Potential future issues loom after DeepSeek software malfunction

The Stock Market Shake-up: AI's DeepSeek Rattles the Market, but Could it Get Worse?

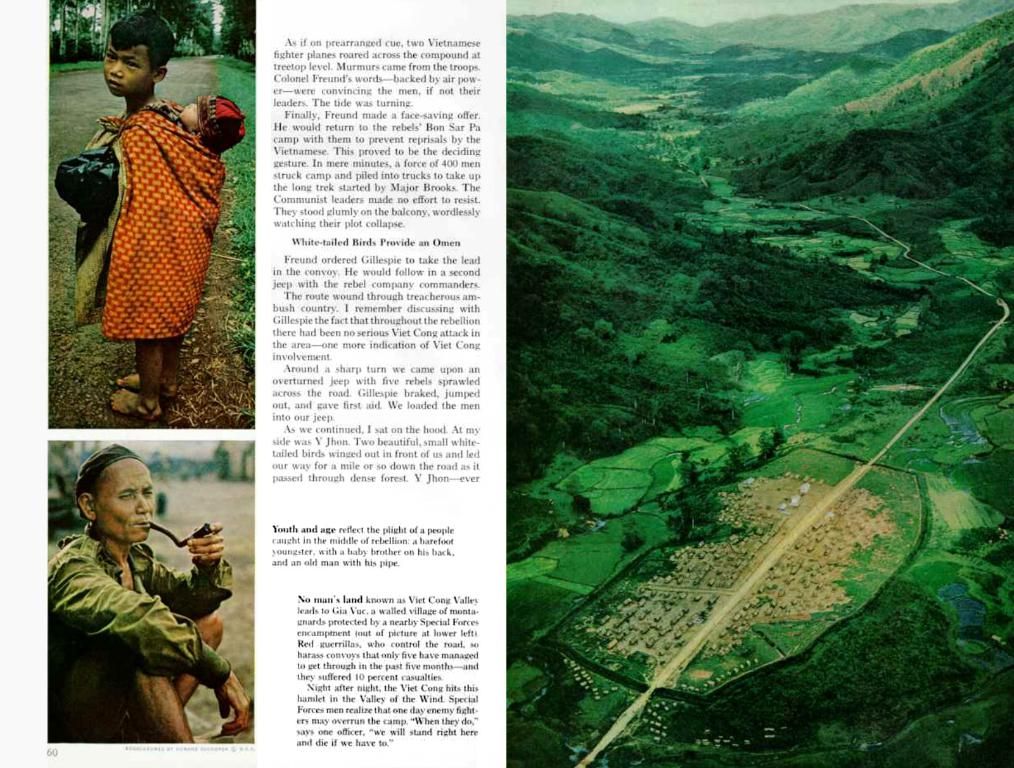

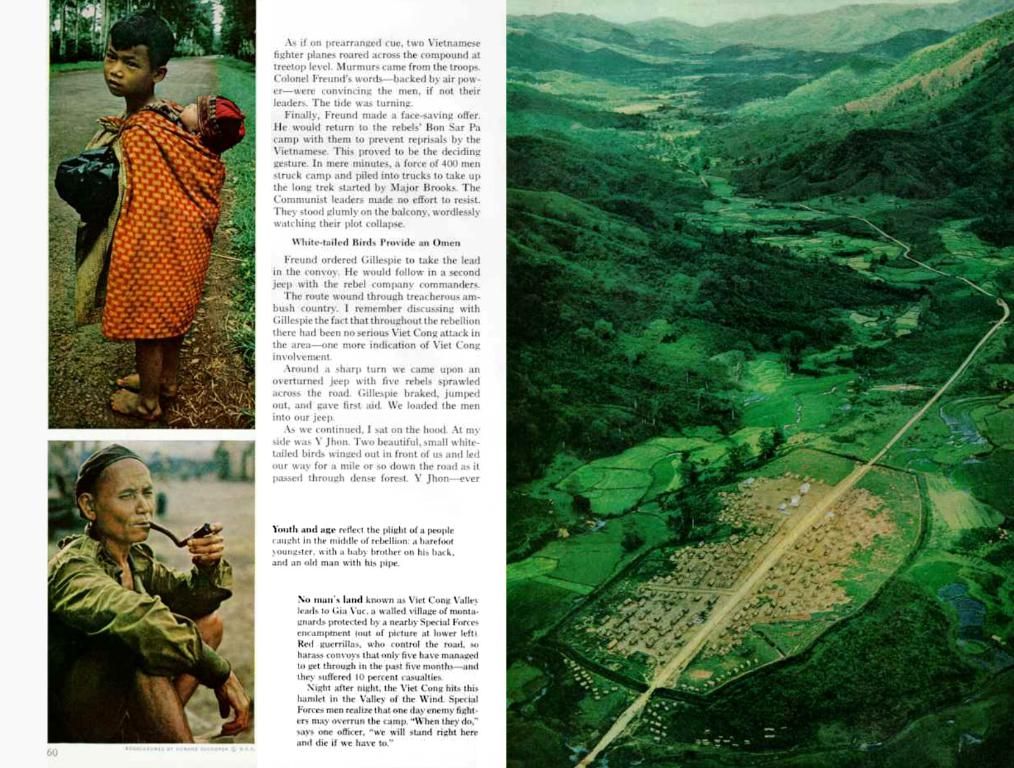

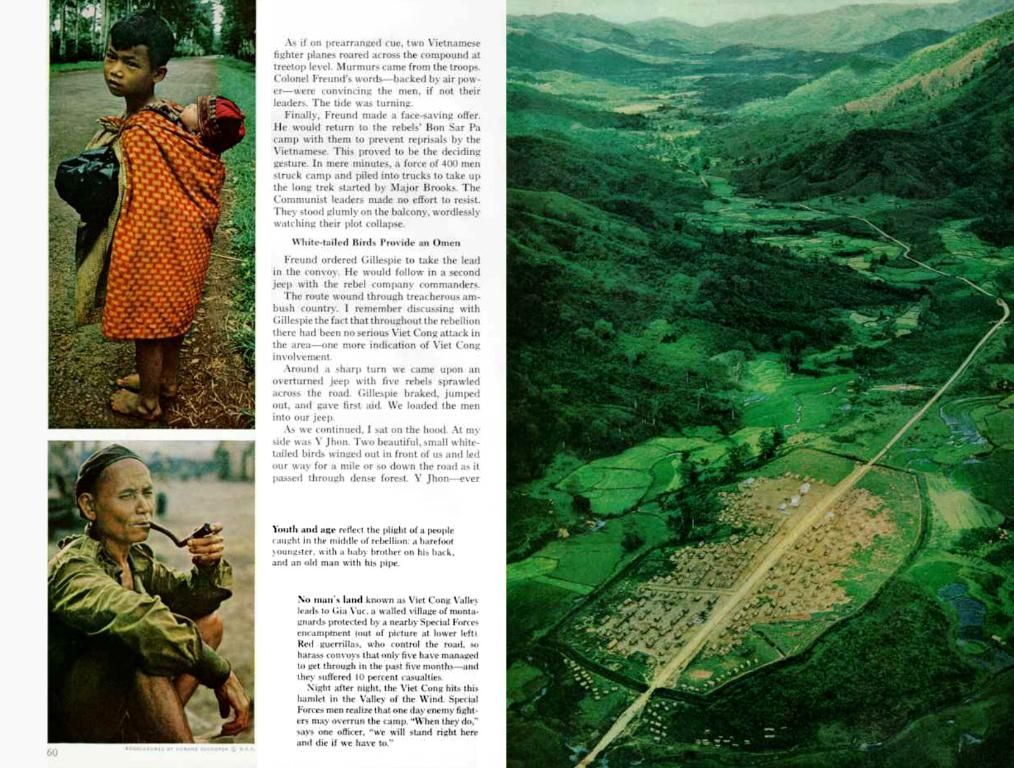

Last week, the stock market felt a tremor when DeepSeek, the new Chinese AI model, hit the scene. This AI is giving US language models a run for their money, causing a massive sell-off in companies like Nvidia and more. But, according to the financial sage behind "Black Swan," Nassim Taleb, this could just be the beginning. Is a market earthquake looming on the horizon?

A Legendary Warning: Brace Your Portfolio

The celebrated mathematician shared his concerns during the hedge fund week in Miami. He suggested that the recent market quake was merely the first sign of a changing landscape. "People are waking up to the fact that it's not all rainbows and butterflies anymore. There's a crack in the mirror," he said.

Taleb believes that AI stocks might just be the next gray swan lurking in the market, as investors may underestimate the risks and turbulence the sector faces. He also pointed out the heavy weight of companies like Nvidia in many indices.

Is the DeepSeek Crash Only the Tip of the Iceberg?

If Taleb is correct, we might witness more aftershocks on the stock exchange, a warning he issued back in 2023. At that time, he promoted a portfolio strategy designed to offer some protection in times of crisis while still allowing for potential gains.

Wondering how to safeguard your investments during these rollercoaster market rides? Check out: Inevitable Market Dip: Protect Your Portfolio from a Mega Crash

Additional Insights:

German Post (DHL Group): The Next Move for its Stock Post Warning Signals

The Unpredictable AI Market

- High Valuations and Skyrocketing Expectations: AI stocks are typically priced high due to investor excitement and growth forecasts, making them vulnerable to sharp price changes when ambitions aren't met.

- Regulatory Looming Shadows: AI is subject to government and regulatory scrutiny over data privacy, algorithmic bias, and job displacement, which could negatively impact operations and growth prospects.

- Intense Competition and Rapid Advancement: The sector is fiercely competitive, with major players and startups rapidly developing technologies, making it challenging for investors to predict long-term trends.

Shielding Your Investments:

- Smart Investment Spreading: Diversify investments across multiple sectors and asset classes to reduce overexposure in any one sector.

- Smart Risk Management: Employ strategies like stop-loss orders to limit potential losses if a stock's value plummets.

- Long-term Vision: View AI stocks as long-term investments, as the industry is projected to keep growing despite short-term volatility.

- ** thorough research**: Thoroughly analyze the financials and growth potential of AI companies before investing.

- Expert Advice: Consult financial advisors to tailor investment strategies suited to your risk tolerance and objectives.

Nassim Taleb's Perspective:

Nassim Taleb, known for discussing antifragility and the influence of rare events on markets, often emphasizes the importance of resilience in investment portfolios. In the context of AI stocks, this means being prepared for possible corrections by adopting a diversified portfolio and exercising caution when investing in overvalued stocks.

- As the stock market continues to feel tremors from DeepSeek's entry, it's critical to consider Taleb's warning about AI stocks being the next 'gray swan' lurking in the market, potentially causing further sell-offs.

- With the unpredictable nature of AI investments, it's crucial to employ smart investment strategies like portfolio diversification, stop-loss orders, long-term vision, thorough research, and seeking expert advice to safeguard your portfolio in the face of market volatility.