Market participants on edge amid speculation about potential Linde crash on February 27th

Let's Talk About Linde Leaving the DAX: What it Means for the Linde Stock and ETF Providers

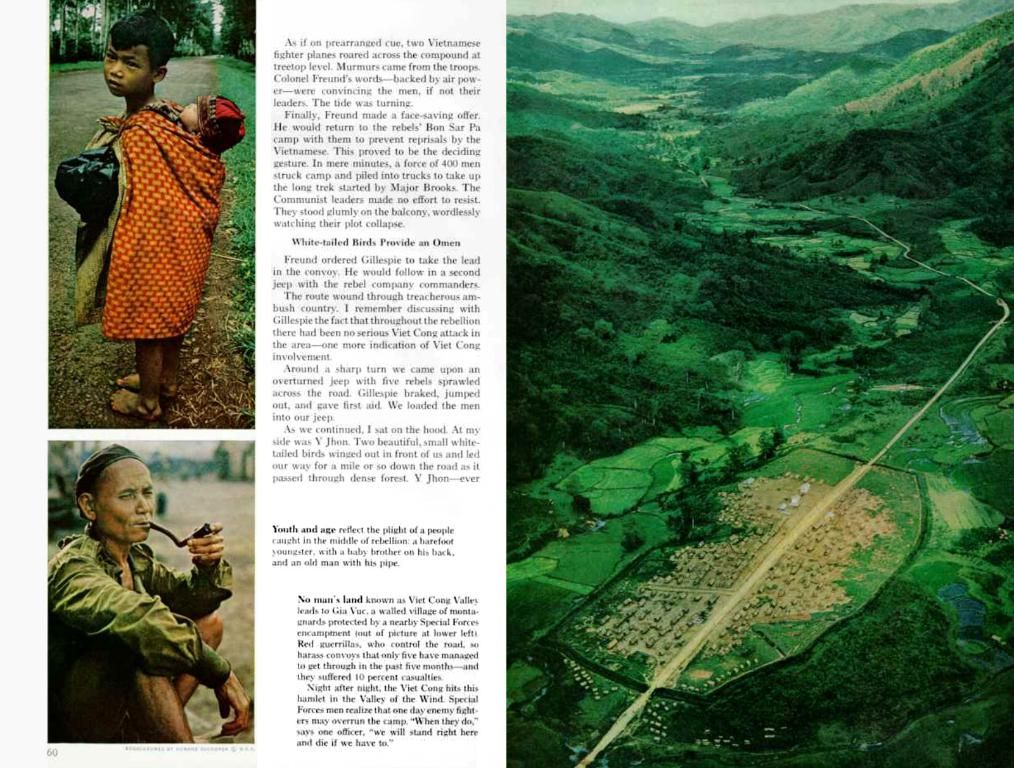

Industrial gas titan Linde is bidding farewell to the Frankfurt Stock Exchange and will only be visible on the New York Stock Exchange from March, but this decision has market players on edge. With a market cap of €149 billion and a 10% stake in the index, the exit of this DAX heavyweight could create a financial storm - not just from the void it leaves behind. ETF providers such as iShares (Blackrock), Xtrackers (DWS), and Lyxor (Amundi) have each invested up to €500 million in Linde stocks, making up a significant portion of their DAX allocation.

A Quandary for Portfolio Managers

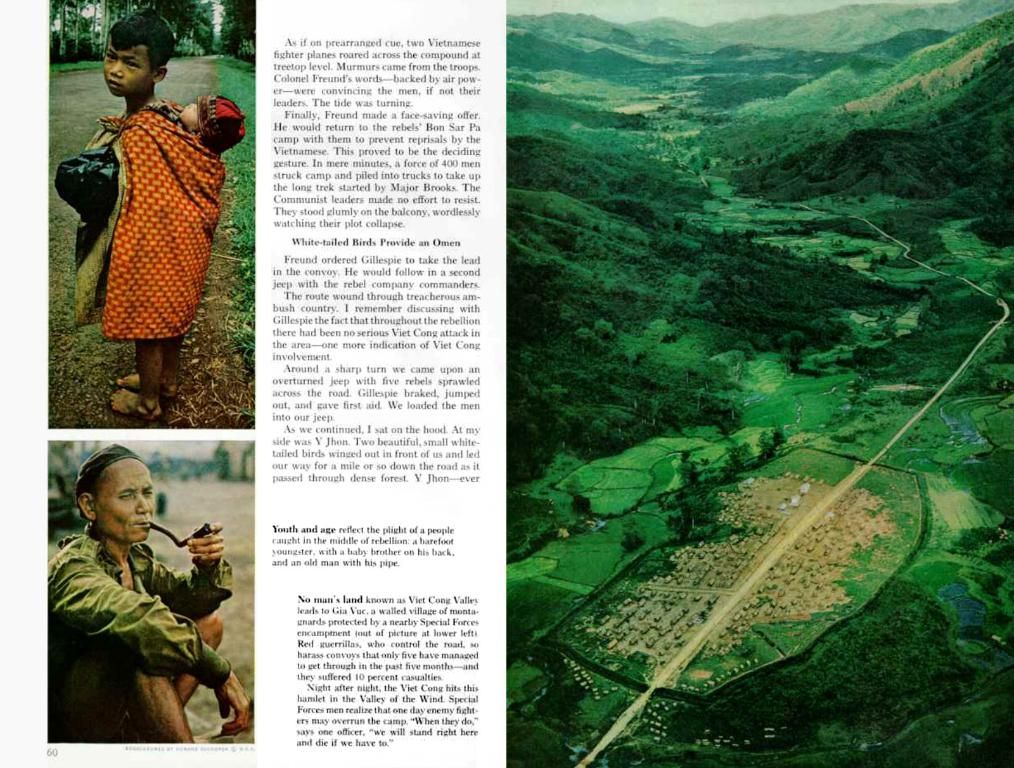

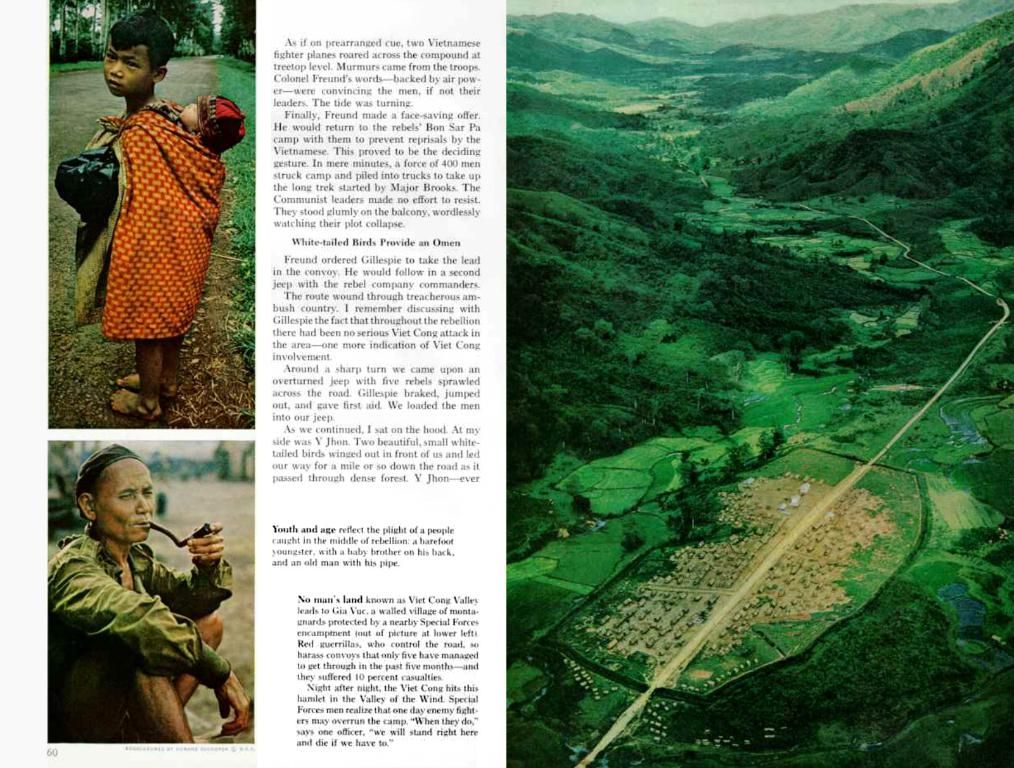

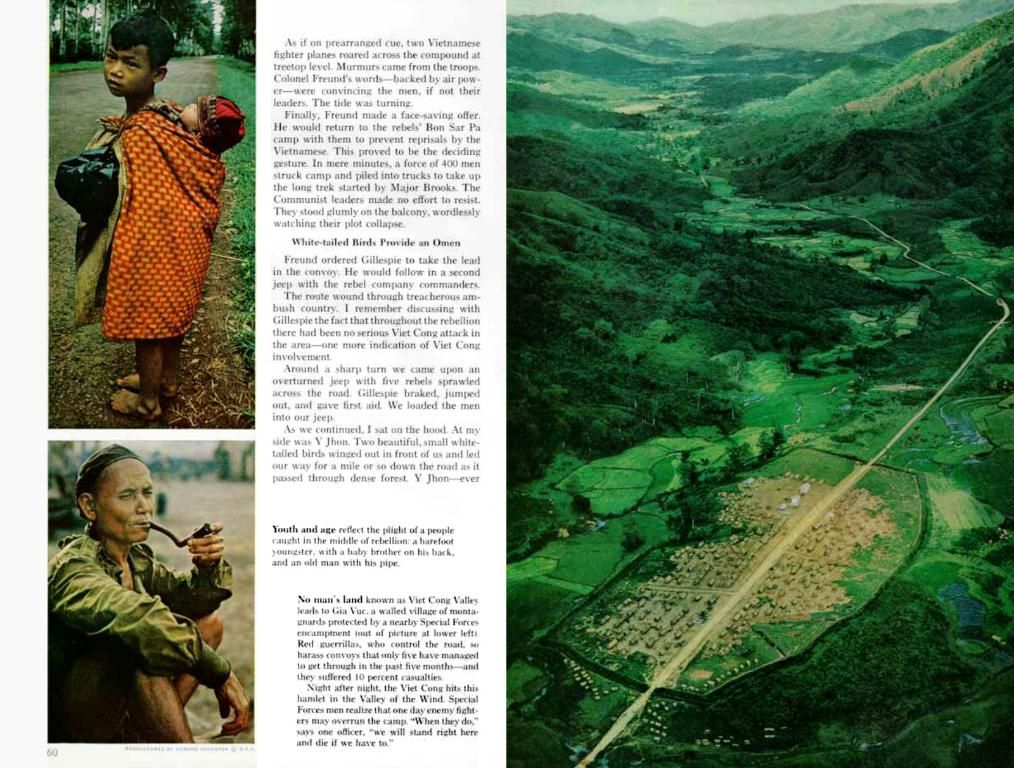

Portfolio managers are faced with a dilemma: they must offload their Linde stock bundles before the cut-off date to replicate the DAX performance as closely as possible. Selling all their stocks at once, though, could cause the Linde price to plummet and invite regulatory attention. Still, some portfolio managers seem unfazed. "We'll stick to implementing index adjustments exactly - for minimal tracking error," says a prominent ETF provider. "After all, investors expect us to accurately mirror an index's performance." February 27 could be another wild ride for the Linde stock.

Fun fact: The world's top analyst foresees a crash but also sees a "great buying opportunity"

Analyzing the What-If Scenario

Although Linde has not officially left the Frankfurt Stock Exchange, let's imagine the potential impacts.

Impact on Linde Stock

- Liquidity Issues: Decreased visibility in European markets could lead to lower trading volumes for Linde’s Frankfurt-listed shares, mainly affecting retail investors focused on German indices[^1^].

- Concentration Risk: A single-exchange listing (e.g., Nasdaq) could intensify volatility due to region-specific investor sentiment.

- Currency Exposure: Euro-denominated investors could face additional FX risks if trading shifts to U.S. exchanges.

Impact on ETF Providers

| ETF Provider | Potential Adjustments ||------------------|--------------------------|| iShares | Rebalancing DAX-tracked funds to exclude Linde, likely replacing it with the next-largest constituent (e.g., Siemens Healthineers, Sartorius). || Xtrackers | Liquidation of Linde-linked synthetic positions in DAX derivatives, with collateral reallocation. || Lyxor | Fee adjustments or creation of niche products targeting industrial gases to compensate for reduced DAX exposure. |

Implications for the DAX Index

- Sector Weighting Shifts: Linde’s removal would reduce the index’s industrial gases representation, increasing reliance on automotive (BMW, Mercedes-Benz) and software (SAP) sectors[4].

- Performance Metrics: Historical returns might need recalculations, affecting index-tracking products’ marketing materials.

- Regulatory Scrutiny: Deutsche Börse could face questions about eligibility criteria if a major constituent exits abruptly.

Factors That Dampen the Storm

- ADR Availability: U.S.-listed Linde shares (NASDAQ: LIN) are already accessible globally, minimizing disruption for institutional investors[3].

- Parallel Listings: If Linde maintains dual listings (hypothetical), index providers might adjust inclusion rules to maintain exposure.

Note: The above analysis assumes a hypothetical departure, as no evidence of Linde’s exit from Frankfurt exists in the provided materials. For confirmed DAX changes, monitor Deutsche Börse’s quarterly index reviews.

- Portfolio managers are grappling with the decision to offload their Linde stock bundles before the cut-off date, as the exit could lead to decreased trading volumes for Linde's Frankfurt-listed shares, especially for retail investors focused on German indices.

- ETF providers such as iShares, Xtrackers, and Lyxor have each invested significantly in Linde stocks. Rebalancing their funds to exclude Linde could result in changes such as replacing it with the next-largest constituent, liquidating Linde-linked synthetic positions, or adjusting fees and creating niche products.

- The removal of Linde could lead to shifts in sector weighting in the DAX Index, increasing reliance on automotive and software sectors and potentially requiring recalculations of historical returns for index-tracking products.

- The potential impact of Linde's exit on the Linde stock can be mitigated by factors like the availability of American Depository Receipts (ADRs) and maintaining dual listings, which could prompt adjustments in inclusion rules by index providers to maintain exposure.