Senator Ron Wyden Advocates for an Inquiry Regarding Jeffrey Epstein's Professional Relationship with Art Collector Leon Black

Billionaire Investor Leon Black under Scrutiny for Tax Transactions with Jeffrey Epstein

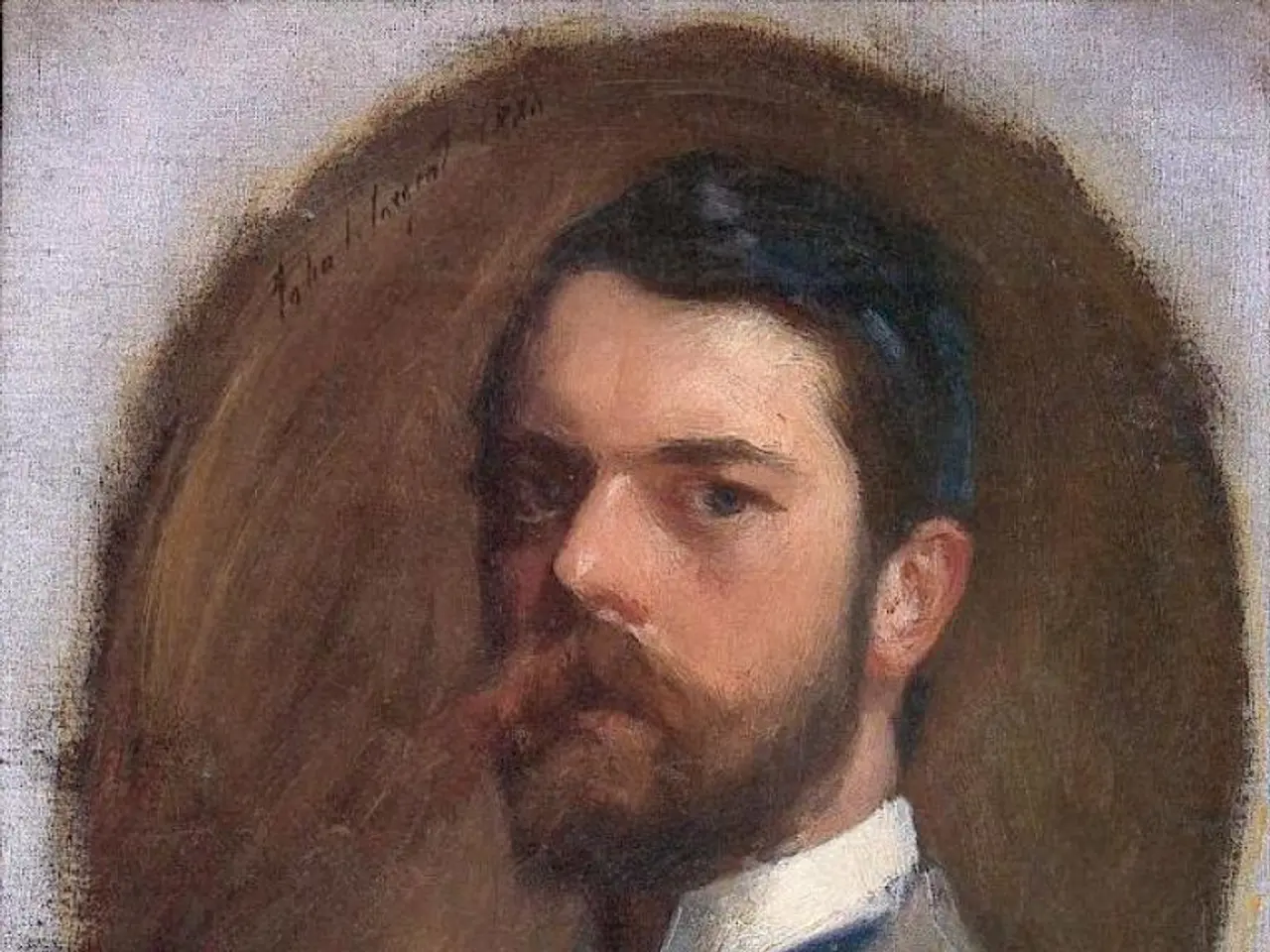

American billionaire investor Leon Black, co-founder of Apollo Global Management and former chairman of the Museum of Modern Art (MoMA), is facing political scrutiny over his relationship with the late financier Jeffrey Epstein.

Between 2012 and 2017, Black paid Epstein approximately $158–170 million for financial advice, primarily focused on tax and estate planning [1][2][3]. This relationship has raised eyebrows due to Epstein's lack of professional credentials in accounting or tax law.

The transactions in question amount to tens of millions of dollars and are alleged to be for tax planning work performed by Epstein for Black. Senator Ron Wyden, a Democratic senator from Oregon, has called on the Internal Revenue Service (IRS) to investigate these suspicious transactions [3][5].

In a letter to the IRS submitted on July 31, Senator Wyden accused the organization of failing to audit major tax transactions involving Epstein over many years. The purpose of the transactions, according to Senator Wyden, is to help Leon Black dodge billions in taxes [4].

The IRS has yet to respond to Senator Wyden's call for an investigation. He has requested more information from the IRS by September 1 [4].

Leon Black has publicly expressed deep regret for his ties to Epstein, describing the relationship as a "horrible mistake" [1][2]. In 2023, Black agreed to a $62.5 million settlement with the U.S. Virgin Islands, satisfying claims that some of his payments to Epstein helped fund Epstein’s illicit activities [1].

Despite this settlement and the ongoing investigations, Black remains a trustee at the Museum of Modern Art. He left his position as CEO of Apollo Global Management in 2021, following revelations about his relationship with Epstein and an independent law firm report [2].

This case highlights ongoing concerns about wealthy individuals employing questionable advisers to exploit tax systems, and the lack of regulatory scrutiny of such arrangements despite public and political concern [1][2][3][5].

Sources:

- Bloomberg

- The New York Times

- CNN

- Forbes

- The Art Newspaper

Read also:

- Discusses Rasmus Sojmark's thoughts on the Legends Charity Game before SBC Summit

- Stone mining has transformed the once renowned 'Sada Pathor' into a desolate, post-apocalyptic landscape.

- In the Heart of Soho, Manhattan, a New Brewery Emerges Underground

- Financial regulatory body OCC imposes Anti-Money Laundering (AML) disciplinary action against Wells Fargo.