Governing gargantuan financial allocations

Nurlan Zhakupov Speaks Out on Executive Pay at "Samruk-Kazyna"

In a candid conversation, board chairman Nurlan Zhakupov addressed the question of executive compensation at "Samruk-Kazyna," a fund managing assets worth over $82 billion.

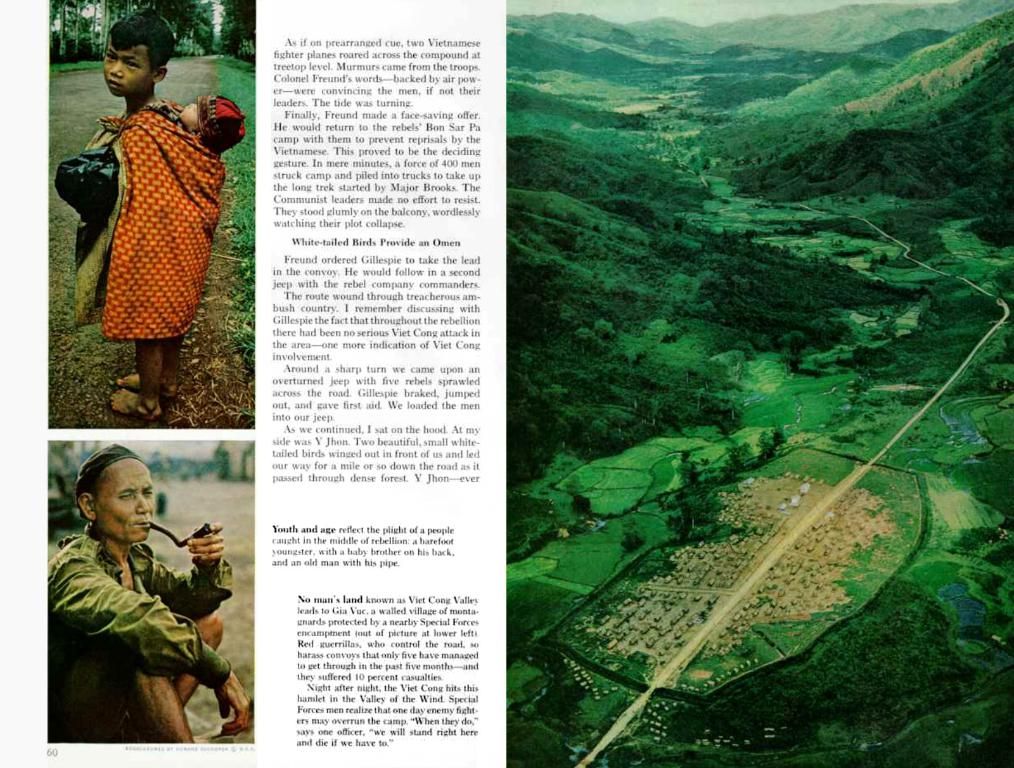

He highlighted the magnitude of responsibility resting on the shoulders of board members, "Decisions we make each day involve staggering sums. From major investment projects in the energy sector, worth a mind-boggling $14.4 trillion, to maintaining current capacities and diversifying across all portfolio companies, it's a weighty burden."

Zhakupov added, "So, what price should a board member bear for wielding such power?" Unfortunately, he couldn't share the exact figures due to corporate regulations.

Mentioning other funds like Temasek, Zhakupov cited their shared corporate practices, "Confidentiality is the name of the game in this world. Whether it's fair or not is another discussion, but it's the norm."

Interestingly, Zhakupov and his team do not rake in bonuses or comp for their board roles in subsidiary portfolio companies.

It's worth noting that the remuneration for board members of large funds varies considerably based on factors such as location, governance policies, and fund structure. Generally, they are reimbursed via a mix of service fees and, on occasion, equity or performance-based rewards. However, precise amounts are seldom publicized and might depend on the jurisdiction and the fund's disclosure policies.

The portfolio for these funds commonly includes fees for meeting attendance, committee membership, and strategic input. Sometimes, they may receive equity or performance-based incentives. Occasionally, additional benefits like travel expenses, insurance, or exclusive networking opportunities might also factor into their compensation.

In sharp contrast, top managers (CEOs, CIOs, etc.) often receive more substantial pay packages, more closely tied to their full-time role and performance. These can consist of high base salaries, performance-based bonuses, and equity or long-term incentives.

Sovereign wealth funds like "Samruk-Kazyna" are less likely to offer performance-based bonuses to ground their pay structures in private equity principles. Meanwhile, funds like Temasek, known for their stringent governance standards, may employ a combination of fees and performance-based incentives, though they axe likely less aggressive than their private sector counterparts.

InZhakupov's words, "So, we've got a tough balance to strike – remunerating our people fairly without crossing any ethical boundaries. It ain't easy, but we're doing our best to keep the dream alive."

Read More:

- "Technically very complex". Chairman of "Samruk-Kazyna" comments on the possibility of liquidating the fund

- Tokayev receives head of AO "Samruk-Kazyna"

- In the discussion, Nurlan Zhakupov, the chairman of "Samruk-Kazyna," emphasized the complexity of their roles, stating that decisions made by board members in the finance sector, such as investing and managing business ventures, are associated with significant amounts of money.

- Due to corporate regulations, Nurlan Zhakupov could not disclose the exact figures of his remuneration, but he mentioned that the compensation for board members of large funds like "Samruk-Kazyna" typically involves a mix of service fees, equity, and performance-based rewards.