Luxury conglomerate Hermes surpasses LVMH in market value, securing the title of the most valuable luxury group.

STEP ASIDE LUXURY KING, HERMES TAKES THE CROWN!

LVMH, the powerhouse behind Louis Vuitton, Dom Perignon, Givenchy, Tiffany & Co., and TAG Heuer, among others, has ceded its throne as the world's most valuable luxury company. Hermès, known for Birkin handbags and luxury merchandise such as clothes, scarves, shoes, jewelry, and belts, upstages LVMH with a market cap of 248.1 billion euros, compared to LVMH's 244.1 billion euros.

Theswap in luxury titans happened after LVMH reported a 3% organic decrease in revenue for Q1 2025, missing analyst expectations and causing a dip in LVMH shares. Fashion & Leather Goods took the hardest hit with a 5% year-over-year drop, while Wines & Spirits saw a 9% decline, and Perfumes & Cosmetics, and Selective Retailing both experienced a 1% organic decline.

The European market showed growth, but the United States and Japan saw slight declines, with China's economic instability and geopolitical uncertainties playing a part. As always, LVMH remains vigilant and confident, ready to weather the storm in the midst of a chaotic global environment.

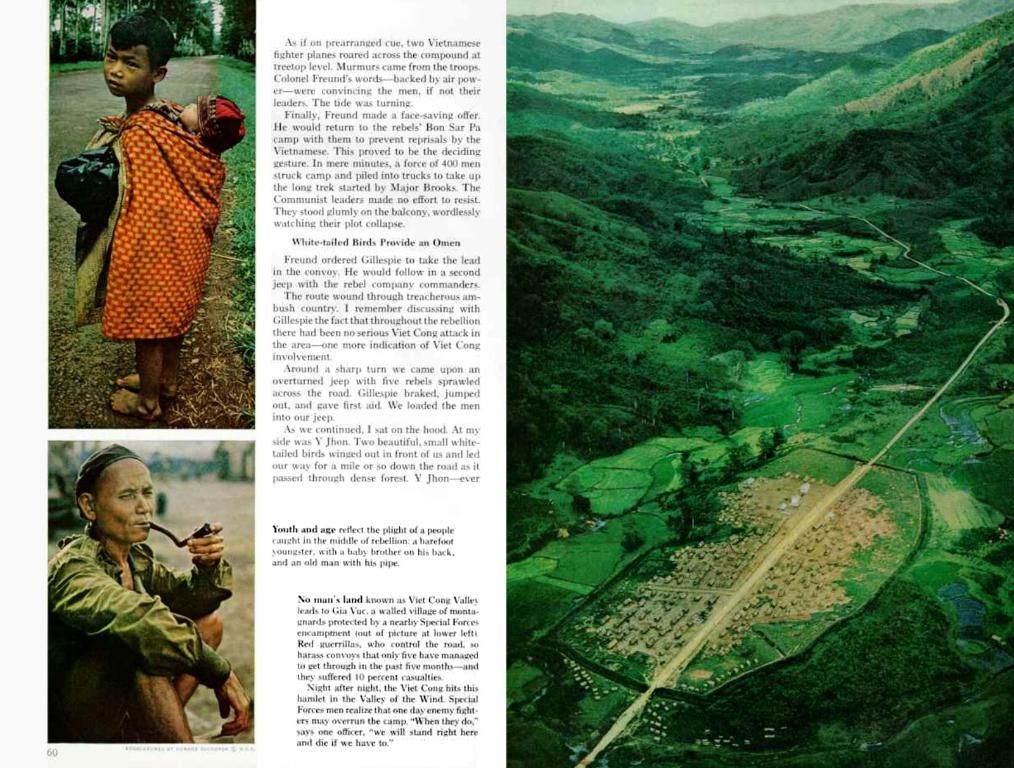

The High Price of Desire: Why Hermès Birkin Bags are a Status Symbol

The high price tags attached to Hermès Birkin bags can be attributed to the bags' craftsmanship, exclusivity, and durable materials. The bags have become a status symbol for the wealthy, and their demand is robust, despite the current downturn in the luxury sector.

A Perfect Storm for Luxury Retail

The decline in LVMH's sales can be linked to three primary factors:

- Post-Pandemic Spending Fatigue and Inflation: After years of luxury splurging, consumers are shifting their disposable income to essential goods and experiences. High inflation has only worsened the situation, making high-end purchases less appealing.

- China's Economic Instability: China's property crisis and rising debt levels have dented consumer confidence, negatively impacting LVMH's revenue in Asia (excluding Japan). The region is a significant player in luxury sales, with Chinese buyers historically driving growth in markets like Japan, which experienced declines due to reduced spending from this group.

- Geopolitical & Trade Risks: Proposed tariffs under President Trump's administration created uncertainty, impacting luxury spending in the Americas. Meanwhile, stagnant growth in Europe and Japan highlights broader demand challenges for the luxury sector.

Analysts anticipate further earnings cuts due to weak demand recovery prospects. The luxury market, it seems, is weathering a perfect storm.

[1] "LVMH Q1 2025 Sales Report: luxury giant posts first decline in 15 years, slammed by Asian markets, and US uncertainties" - Business Insider (2025).

[2] "Why is LVMH facing a sales decline in Q1 2025?" - Economist Magazine (2025).]

- The downturn in the luxury sector, as evidenced by LVMH's 3% organic decrease in revenue, has caused a dip in the global economy, affecting markets worldwide.

- The shift in consumer spending preferences, fueled by post-pandemic spending fatigue and inflation, has contributed to a decreased demand for luxury goods, like those produced by LVMH.

- The economic instability in China, coupled with geopolitical uncertainties, has played a significant role in the decline of LVMH's revenue, particularly in Asia.

- The luxury market's performance is not only influenced by economic factors, but also by trade risks and financial uncertainties, as demonstrated by proposed tariffs under President Trump's administration.

- In the midst of this perfect storm, some luxury companies, like Hermès, continue to thrive due to their exclusive, high-quality products, demonstrating the resilience of the luxury market on a basis of premium craftsmanship and desirability.