Indian Crypto Regulation Halted by RBI Apprehensions and Judicial Demands

Let's Dive into the Cryptic World of Cryptocurrencies in India

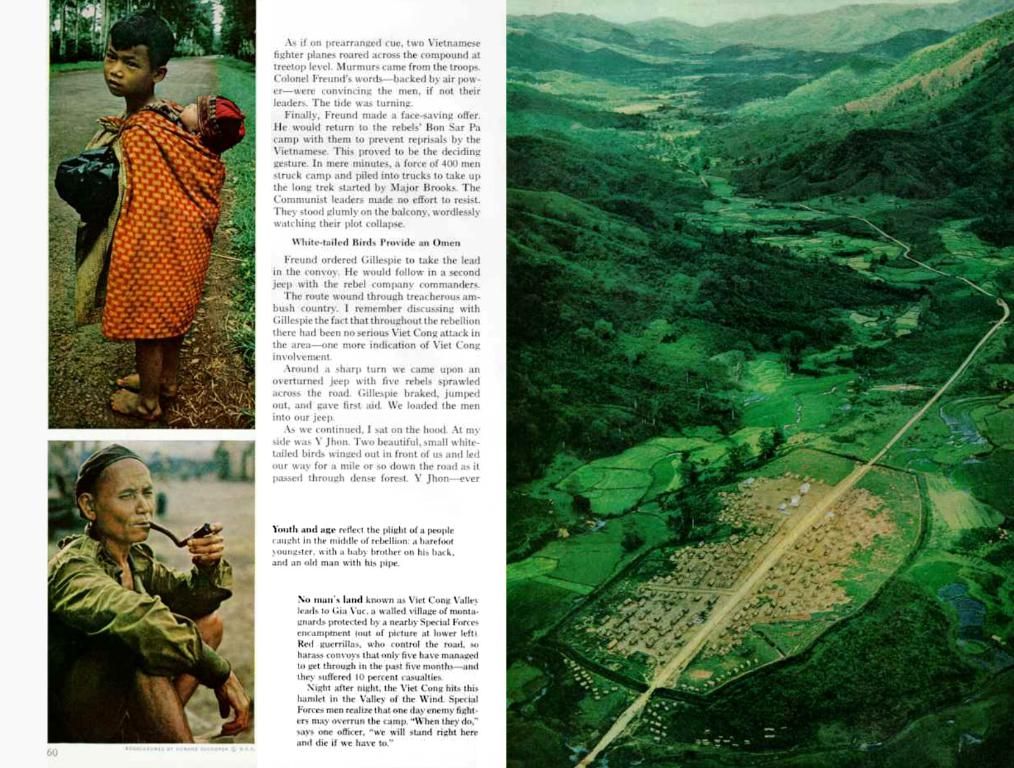

India's Reserve Bank of India (RBI) governor, Shaktikanta Das, has spilled the beans on the nation's stance towards cryptocurrencies. Despite some initial reluctance, a government panel has been set up to delve deeper into the digital currency realm.

Malhotra has voiced valid concerns about the potential threat cryptocurrencies might pose to India's financial stability and monetary policy. The Supreme Court hasn't been too pleased with the government, either, for not establishing clear-cut rules.

Crypto-Taxation but Limbo on Legal Status

While cryptocurrencies haven't been officially acknowledged, India has a system in place for crypto transactions. As early as 2022, taxes started demanding their due. A 30% tax was slapped on crypto gains, and 1% tax got deducted from every transaction. Plus, Goods and Services Tax (GST) was collected on services provided by crypto exchanges.

However, these taxes don't reflect an official nod. Cryptocurrencies are yet to get the green light from the government, and the sector still operates under the shadow of uncertainty. Although it's subject to money laundering rules, there are no exclusive regulations just for cryptocurrencies.

The government has taken the first step towards visualizing the future of cryptocurrencies in India. Officials from the RBI, SEBI, and the Ministry of Finance have joined hands. They've been reviewing policies from around the world and drafting domestic guidelines. Once done, they plan to open the floor for public opinion during the consultation process.

Supreme Court Puts Pressure on the Government

The Supreme Court's recent involvement underscores the legal limbo surrounding cryptocurrencies. With reports of illicit activities on the rise, the judiciary is pushing for a clarified policy. Despite the ban on crypto banking getting struck down in 2021, a robust legal framework is essential to ensure the sector thrives.

The RBI has been nervy about the potential risks of a wider crypto adoption. The central bank underscores the importance of treading carefully when financial institutions adopt new technologies.

Current Legal Landscape of Cryptocurrencies in India**

As of 2025, cryptocurrencies in India are considered a grey area, neither legal tender nor officially banned. Though tax laws have been implemented, a comprehensive regulatory framework is yet to see the light of day. The government is, however, moving towards aligning with global regulatory standards.

Proposed Regulatory Framework

The government is gearing up for a more structured framework. A significant development is the Supreme Court's recent call for the government to provide clearer guidelines for cryptocurrencies. In May 2025, it was announced that a discussion paper on cryptocurrencies might be released in June, which could lay the groundwork for future legalization or regulations.

The Securities and Exchange Board of India (SEBI) has also started keeping a watch on crypto tokens that resemble securities, indicating a multi-agency approach. Despite these developments, a clear and comprehensive regulatory framework is still awaited.

- In the current legal landscape, cryptocurrencies in India are considered a grey area, neither officially banned nor acknowledged as legal tender, despite the implementation of tax laws.

- The government, backed by officials from the Reserve Bank of India, SEBI, and the Ministry of Finance, is working on a proposed regulatory framework, with a possible discussion paper on cryptocurrencies set to be released to align with global standards and potentially legalize or regulate cryptocurrencies in the future.

The business and finance sectors ponder the potential implications of such a framework on India's financial stability and monetary policy, as well as the tax revenue generated from cryptocurrency transactions.