HSBC hastens its move into private credit by infusing $4 billion

Shelling Out Big Bucks: HSBC Dives Deeper into Private Credit Funds

Stepping up its game in the private credit realm, Europe's colossal lender, HSBC, has dropped a whopping $4 billion into its asset management division. This move signals a bold entry into the thunderous $1.6 trillion private credit market.

With the funds earmarked for its alternative credit funds, HSBC aspires to lure in investors and scale up its $50 billion credit platform within the next five years. As the banking sector vies for dominance in the private credit market, historically the domain of asset managers like Blackstone and Ares, HSBC is pulling out all the stops.

HSBC's governing honcho, Nicolas Moreau, spoke frankly to Reuters, succinctly summarizing the competitive landscape as an "arms race." He expressed confidence that the newfound funding would help the division entice fresh capital.

Racing Towards the Private Credit Finish Line

Riding the wave of direct lending opportunities across Asia and the UK, HSBC strategizes its private credit foray. In a bid to diversify its offerings in the speedily expanding market, the finance titan launched a new venture debt strategy in November 2024. This strategy aimed to corral $500 million from investors, targeting annual returns of 15 to 18 percent. As analysts forecast the market might balloon to a whopping $2.8 trillion by 2028, HSBC is poised to capitalize on the growth.

This expansion continues Chief Executive Georges Elhedery's overhaul of the banking establishment. Elhedery outlined his vision of a "simpler, more dynamic, and agile organization" in his comprehensive restructure first announced in October 2024. With a promise to slash £1.2 billion in costs by the end of 2026, the bank's strategy includes divvying up the business into "eastern markets" (Asia-pacific and the Middle East) and "western" (the Americas and Europe).

However, the restructure has sparked concerns over a potential, gradual exit from European markets following workforce reductions across the region. Treading through the volatile waters of the financial world, only time will tell if HSBC's leap into the private credit market will prove to be a game-changer or a misstep in its ongoing transformation.

Gearing Up for Intense Competition

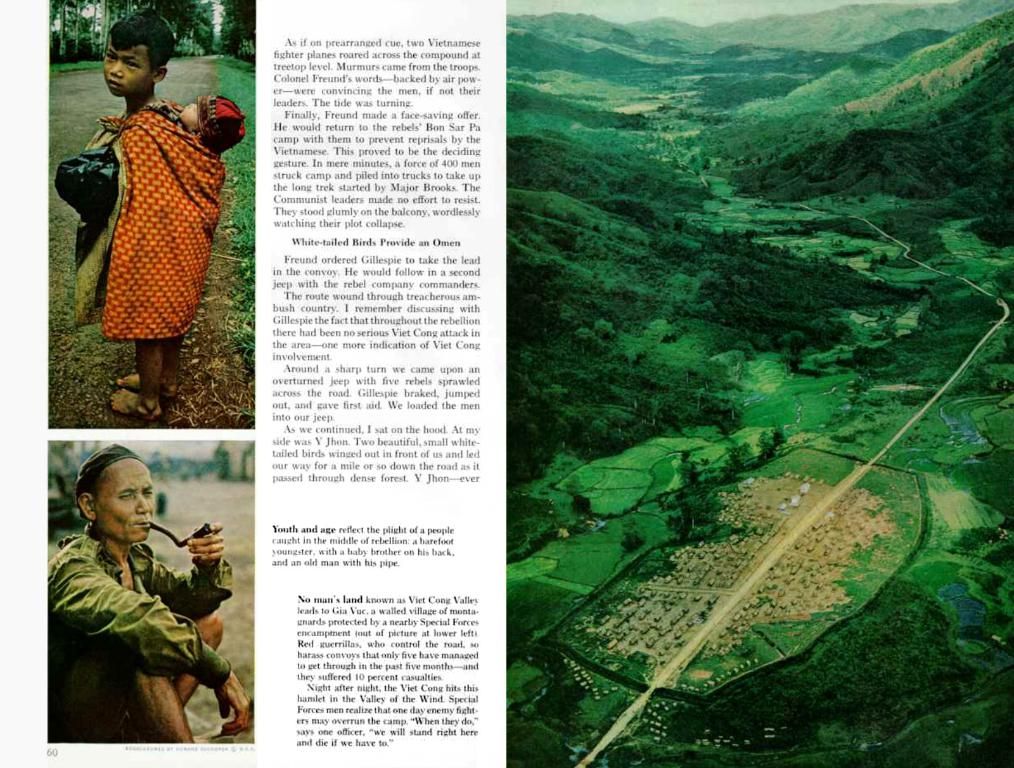

Given its aggressive expansion into the private credit market, HSBC aims to leverage its newfound $4 billion funds to attract investors and expand its $50 billion credit platform. Amidst an "arms race" in the private credit market, where asset managers like Blackstone and Ares traditionally hold strong positions, HSBC is making strategic moves to capitalize on the growing market size anticipated to hit $2.8 trillion by 2028.