Financial executive Mervyn King issues debt cautionary statement

Spotlight on Britain's Soaring Debt Burden:

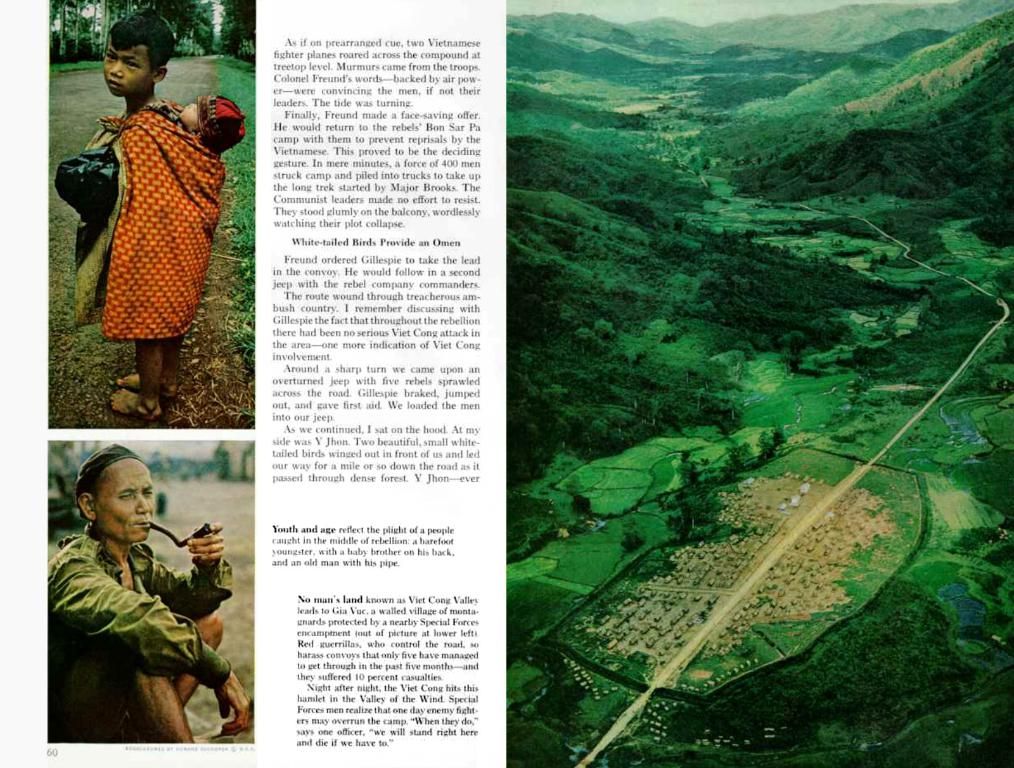

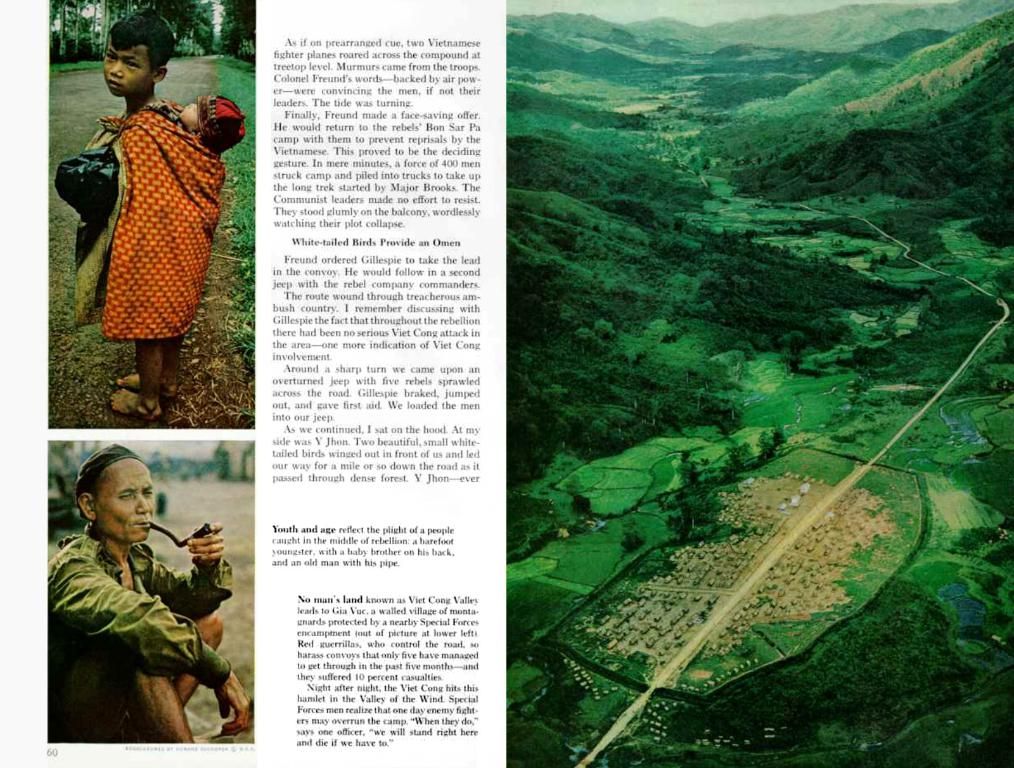

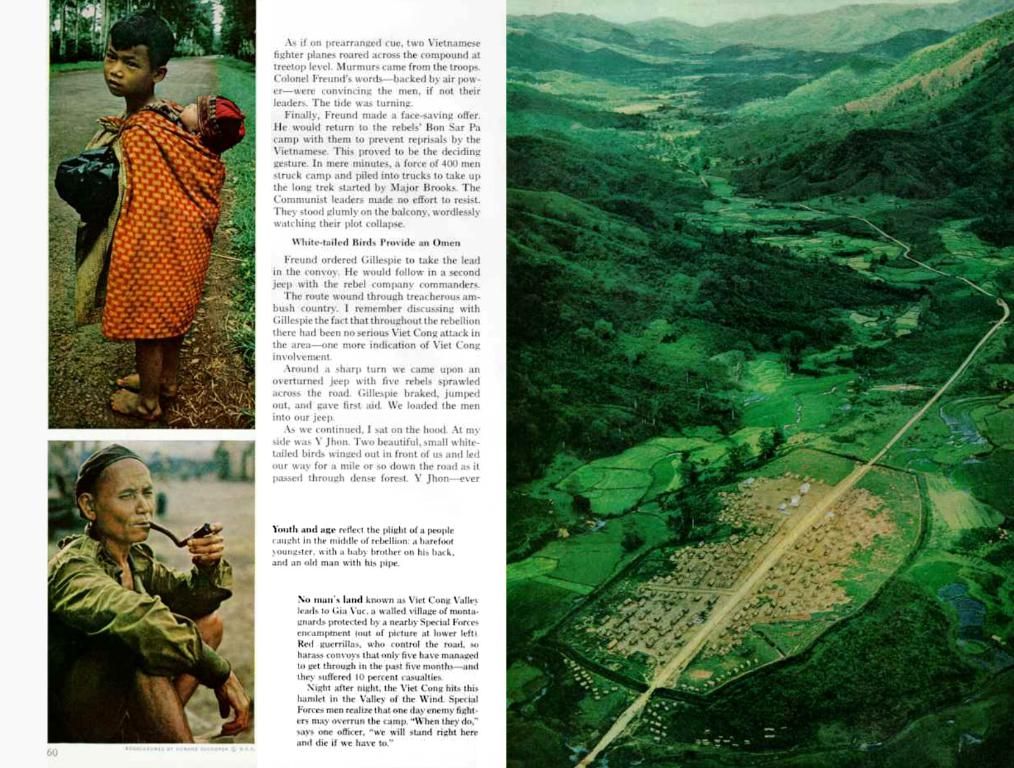

Former Bank of England chief, Mervyn King, has publicly chided Rachel Reeves for ignoring the burgeoning national debt. Speaking in the House of Lords, King urged a dedication to lessen the overwhelming £2.8 trillion debt burden that currently weighs on us, equating to £95,300 per household.

King, age 77, voiced his discontent during a Lords debate following the revelation this week of Britain’s crushing debt pile.

The criticisms fired at Reeves's budgeting strategies revolve around their alleged flaws, which allow debt to persistently rise as a proportion of GDP, with the expectation that it will eventually decline in the coming years.

While King headed the Bank of England from 2003 to 2013, his words hold weight in financial circles.

Policy Proposals to Tackle National Debt

Solutions toLogin to continue reading this post. Already a subscriber? Log in or Activate your account.Our journalism is funded by advertising, so Invest with clarity and confidence by understanding the market. Sign up now for the best in investing advice, delivered daily.

King's comments came after the release of official figures this week, which heightened public awareness of Britain’s escalating debt mountain.

DIY Investing Platforms

AJ Bell

AJ Bell

Learn More Learn More

Hargreaves Lansdown

Hargreaves Lansdown

Learn More Learn More

interactive investor

interactive investor

Learn More Learn More

InvestEngine

InvestEngine

Learn More Learn More

Trading 212

Trading 212

Learn More Learn More

Tackling this £2.8 trillion debt mess is no easy feat, and King's plea for reform underscores the urgency of addressing the issue. To facilitate the process, Here's Money can guide you through the finest stock and share ISA options and DIY investing platforms, ensuring you invest wisely and reap significant returns.

Streamlining Debt Reduction

The government delves into approachable, yet effective avenues to trim the national debt, as elaborated in key initiatives of the Spring Statement 2025:

- Financial Austerity and Budgeting Rules: Focusing on aligning daily spending with revenue by 2029-30, this rule will deter the accumulation of debt.

- Welfare Reductions: The Spring Statement 2025 proposes cutting welfare spending, with expected net savings of £3.4 billion.

- Housing and Economic Expansion: The Government plans to rapidly build over 1.3 million homes in the UK, harnessing potential economic growth to enhance tax revenues, navigating the necessity for borrowing.

Controversies Surrounding Existing Strategies

While the government's proposed strategies show a willingness to tackle the national debt, they face opposition on several fronts:

- Sluggish Progress on Debt Reduction: Skeptics argue that the current strategies are insufficient in significantly reducing the national debt, with the Office for Budget Responsibility (OBR) predicting annual debt growth of nearly £11 billion between 2025-26 and the end of the decade.

- Reliance on Economic Growth Projections: The success of government initiatives hinges on optimistic economic growth forecasts, which have undergone repeated adjustments. For instance, this year's projected growth was slashed in half from 2% to 1%. Such volatility undermines trust in the government's capacity to meet its fiscal targets.

- Revised Fiscal Rules: The government's shifting definitions of debt for fiscal rules are viewed by some as a tactic to manipulate appearances rather than confronting the actual debt problem.

- Interest Rate Dependence: Concerns have been voiced about the sensitive nature of the government's fiscal mandate to changes in interest rates. Any upward movement in bank rates or gilt yields could seriously compromise the government's ability to achieve its fiscal objectives, highlighting the vulnerability of UK public finances to economic shocks.

- Mervyn King, the former Bank of England chief, has publicly criticized Rachel Reeves for ignoring Britain's escalating national debt, which currently stands at £2.8 trillion and averages £95,300 per household.

- King, 77, raised his concerns during a debate in the House of Lords, following the revelation this week of Britain's overwhelming debt burden.

- The criticisms leveled at Reeves's budgeting strategies are centered around their alleged flaws, as they allow debt to persistently rise as a proportion of GDP, with the expectation that it will eventually decline in the coming years.

- To assist in addressing Britain's colossal debt problem, Here's Money can provide guidance on the best stock and share ISA options and DIY investing platforms, ensuring effective investment and substantial returns.

- The government has outlined several strategies to trim the national debt, as discussed in key initiatives of the Spring Statement 2025, such as implementing financial austerity and budgeting rules and cutting welfare spending, but these approaches face opposition due to concerns over sluggish progress, reliance on economic growth projections, and revisions to fiscal rules.