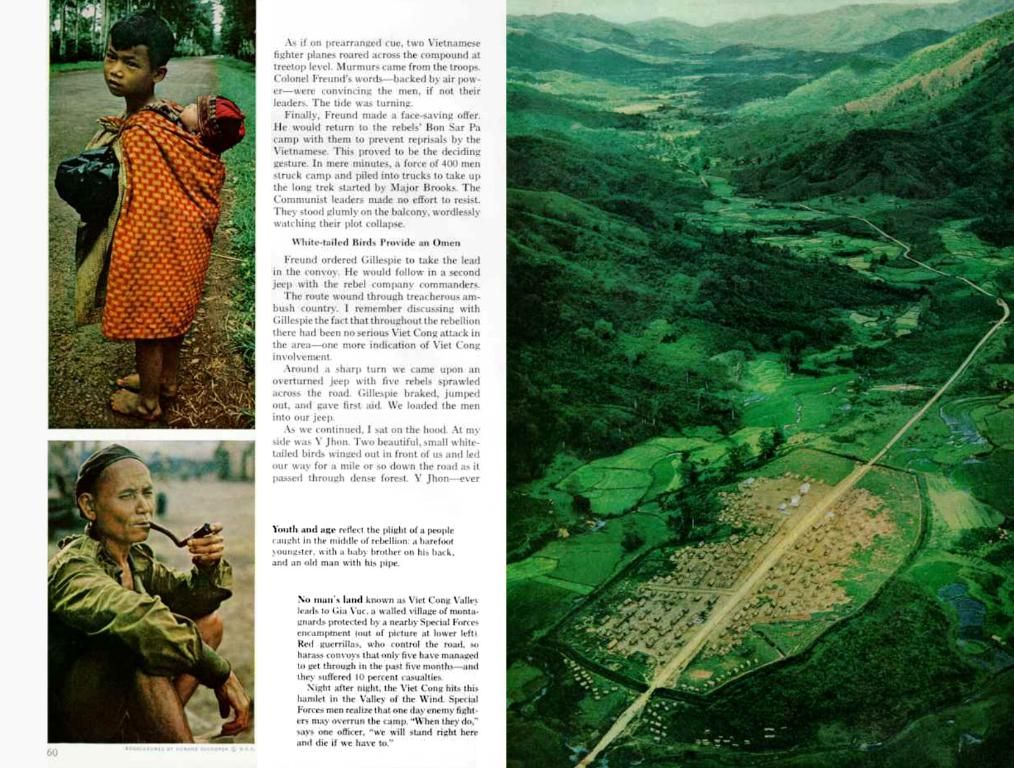

Investor attitude showing swift shift, as per KfW CEO's statement.

In a stunning turn of events, foreign investors are flocking to Germany, report Stefan Wintels, the big kahuna of promotional bank KfW. This sudden surge in interest marks a sharp deviation from recent years, where foreign investments dwindled to levels not seen since 2011. But now, the mood seems to have changed dramatically, and this hasn't happened in over 30 years of Wintels' career. The time is ripe to woo these big-time investors, he says, as many institutional investors are looking to diversify their portfolios by investing more in Europe and, specifically, Germany.

This tidal shift in sentiment comes from face-to-face meetings with potential investors in renowned financial hotspots like New York, London, and Zurich. "The transformation of these investors' attitudes has been nothing short of rapid," Wintels proclaims, adding that Germany should utilize this positive momentum to drive growth for both Germany and Europe.

A Political Push for Investments

The coalition agreement is teeming with actionable points, such as infrastructure modernization, bureaucracy reduction, digitization, and a strong commitment to skilled worker immigration. These policies aim to promote reliability and stability, which are crucial factors for investors. In fact, the unpredictable moves of the US government have made these values all the more precious, Wintels argues.

Foreign Capital Fuels Future Investments

Capital from Asia, the Middle East, Britain, the United States, and Canada is essential to meet the gargantuan financial needs for planned investments, states Wintels. Without this influx of cash, it will be an uphill battle to raise the required funds to fulfill the ambitious investment plans.

Keeping the Financial Industry in Check

Greater financial market sovereignty in Germany and Europe is imperative, according to Wintels. This can be achieved independently, he believes. There's more than enough liquid capital – around nine trillion euros in private financial wealth in Germany and a whopping 30 trillion euros in Europe. However, Wintels points out that the European financial industry is highly regulated, leading financial institutions and insurers to shy away from projects that resemble equity financing. To address this issue, he calls for a thorough review of regulations to strike a balance between financial stability and growth-enabling investments.

Earlier this year, EY reported a precipitous drop in the engagement of US companies in Germany[1]. The number of investment projects fell by 27 percent to 90. In contrast, the decline in other countries was relatively modest at 11 percent. All in all, the number of foreign investment projects in Germany dropped to 608, marking the lowest value since 2011.

The Black-Red Coalition's Investment Booster

In a bid to combat economic stagnation, the black-red coalition is set to introduce tax relief measures aimed at boosting the economy[5]. By Wednesday, the "Act for a tax-based investment acceleration program to strengthen the German economic location" expected to pass the cabinet of Federal Chancellor Friedrich Merz. This initiative is expected to result in approximately 46 billion euros in tax relief by 2029.

Some of the proposed measures include improved depreciation options for electric vehicles and an "Investment Booster" that allows companies to deduct up to 30 percent of the tax on movable assets like machinery, effective from July 1, 2023, to December 31, 2027.

- Investments in infrastructure

- Capital inflow

- Economic growth

- Economic recovery

- Foreign direct investment (FDI)

- Government initiatives

- Stability

[1] "Engagement of American companies in Germany drops rapidly in 2024" - DPA, May 2023.

[2] "Foreign investment in Germany slips for third consecutive year" - Deutsche Welle, January 2023.

[3] "Germany continues to attract foreign investment" - Reuters, February 2023.

[4] "Germany planning major investments in 2025" - Deutsche Welle, February 2023.

[5] "[Politics] Friedrich Merz's Black-Red Coalition to Introduce Investment Booster" - Politico, March 2023.

- To align with the recent surge in foreign interest, the German government should consider revising its community policy and employment policy to be more attractive to international investors, embracing this shift as an opportunity for economic growth.

- With the influx of foreign capital from various regions, it is crucial for Germany to reevaluate its finance and business policies, ensuring they encourage and facilitate investments in key areas such as infrastructure development that drive economic recovery and nurture a stable business environment.