Kazakhstan's National Bank Sets Key Interest Rate at 16.5%

Revamped Take:

➡️ ASTANA—Uh-oh! The Monetary Policy Committee of Kazakhstan's National Bank (NBK) has cranked up the base rate by 16.5% on a yearly basis, with a wiggle room of +/- 1 percentage points, according to their official announcement.

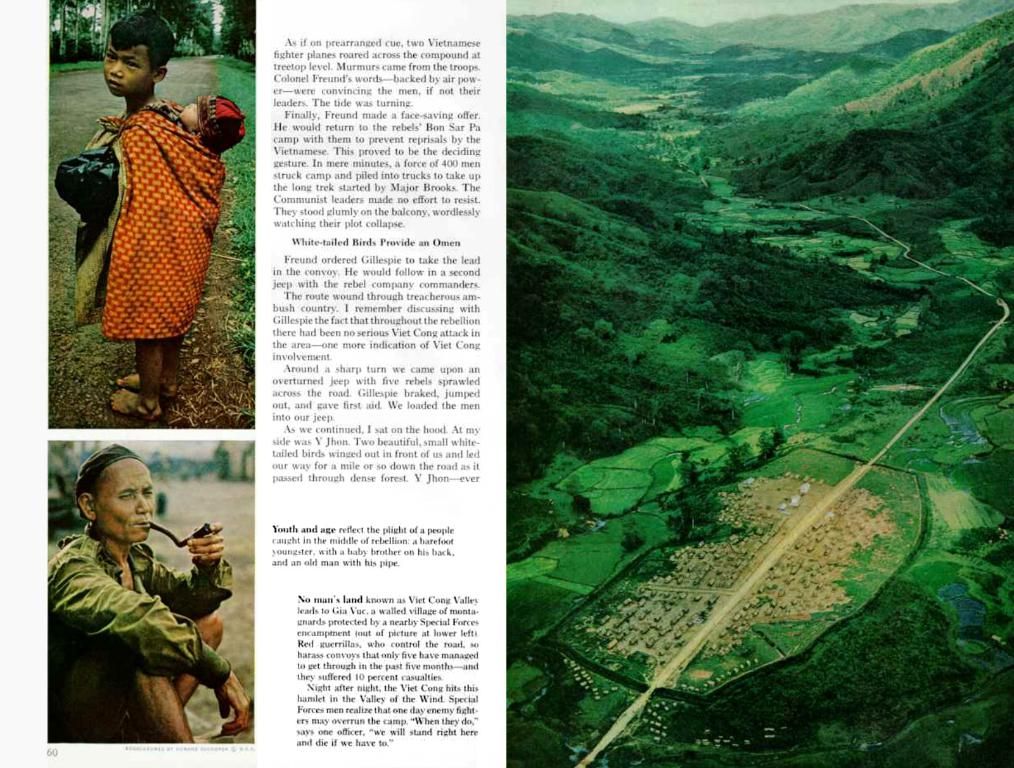

❗️🔥 Bank's Snazzy Digs: 📷 Don't worry; we've got you covered with a peek at the NBK's headquarters in Astana. 📸 [National Bank of Kazakhstan press service]

Cause for Action:

The move arrives on the heels of relentless inflationary pressure that's been steadily nudging upwards. Speaking of that, May's inflation clocked in at 11.3%, with price hikes occurring in regulated tariffs and market-based services alike. Factors like Russia's economic deeds and high global commodity prices are also contributing to the inflation party.

Laying Down the Law:

In light of these persistent inflationary challenges, the NBK has signaled their intention to keep things tight on the monetary front for a while longer than initially expected. In other words, get ready for a durable episode of monetary stringency.

The NBK's Governor Timur Suleimenov himself admitted the uncertainties surrounding future policy decisions, but he emphasized that current forecasts predict the base rate will hum along at 16.5% throughout 2025.

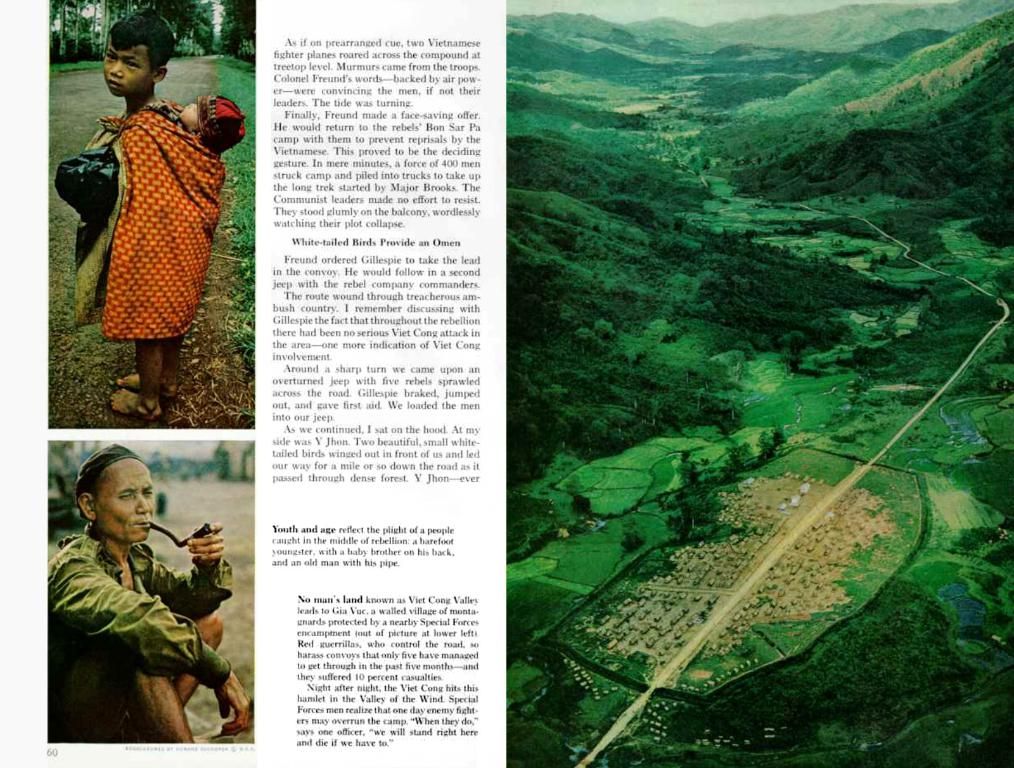

❗️🔥 Governor Suleimenov's Snap: 📷 Here's a glimpse of our man in charge, Governor Timur Suleimenov. 📸 [National Bank of Kazakhstan]

Economic Prospects in 2025 & Beyond:

The good news is that the economic growth forecast for 2025 has bounced up to 5-6%, thanks to a spark in domestic demand and increased investment. However, for 2026, things may slow down a bit to 4-5%, with a milder growth velocity and dampened export growth in a lower oil price scenario.

Keeping the economy moving forward will depend on a flurry of government-initiated structural reforms, like encouraging capital investment, attracting foreign direct investment, and loosening the economic reins.

May's Inflation Data:

May's monthly inflation came in at 0.9%, significantly stealing the show compared to historical trends. Core and seasonally adjusted inflation indicators? Talk about high stakes—they sizzled at 10.1% and 11.4% year-on-year, respectively.

Population's Inflation Expectations:

Inflation expectations among the populace have escalated following a limelight-grabbing surge, landing at a sweaty 14.1% in May. This indicates ongoing volatility and uncertainty in the inflation arena.

Updating the Oil Scenario:

The NBK has adjusted its baseline scenario for Brent crude oil to average $60 per barrel throughout the forecast period. This change reflects an oversupply in the global market. As a result, inflation forecasts have been tweaked, with expectations of inflation standing at 10.5-12.5% in 2025 and 9.5-11.5% in 2026. By 2027, inflation should dip to 5.5-7.5%, thanks to a tightening of the monetary policy and the gradual phasing out of budgetary stimulus as part of fiscal consolidation efforts.

Enrichment Insight:- The rate hike was the result of growing inflationary pressures, external and domestic factors, and concerns about economic growth.- The base rate was increased to 16.5% in response to several factors including inflationary pressures, external pressures, and domestic factors.- The inflation forecast was raised due to high fuel prices, VAT increases, housing reforms, and reduced oil production.- The NBK is balancing growth with inflation control.- The NBK plans to tighten macro and microprudential regulations on retail lending to address inflationary risks.- There is a possibility of another rate hike in the second half of 2025 if inflation trends continue to challenge official projections.

- The National Bank of Kazakhstan (NBK), despite admitting uncertainties about future policy decisions, predicts that the base rate will stay at 16.5% through 2025, a move likely to impact the finance sector of Kazakhstan's business environment.

- The persistent inflationary challenges faced by Kazakhstan and the subsequent rate hike by the NBK could pose significant hurdles for businesses operating in sectors vulnerable to price volatility, particularly those reliant on market-based services or regulated tariffs.