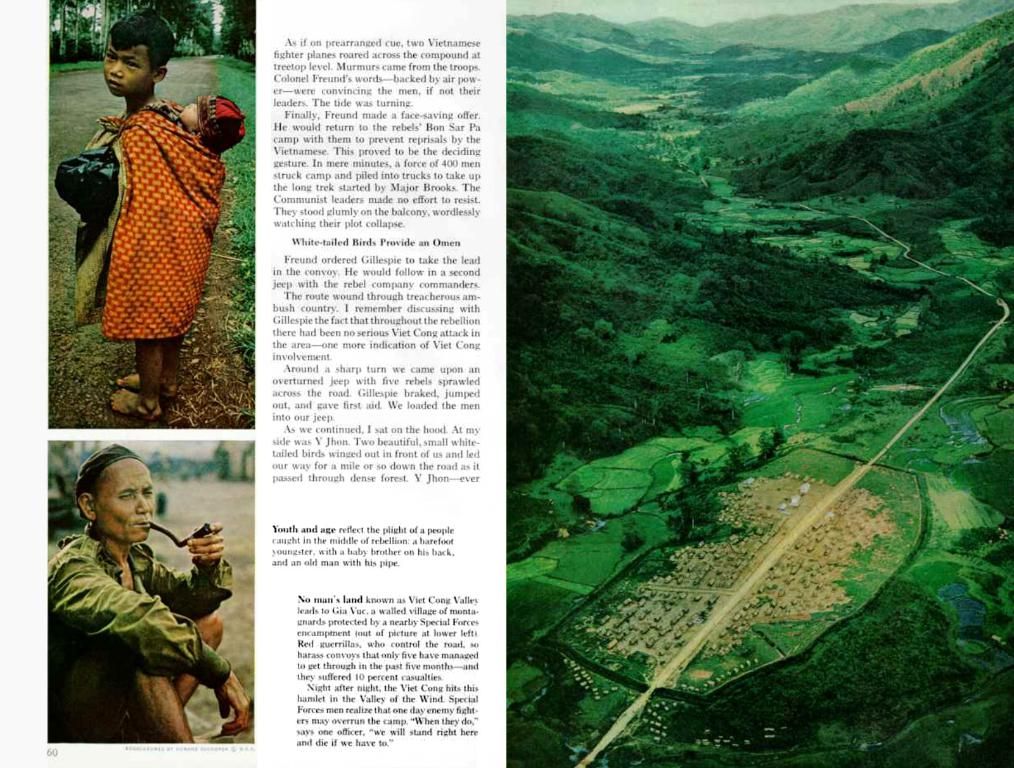

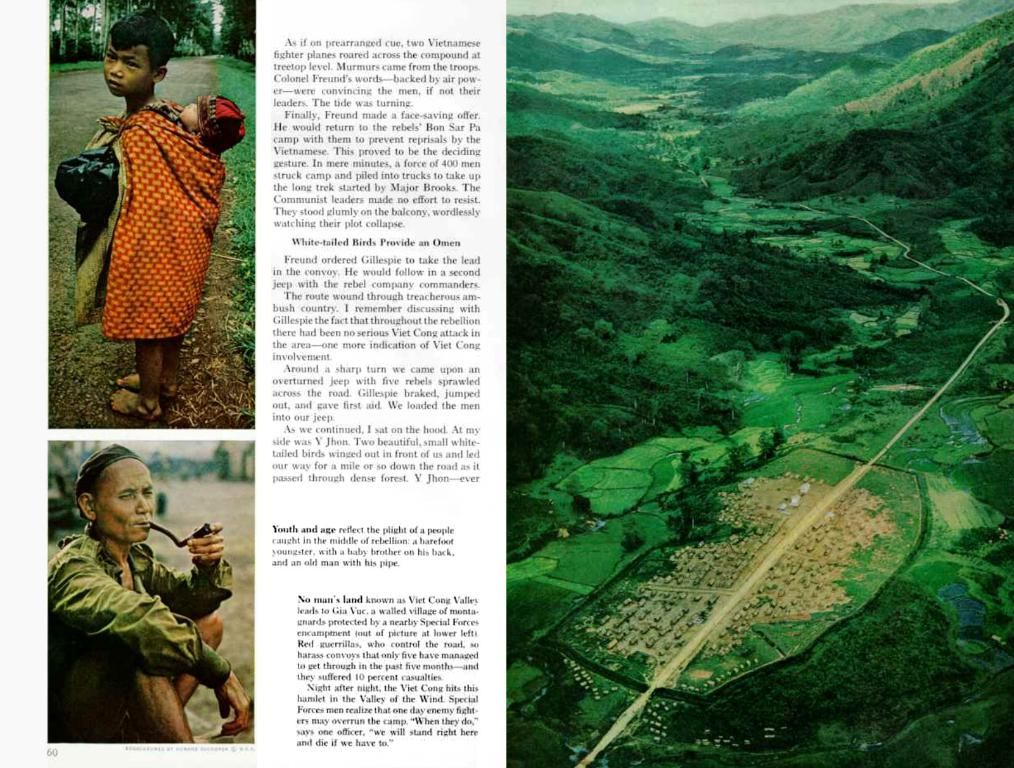

Financial entities, represented by individuals, manage to safeguard Wall Street's prosperity

Informal, Approachable and Straightforward

In spite of a gloomy economic outlook, Wall Street managed to close in the black on Thursday, thanks to a select few stocks that proved to be real stars. While tensions in the Middle East continued to cast a shadow over the market, it was not enough to completely dampen spirits.

What's Happening on the Street

The Dow Jones Industrial Average grew 0.2 percent, closing at a respectable 42,968 points. The tech-heavy Nasdaq followed suit, adding 0.2 percent to reach 19,662 points, and the broader S&P 500 also saw a 0.4 percent increase, hitting 6,045 points.

Oracle Shines, Boosting the Market

One of the standout performers of the day was Oracle, whose shares saw a significant surge of 13 percent. Fueled by strong demand for cloud services and quarterly results that outshone expectations, Oracle's stock was a big reason for Wall Street's upturn.

Biontech and Curevac: A Dance of Acquisitions

Curevac's U.S.-listed shares skyrocketed nearly 40 percent, with German rival Biontech vying to buy the company for approximately $1.25 billion. Biontech's stock fluctuated throughout the day, trading anywhere from a 1.4 percent loss to a 2.4 percent gain. By the end of the day, Biontech stock was down around half a percent.

The Fall of Boeing

Boeing shares saw a significant drop of almost 5 percent, following a tragic incident involving a Boeing 787-8 Dreamliner crash in India. The investigation is currently underway, with speculation arising around maintenance issues rather than flaws with original equipment.

Gamestop: A Noteworthy Dip

Gamestop's stock dipped more than 20 percent after the company announced a new bond offering.

Global Tensions and the Commodities Market

Geopolitical tensions continued to be a hot topic, with the International Atomic Energy Agency (IAEA) accusing Iran of violating nuclear non-proliferation agreements, and Iranian military forces starting military maneuvers earlier than planned. This has added another layer of unrest to an already volatile region.

Gold: A Safe Haven

Despite the uncertainties, investor anxiety is escalating, evident in the commodities market where gold – often considered a safe haven – gained nearly 1 percent to close at $3,385 per troy ounce. Meanwhile, both Brent crude oil and WTI crude oil fell by about half a percent.

The Dollar Index Slides

The Dollar Index dipped up to 1 percent to 97.921 points, marking its lowest point since March 2022, as it has shed around 10 percent this year.

Bitcoin: Rollercoaster Ride

The most traded cryptocurrency, Bitcoin, experienced a two percent decline to $106,638, following disappointments with the US-China trade deal announced on Wednesday. Timo Emden of the analysis firm Emden Research speculated that investors might have hoped for more specifics, leading to the subsequent plunge in bitcoin's value. Commerzbank analyst Thu Lan Nguyen expressed skepticism over the deal, implying that further tariff reductions may prove challenging.

For the latest market news, click here.

- Wall Street

- Dow Jones

- Investments

- Acquisitions

- Boeing

- Gold

- Bitcoin

In the midst of ongoing geopolitical tensions and a potentially dreary economic outlook, Wall Street's resilience was demonstrated as it managed to close positively, with significant gains in some key stocks like Oracle, boosted by strong cloud service demand and promising financial results. Amidst this optimistic market landscape, there were also notable declines, such as Boeing's shares plummeting following a tragic incident, and Bitcoin dipping due to disappointments with the US-China trade deal. Meanwhile, gold, often considered a safe haven, experienced a considerable increase, reflecting the escalating investor anxiety. The potential for further M&A activity, as seen in the ongoing dance between Biontech and Curevac, adds another dimension to this intricate financial dance.