Interest rates for refinancing exhibit a minor increase, ending a four-day downward trend.

Refinance Rates Soar on Friday, Remaining Elevated

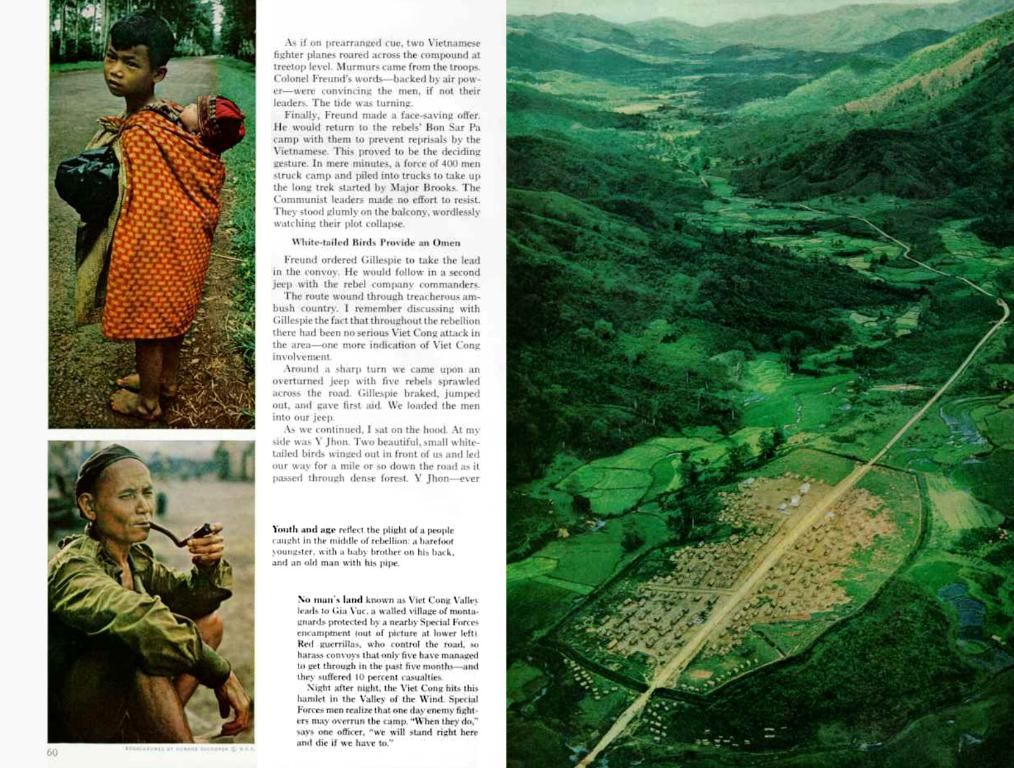

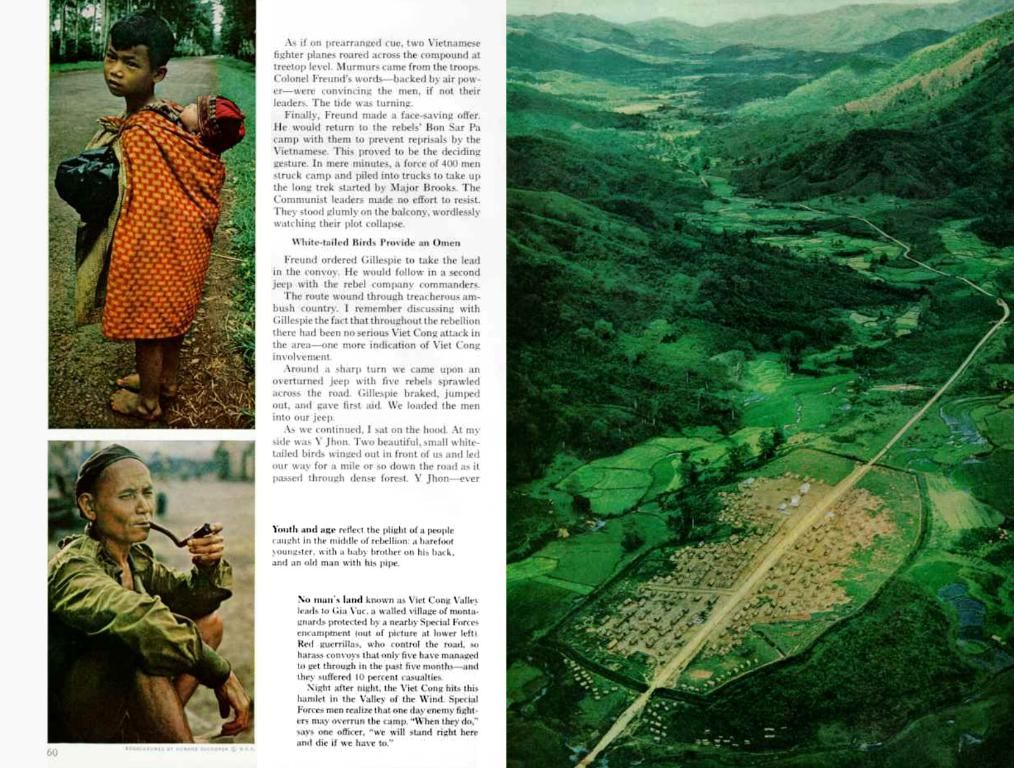

After a sharp drop of 16 basis points over four days, ultimately hitting a six-week low, 30-year refinance rates surged 5 points higher on Friday, ending the week at 7.09% on average. Despite this shift, rates still remain improved compared to the May peak of 7.32%, marking a 10-month high.

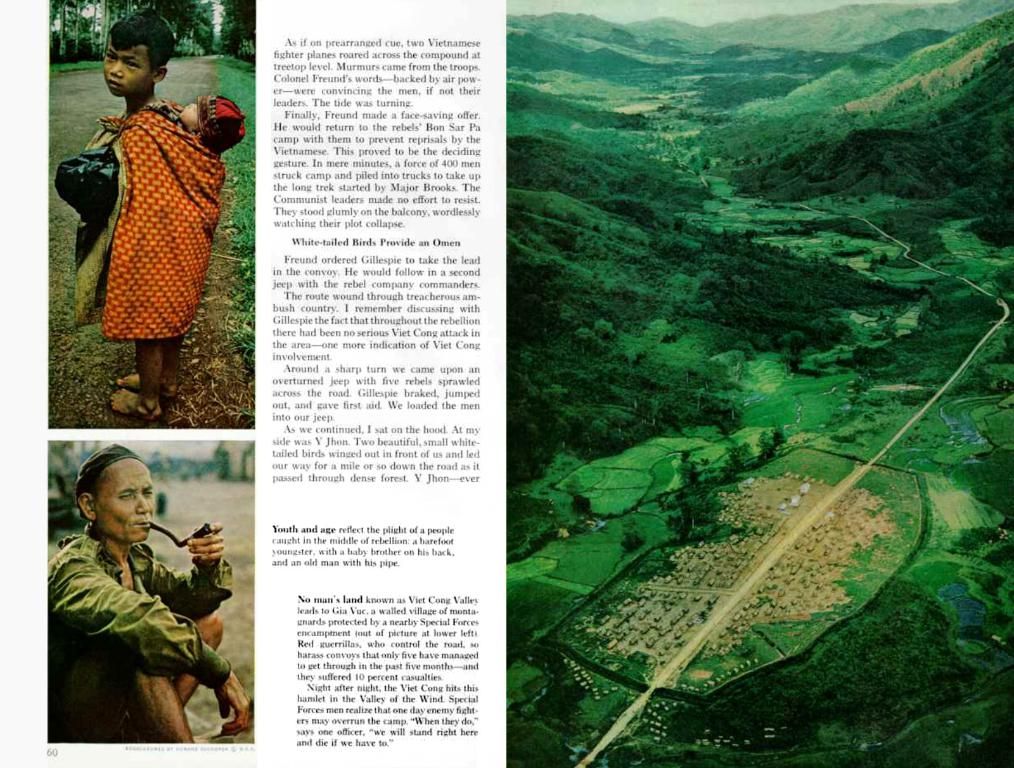

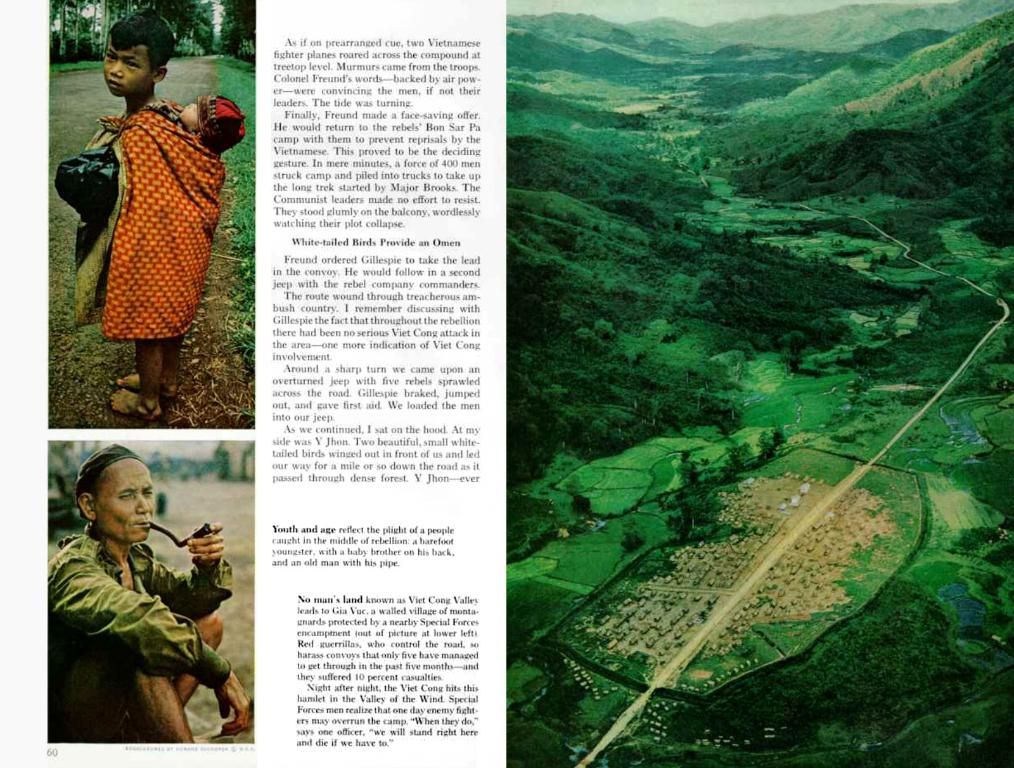

While 30-year refi rates had dipped as low as 6.71% in March, they remain notably inflated compared to the current average. This average is also significantly more than a percentage point higher than last September's 6.01%, a two-year low.

Several other refi rates also saw increases on Friday. The 15-year and jumbo 30-year refinance averages increased by 3 and 2 basis points respectively, while the 20-year refi average jumped 9 basis points higher.

Understanding Teaser Rates and Lender Comparison

The rates provided here won't align directly with the teaser rates you might see advertised online, as these teaser rates are handpicked to represent the most attractive options vs. the averages presented here. These teaser rates may require paying points upfront or may be based on an exceptionally high credit score or a smaller-than-usual loan amount. Keep in mind that the rate you ultimately secure will depend on factors such as your credit score, income, and more-meaning it may vary from the averages provided.

As rates can differ significantly between lenders, it's always prudent to shop around for the best mortgage refinance option and compare rates regularly. Regardless of the type of home loan you're seeking, it's essential to compare options to determine the most favorable rates.

Mortgage Calculator for Varied Scenarios

By inputting key details such as home price, down payment, loan term, property taxes, homeowners insurance, and your anticipated interest rate, you can get a sense of what your monthly mortgage payment might look like. Consider utilizing our Mortgage Calculator to establish a clearer understanding of your potential monthly payment.

What Causes Mortgage Rates to Rise or Fall?

Mortgage rates are influenced by a myriad of macroeconomic and industry factors. Some key factors include:

- Federal Reserve Policy: Changes in the Federal Reserve's monetary policy can directly impact borrowing costs for banks, which in turn can affect mortgage rates.

- Inflation: High inflation can lead lenders to charge higher interest rates due to the reduced value of money over time.

- Supply and Demand for Loans: Market demand and the availability of loans can impact interest rates.

- Bond Market Activity: Fixed mortgage rates are significantly tied to the 10-year Treasury yield. When Treasury yields rise, mortgage lenders typically increase rates to match the market.

- Economic Indicators: Strong employment reports and robust economic growth can cause mortgage rates to increase, while economic slowdowns and high unemployment can push rates down.

With all these complex variables at play, it can be challenging to attribute a single change in mortgage rates to a single factor.

Different Factors Impacting Mortgage Rates

In addition to these general factors, there are also borrower and loan-specific influences on mortgage rates:

- Credit Score: Borrowers with higher credit scores often secure lower interest rates due to their lower risk profile.

- Down Payment and Loan Amount: A larger down payment and smaller loan amount can lead to lower interest rates as these factors represent less risk to the lender.

- Loan Type and Term: Different types of loans (e.g., fixed-rate, adjustable-rate, FHA) and varying term lengths have different rate structures. Shorter-term loans typically have lower interest rates than longer-term loans.

Other factors, such as the term premium, prepayment risk, option-adjusted spread, and lender fees and competition, can also impact mortgage rates-though these factors may be more technical in nature.

When taken together, these factors interact to create dynamic mortgage rates that respond to both macroeconomic trends and individual borrower characteristics.

- Considering the current surge in refinance rates, prospective investors might want to explore alternative avenues for personal-finance management, such as investing in crypto tokens or other financial instruments.

- As mortgage rates remain elevated, it becomes crucial for individuals to monitor their personal-finance situation carefully, ensuring they have a solid understanding of their financial obligations and available resources.