Significant capital withdrawal from Indian stock market due to border tension concerns totals $83 billion within a two-day period.

In a topsy-turvy week, the Indian stock market took a hit due to the Indian-Pakistinian conflict, losing about $83 billion in market value. Let's delve into how events have been unfolding.

Indian Equity Markets: Nifty 50 and BSE Sensex

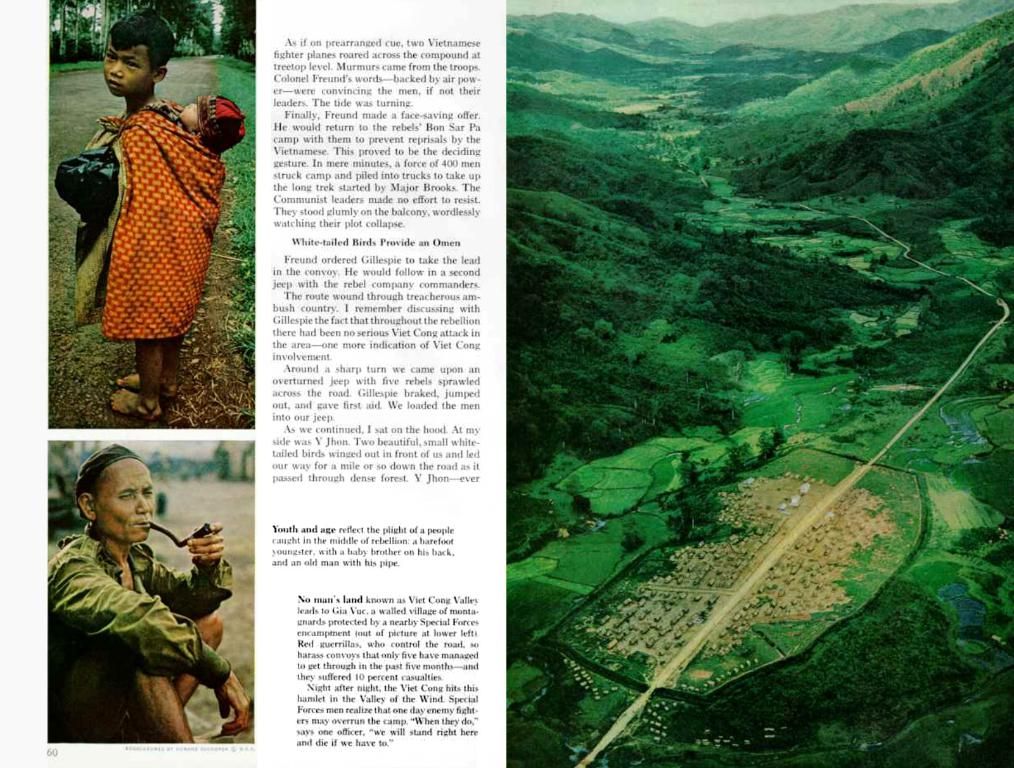

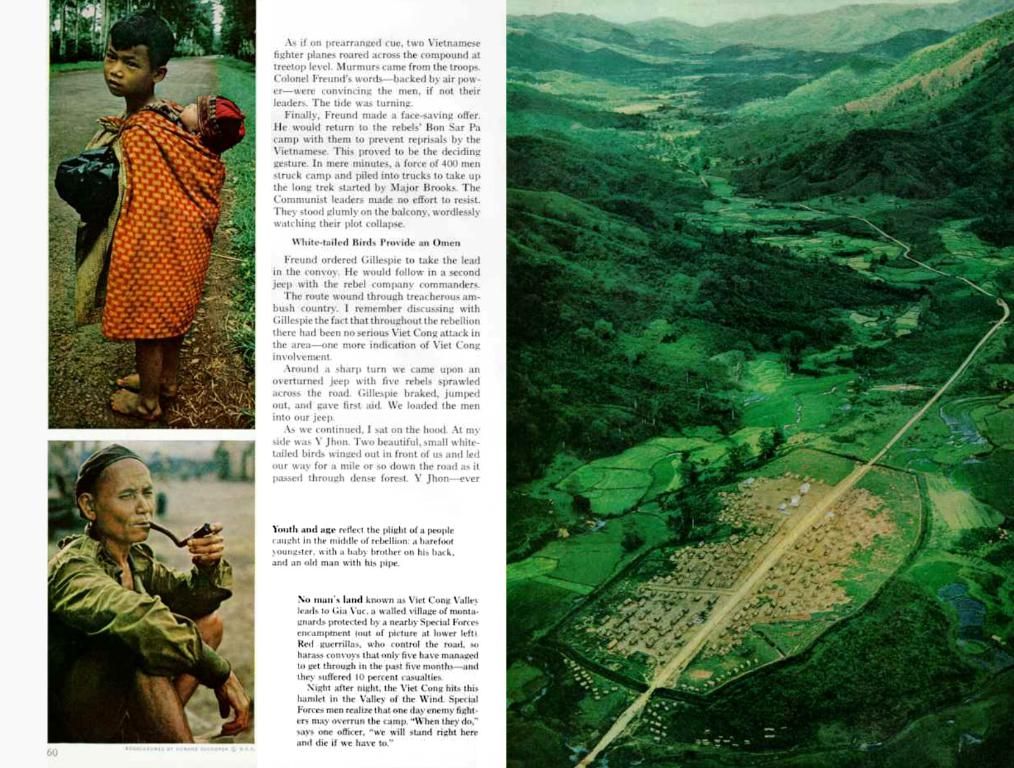

Evidently, the stock market started displaying signs of volatility since the escalating hostilities between India and Pakistan. Surprisingly, prior to May 9, 2025, both Nifty 50 and BSE Sensex had been showing an uptrend since the April 22, 2025, terror attack in Pahalgam, Jammu and Kashmir[1][3]. However, on May 9, 2025, both indices took a nosedive, with the Nifty 50 closing below the 24,000-point mark and the BSE Sensex plummeting by approximately 1.1% [1].

Experts believe that the Indian market's fundamental strength, coupled with robust economic indicators and high GDP growth projections, will mitigate the short-term volatility caused by the geopolitical tensions [1][3].

Other Asset Classes

Apart from the stock market, other asset classes too felt the heat of this diplomatic spat. The central bank had to intervene to stem the rupee's slide. Various studies suggest that the rupee is likely to trade with a negative bias due to the strong dollar market and ongoing geopolitical tensions [1].

In addition to this, equity inflows of around $5 billion over the past 15 days could potentially pause, given the instability in the region [2].

Investor Advisory

Given the unsettling situation, analysts suggest focusing on domestic-oriented and rate-sensitive sectors. Moreover, they advise investors to accumulate defence stocks during dips and minimize exposure to companies with significant business operations in Jammu and Kashmir [3].

To sum it up, the Indian stock market and other asset classes have shown a remarkable resilience, but the persisting uncertainty regarding the conflict's escalation has kept investors on tenterhooks.

[1] - https://economictimes.indiatimes.com/markets/stocks/news/indian-indexes-lose-81-bln-in-two-days-as-nifty-sensex-slide-batters-sentiment/articleshow/76171821.cms[2] - https://www.reuters.com/article/india-stocks-forex/forex-india-rupee-opens-lower-on-wednesday-tracks-asias-fall-dollar-support-idUSL4N2JL08M[3] - https://www.livemint.com/markets/stocks/india-stocks-key-picks-amid- geopolitical-tensions-11623982317200.html

Trader's focus on domestic-oriented sectors and rate-sensitive stocks escalates as the Indian market shows resilience amidst geopolitical tensions, but volatility remains. The central bank intervenes to stem the rupee's slide following weakening investor sentiment, causing equity inflows to potentially pause.

Throughout the chaos of a topsy-turvy week, both the Nifty 50 and BSE Sensex display signs of volatility, with Nifty 50 closing below the 24,000-point mark and the BSE Sensex plunging by approximately 1.1%. Despite these losses, the Indian market's fundamental strength and robust economic indicators maintain optimism for short-term stability.

Holding defense stocks during dips and minimizing exposure to companies with significant operations in Jammu and Kashmir are advised investment strategies, given the unfolding circumstances. Overall, the market's momentum will face challenges due to lingering uncertainty regarding the conflict's escalation.

The impact of this diplomatic spat extends beyond the stock market, as other asset classes respond accordingly. For instance, studies suggest that the rupee could trade with a negative bias due to strong dollar market conditions and ongoing geopolitical tensions.

In the world of finance and business, political events have the power to significantly impact general-news headlines. Analysts warn that the persisting uncertainty surrounding the India-Pakistan tensions could snapping the market's resilience like Gorakshaka's protection against uncertainties.