Private credit: The hidden danger in the financial sector?

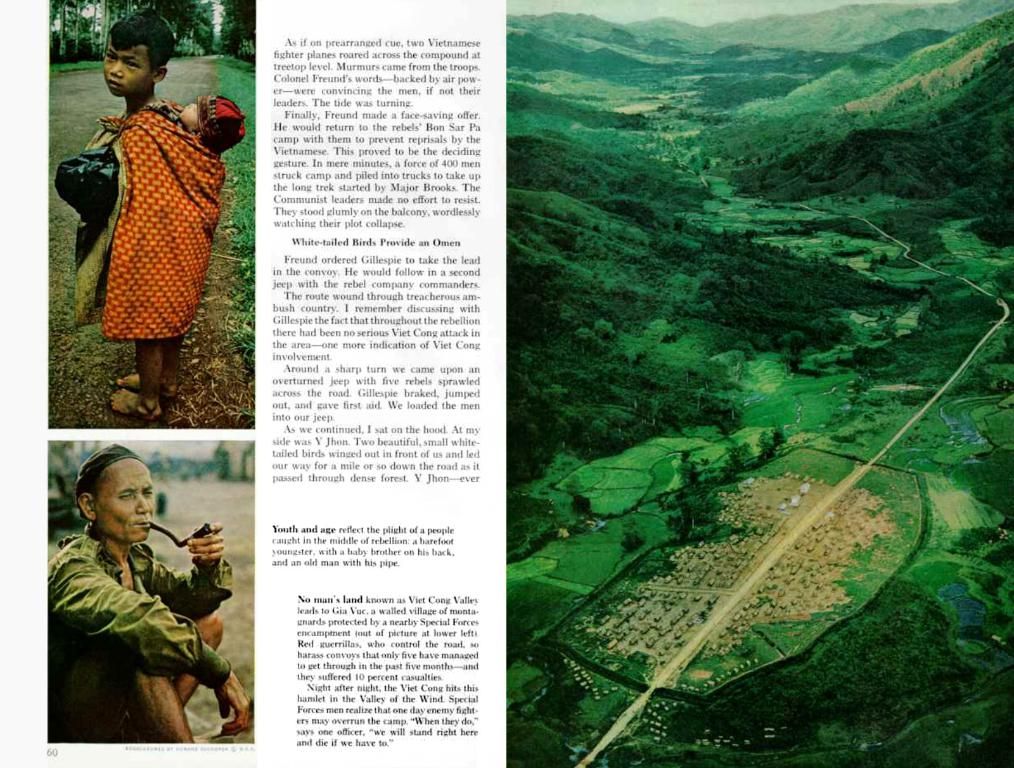

Frankfurt vibes

Private credit market faces potential hazards, cautions Moody's

In a recent report, Moody's Analytics flagged a potential danger lurking within the private credit sector and its effects on the broader financial system. co-authored by Chief Economist Mark Zandi along with experts from the SEC and a former advisor to the U.S. Department of the Treasury. Zandi's work has been under scrutiny recently, following a disagreement with U.S. Treasury Secretary Janet Yellen over the country's credit rating.

Key points to remember

- Secrets and webs: Transparency in private credit is far from ideal, with obfuscated loan conditions, hidden exposures, and mysterious leverage making it hard to identify vulnerabilities, both for market participants and regulators.

- Chain reaction: Private credit funds could be the spark igniting a wildfire in times of crisis, as losses in this sector might trigger a domino effect, especially if institutional investors, like insurers and sovereign wealth funds, are compelled to liquidate diverse asset classes to recoup losses, causing a ripple effect across markets.

- Risky business: Leverage varies dramatically across private credit funds, with some strategies being riskier than others. With banks tightening lending standards, riskier borrowers are flocking to private credit, resulting in a higher risk of adverse selection as funds take on riskier loans.

- From small acorns grows mighty oaks: Growth within the sector has been unprecedented, primarily fueled by stricter bank regulations following the 2008 crisis. However, this expansion has outpaced regulatory oversight, leading to concerns that the industry might fuel systemic stress or worsen a financial crisis if a severe correction occurs.

- History repeats itself: Experts warn of a disturbing similarity between the private credit sector and the pre-crisis mortgage market, implying that a combination of opacity, leverage, and interconnectedness could result in situations eerily reminiscent of past financial meltdowns, if not managed properly.

Here's a quick breakdown of the primary concerns:

| Challenge | Explanation ||---------------------------|--------------------------------------------------------------------------------------------------|| Inopportune secrecy | Limited disclosure in loan terms, exposures, and leverage can complicate crisis management || Intreconnectedness | Institutional investors with cross-asset portfolios could face contagion risks || Contagion possibility | Losses in one sector might lead to forced asset sales and stress propagation || Leverage and risk exposure| Widely varying leverage among funds, with some investing in excessively risky ventures || Runaway growth | Sector has expanded rapidly, outpacing regulatory oversight |

These findings underscore the critical need to maintain a keen watch on private credit's role in the financial system to ensure it doesn't become a catalyst for broader instability.

- One significant concern within the private credit sector is its lack of transparency, as loan conditions, hidden exposures, and mysterious leverage make it difficult to pinpoint vulnerabilities, not only for market participants but also for regulators, potentially contributing to broader financial instability.

- In times of crisis, losses in the private credit sector could spark a chain reaction, as institutional investors like insurers and sovereign wealth funds, compelled to liquidate diverse asset classes to recoup losses, could cause a ripple effect across markets, leading to a potential domino effect and systemic risks.