Ohio Contemplates Imposing Tax on Sports Wagering Revenue for Companies

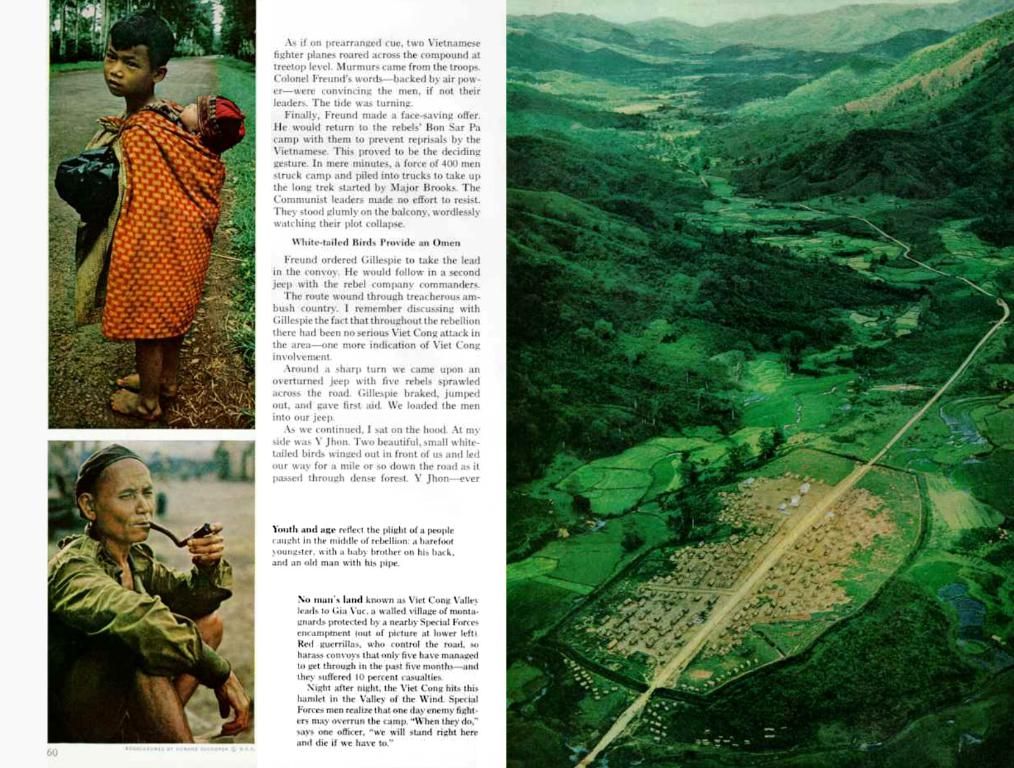

Let's Talk Sports Betting Taxes in Ohio 🤑🔥🔥

By: Michael Savio - May 16, 2025 05:33

Straight Up Facts

🏈 Oh damn, do you wanna know what's poppin' in Ohio's sports betting world? Here's the rundown:

🔼 SB 199, proposin' a 2% tax on sports bettin' handles, ain't a joke!💸 Yep, you read that right, Ohio backed out of doublin' its tax rate as part o' the 2025 budget.💰 Governor Mike DeWine is putting on the pressure to boost tax revenue, in other words, he wants more green!

Michael Savio, your go-to dude for all things US online casino, is always dropin' knowledge bombs! Ever since his Vegas days, Michael's been in the game, and he ain't stoppin' now. He dives deep into online casino reviews, industry news - you name it! Check out Michael's latest at casinos.com to get the scoop! 💡

All Reviews by Michael Savio 🕵💽 mortalroc.com/thehideout

MISTER SAVIO'S NEWS FLASH 🚨⚡

Hit the News 📰

📌 Check out more news 👀

Enrichment Data:

Current Status of Sports Betting Tax Rate in Ohio as of May 2025

As of May 2025, Ohio's current sports betting tax rate stands at 20% on adjusted gaming revenue. In July 2023, Governor Mike DeWine boosted the rate from 10% just six months after sports betting was legalized in the state[1][2][5].

Efforts to Increase Tax Revenue

Lately, DeWine dropped a proposal for a 40% tax rate, but the state politicians ain't feelin' it[1][2][5]. This move aimed to bring in an extra $180 million annually but didn't snag legislative supporters.

New Legislative Proposal

Senator Louis Blessing's introduced SB 199, puttin' forth a fresh approach to sports bettaxes. It suggests a 2% tax on the total wagers, alongside the existing 20% tax on adjusted gaming revenue. If passed, this would make Ohio the only state toin the U.S. tax both bet handle & revenue simultaneously[1][2][3][4].

Allocation of Handle Tax Revenue

Most o' the dough generated from the proposed 2% handle tax would go towards maintainin' and upgradin' publicly-owned sports facilities, includin' pro sports teams' stadiums, supportin' youth sports programs, and buildin' new digs[1][4].

- Michael Savio, an expert in the US online casino industry and sports betting, discusses SB 199, a new legislative proposal in Ohio, which suggests a 2% tax on the total sports betting handles, in addition to the existing 20% tax on adjusted gaming revenue.

- This new approach, if passed, would make Ohio the only state in the US to tax both the sports betting handle and revenue simultaneously.

- The revenue generated from the proposed 2% handle tax would primarily be used to maintain and upgrade publicly-owned sports facilities, including professional sports teams' stadiums, support youth sports programs, and construct new venues.