Gold Hits All-Time High Amidst Chaos

Record-breaking gold price soars past $3,500 per ounce.

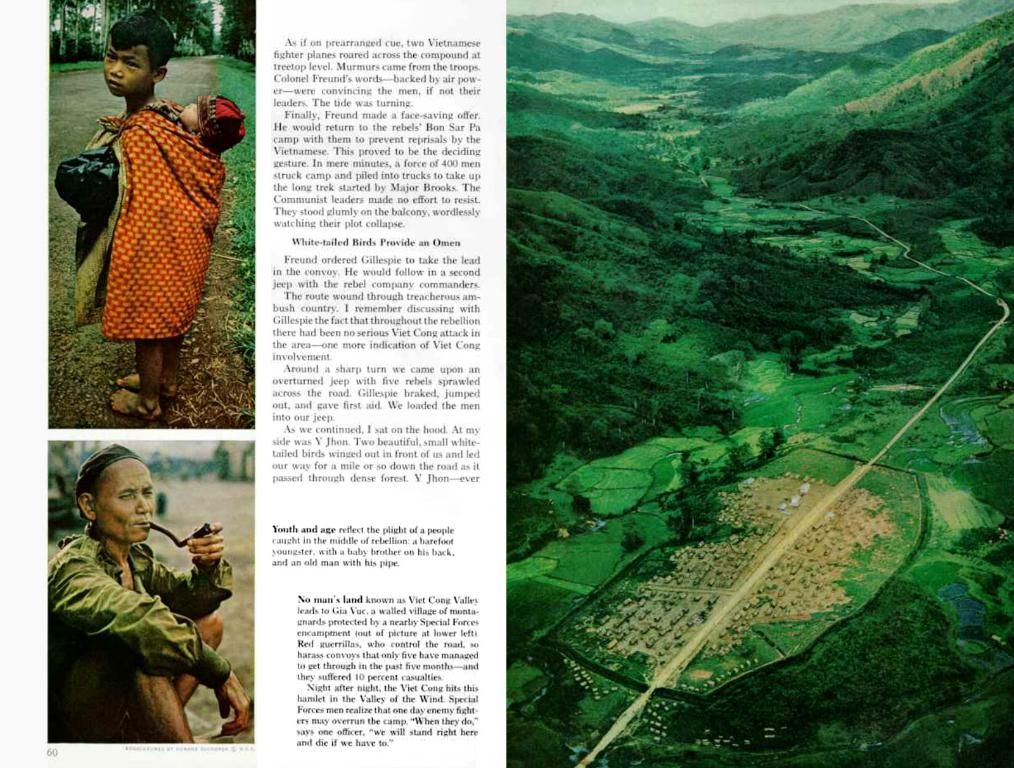

Breaking News! The cost of an ounce of gold soared past $3,500 for the first time ever on Tuesday, fueled by the ongoing trade war and tensions between Donald Trump and the Federal Reserve Chair. Gold was trading at $3,467.87 at 7:30 AM GMT, following a record high of $3,500.10 earlier in the day.

© rc.xyz NFT gallery - UNSPLASH By our website with AFP Published on

- Copy link Link copied

This surge in gold price can be attributed to jitters in the stock markets, particularly on Wall Street, which has been struggling under the weight of Donald Trump's frequent attacks on the Federal Reserve Chairman, as well as ongoing uncertainties about the trade war. China reaffirmed on Tuesday its firm opposition to any agreements harming it in a potential new sign of escalation between Beijing and Washington.

As a haven asset, gold is known to attract massive investments during times of uncertainty and market turmoil. Predictions for gold prices by the end of 2025 amid ongoing trade wars and market tensions indicate a generally bullish to mixed outlook among experts, driven by geopolitical risks, central bank demand, inflation concerns, and interest rate expectations.

For instance, JP Morgan sees gold averaging around $3,675 per ounce by late 2025 and potentially surpassing $4,000 per ounce by mid-2026 due to ongoing recession fears, central bank gold purchases, and expected decline in interest rates. Similarly, Goldman Sachs has revised its 2025 target to $2,900, with prices possibly rising to $3,700 or even as high as $4,500 in the most aggressive scenarios, where central banks continue to acquire gold to hedge global risks and diminish dependence on the US dollar.

However, Morningstar’s Jon Mills provides a contrasting forecast, suggesting a potential 38% decline over five years, resulting in gold falling to approximately $1,820 per ounce due to underlying long-term pressures.

Other key factors influencing gold prices include trade war-related uncertainties, central bank demand, interest rates, and inflation. To remain accurate in gauging price movements, investors should closely monitor these factors to navigate the volatile gold market in 2025.

Investors considering finance options for 2025 may find portability in investing in gold, as predictions suggest it could outperformed stocks, with estimates ranging from Goldman Sachs' projected $3,700 per ounce to JP Morgan's bold assertion of $4,000 per ounce. However, it's worth noting that Morningstar's Jon Mills presents a contrasting forecast, predicting a 38% decline, resulting in gold falling to approximately $1,820 per ounce. Thus, the volatile nature of gold investing requires investors to exercising due diligence and monitoring factors such as trade war-related uncertainties, central bank demand, interest rates, and inflation to make informed decisions. Therefore, while gold stocks could potentially offer an attractive return in 2025, they may not meet the criteria for a conventional scholarship investment due to their inherent risks.