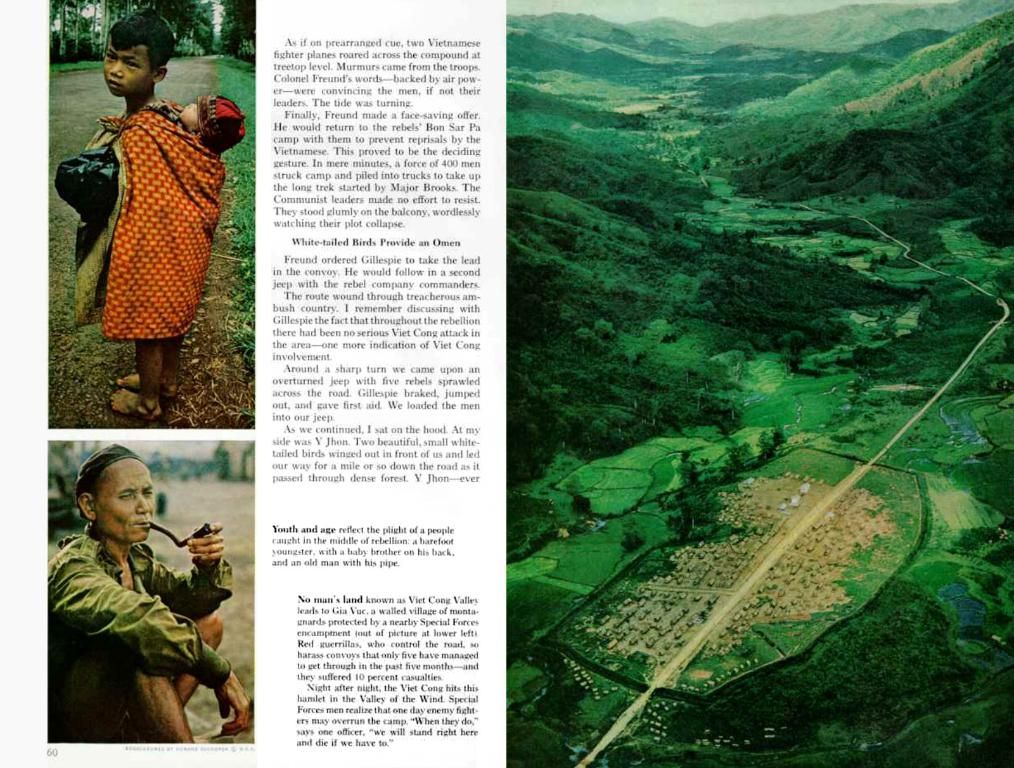

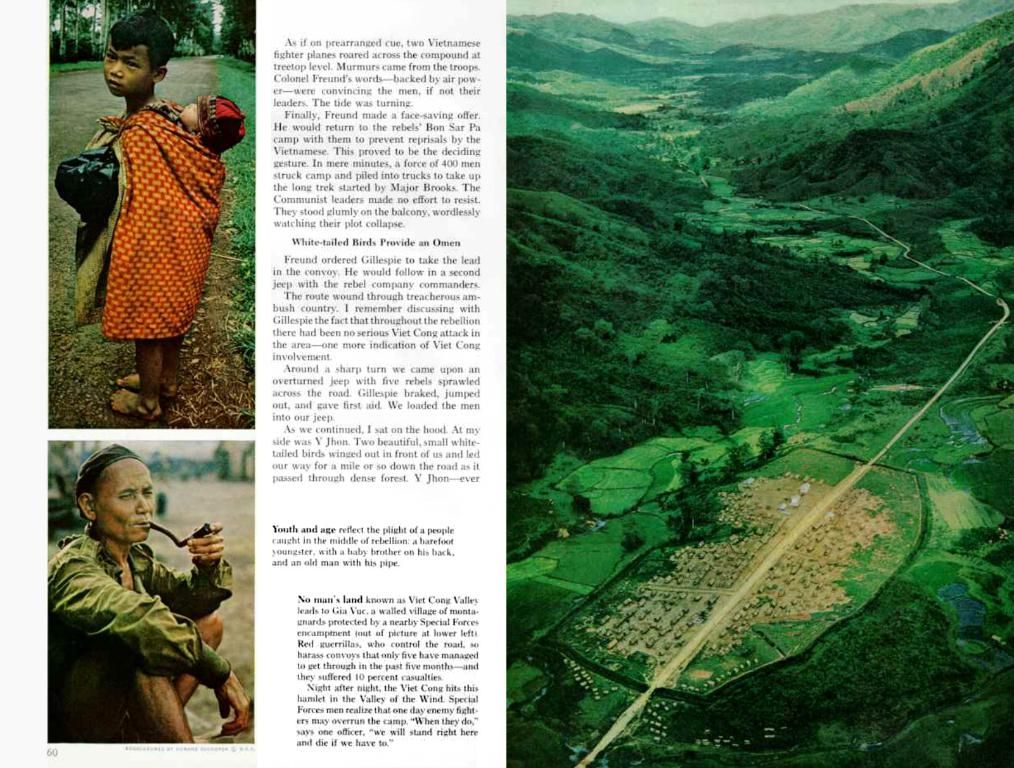

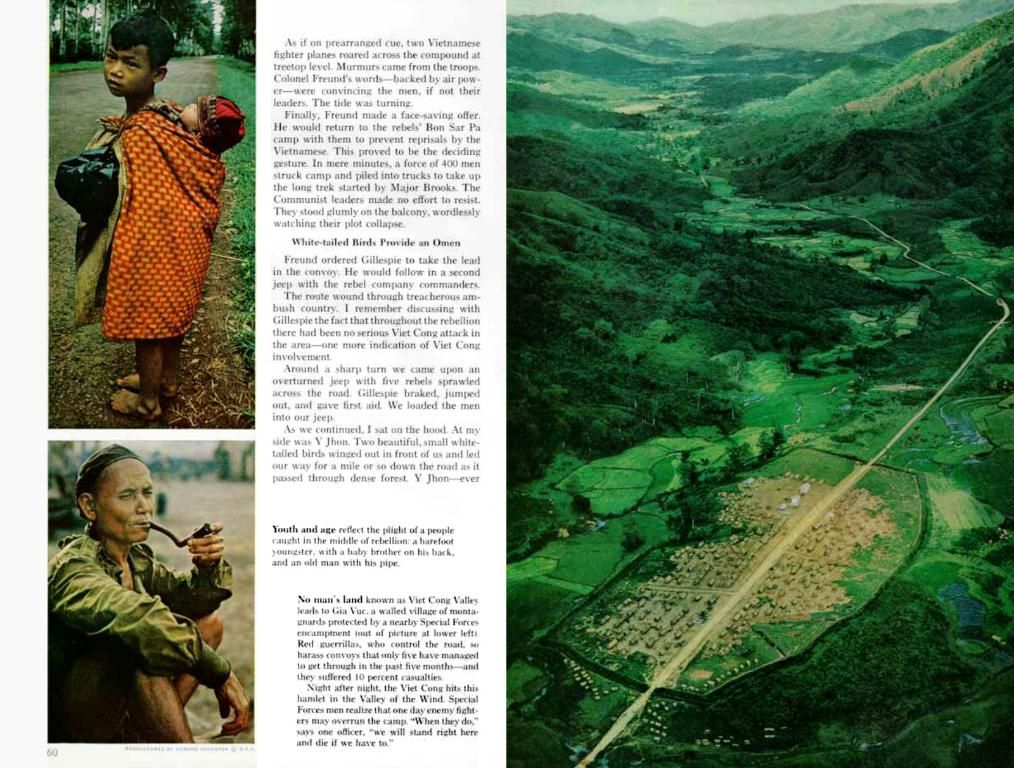

Has the stock market experienced its lowest point as per historical trends?

The Global Stock Market Rollercoaster: Climbing Out of Trump's Trade War Slump

The stock market saw a bullish rally on Wednesday, yet the S&P 500 remains trapped in a downward spiral ignited by President Donald Trump's trade war. After achieving a record high in February, the S&P 500 plunged into a correction in March, following Trump's tariff announcement. The index as of today is still 12.5% lower than its peak two months ago.

Historically, a 10% decline from a peak is termed a correction, while a 20% decline constitutes a bear market. Since its record high in February, the S&P 500 has witnessed a staggering loss of $6.5 trillion in market value according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

Investors continue to grapple with determining when the market might find a stable footing. In truth, no one can accurately predict the market's future movements.

The market experienced its lowest closing price this year on April 8, down 18.9% from its February peak. To date, the S&P 500 has not retested this low, leaving many wondering whether the market will keep climbing or drop lower.

Historically, when the S&P entered correction but did not enter a bear market, it took an average of 133 days to find the bottom. Recovery took an additional 113 days on average. If April 8 marks the market's bottom, it would be a record-breaking 48 days from the February peak to the bottom – significantly faster than the usual timeframe.

Another factor to consider is the speed at which the market drops. Typically, when there is a sharp decline from a peak to a correction, the slump tends to be relatively short-lived. However, the market correction this year has been driven primarily by the White House's policy, making it relatively unique.

Some analysts believe the market may "retest" the April 8 low before finding a bottom. For the market to maintain the April 8 low, investors must perceive a substantial shift in trade policy, giving them hope that the worst has passed, says Nick Colas, co-founder of DataTrek Research.

The retesting period can be traced back to the 1987 market crash. On October 19, 1987, the S&P 500 plummeted 20.5% before rebounding about 14% across the next two days. However, the benchmark index failed to hold those gains and eventually retested the October low in December, marking the bottom.

The length and depth of the market slump are uncertain, making it challenging to predict whether it will be a swift recovery or a prolonged grind to find a stable footing. Adam Turnquist, chief technical strategist at LPL Financial, has been hesitant to call for a swift recovery this year. In contrast, Kim Abmeyer, a certified financial planner and founder of Abmeyer Wealth Management, suggests a sideways grind may be in store.

Ultimately, while it is impossible to predict precisely when the market might find a bottom, patients and disciplined investors who stick to their plans will be rewarded in the long run. Younger investors with long-term goals should view market corrections as an opportunity to buy stocks at a discount. Investors approaching retirement may consider diversifying into more Treasuries and safe investments, like money market funds, to protect their investments.

The outlook for the market largely depends on investors receiving more clarity from the White House, potentially leading to decreased uncertainty and favorable market reactions.

- Despite the stock market rally on Wednesday, the S&P 500, still trapped in a downward spiral due to President Donald Trump's trade war, is 12.5% lower than its peak in February.

- Investors struggle to determine when the market might find a stable footing, as no one can accurately predict the market's future movements.

- The speed of the market correction this year, driven primarily by the White House's policy, is relatively unique; traditionally, when there is a sharp decline from a peak to a correction, the slump tends to be relatively short-lived.

- Some analysts believe the S&P 500 may "retest" the April 8 low before finding a bottom, requiring a substantial shift in trade policy for investors to perceive a hopeful change in direction.

- As the outlook for the market depends on investors receiving more clarity from the White House, investors approaching retirement may consider diversifying into more Treasuries and safe investments, like money market funds, to protect their investments, while younger investors should view market corrections as an opportunity to buy stocks at a discount.