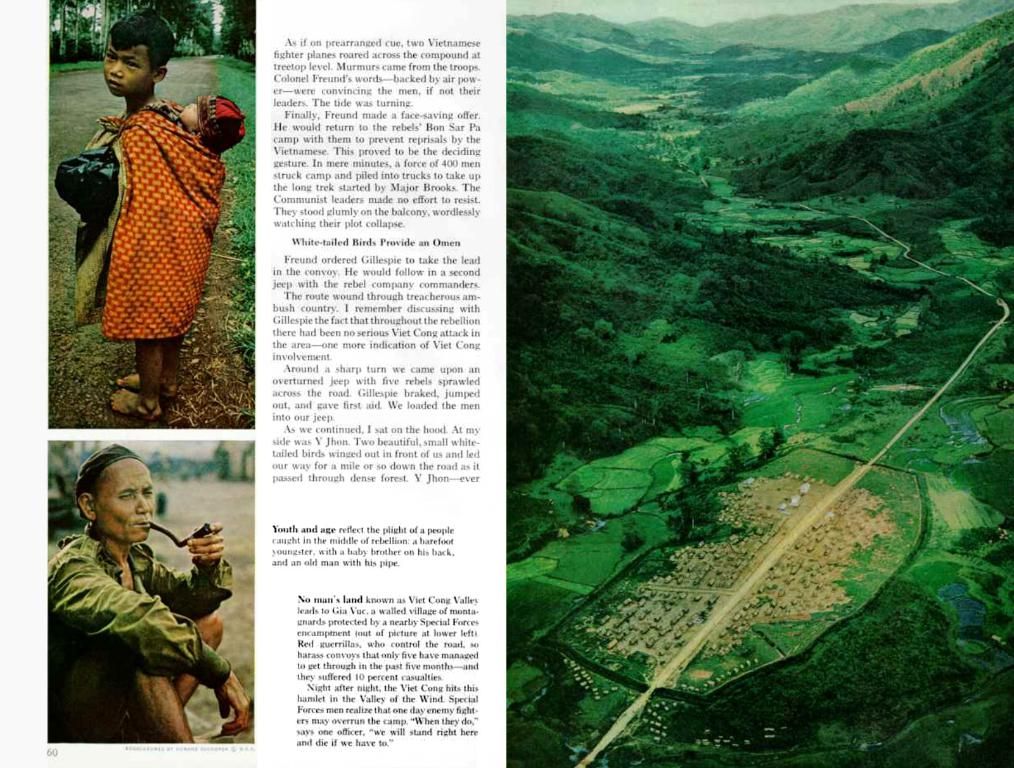

- Volatility and Uncertainty: Conflicts in the Middle East can ramp up the unpredictability of oil prices—worries over supply disruptions tend to do that. As the home to several major oil-producing nations, such as Saudi Arabia, Iraq, and Iran, this region holds a powerful sway over the global oil market.

- Supply Chain Disruptions: Any disruption in oil production or transportation can impact global supplies, leading to increased oil prices. For instance, attacks on oil facilities or pipelines can reduce output and drive prices up.

- Geopolitical Tensions: Ongoing tensions between countries like the U.S., Iran, and their allies can also affect markets. Sanctions and military actions can restrict oil exports from affected countries, further tightening global supplies.

- Future Forecast: To sum up, conflicts in the Middle East are likely to keep oil prices volatile. Diversifying energy sources and investing in alternative energy could help mitigate the impact of future conflicts. Broad economic trends and political developments will also play a significant role in shaping the future of oil prices.

- Impact on Heating Oil: The price of heating oil is closely tied to the overall oil market. Higher crude oil prices due to Middle Eastern conflicts can translate into higher costs for consumers, especially in regions that rely heavily on oil for heating during the winter months.

- The escalating Middle East conflict between Israel and Iran, leading to a rise in oil prices, has caused heating bills in Germany to soar, making it more expensive for households to heat their homes.

- Despite the current surge in heating oil prices, around 93 euros per 100 liters, long-term cost benefits are still viable according to Verivox, as this price is lower compared to 2024, 2023, and 2022 average prices.

- The unpredictability of oil prices due to conflicts in the Middle East, which has a significant impact on oil-producing countries like Saudi Arabia, Iraq, and Iran, poses a challenge to both the global economy and household budgets, particularly with regards to heating costs.