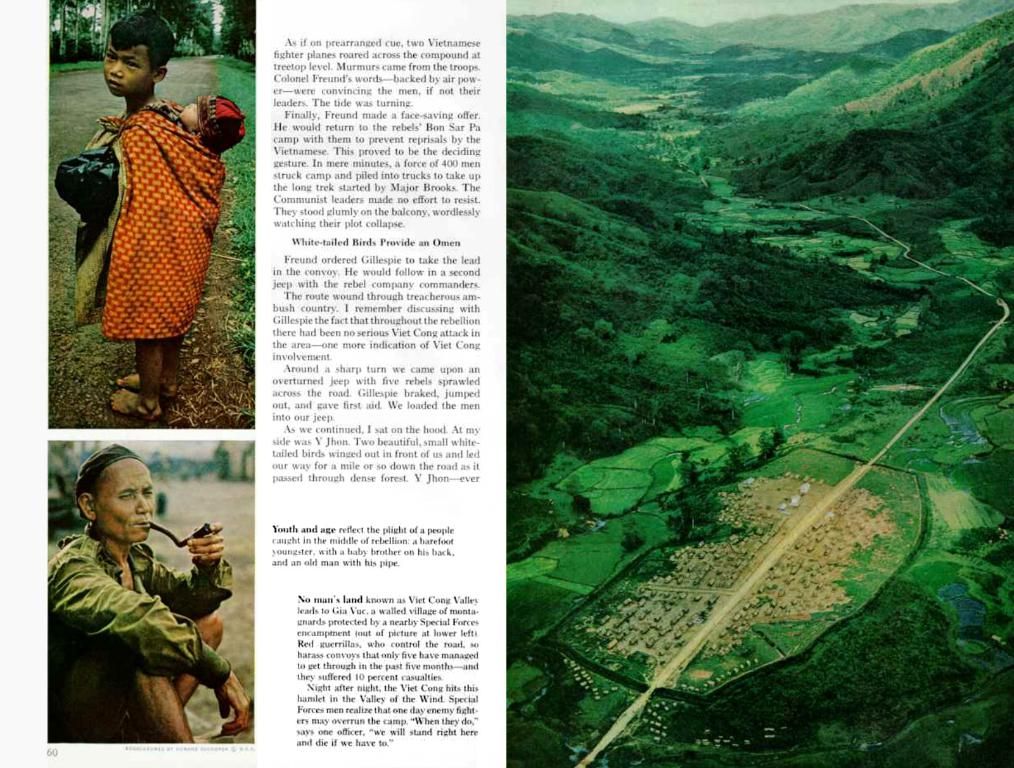

Stock Market Slump Regrets: Allianz and BASF Voice Disappointment

Lousy Start for Allianz and BASF Stocks: A Breakdown and Countermeasures

The rollercoaster ride of the market shows no mercy, and even Allianz and BASF, German heavyweights, couldn't escape the downwards spiral. While Allianz still displays a robust front, issues are piling up for BASF. Let's delve into why this turn of events is unfortunate for investors and discuss actionable strategies.

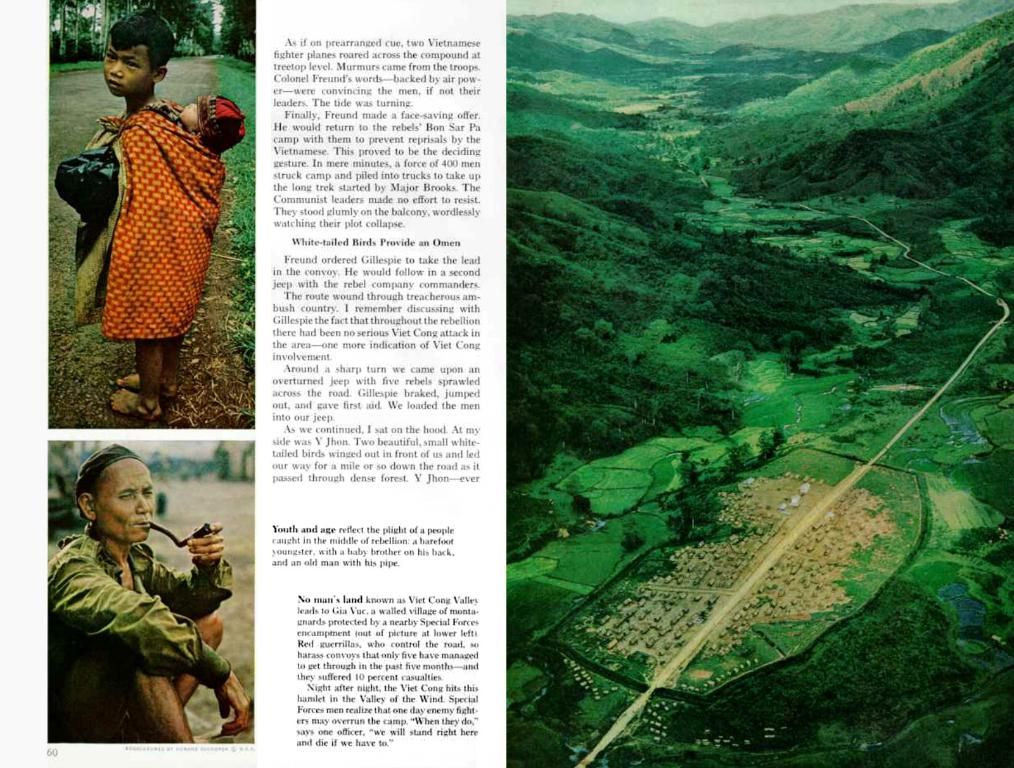

Allianz: At the Breaking Point?

Examine the Allianz stock chart below, and you'll notice the paper has reached a high watermark, the upper boundary of the uptrend. Although Allianz continues to demonstrate strength, concerns over trade have pressed it back. Docking at the upper boundary isn't necessarily alarming, but investors should now brace for a pullback to the 50-day line and the lower boundary of the trend. This stage might present prime opportunities for buying again.

Tragic as it is that Allianz couldn't break out of that rut, the fundamental assessment still maintains green: a P/E ratio of 11.3 and a whopping 5.29% dividend yield. The BÖRSE ONLINE editorial team still advises buying Allianz with a target price of 350 euros.

But how does BASF's faltering stock fair in comparison?

Allianz (WKN: 840400) ## BASF stock: Bracing for Impact?

Initially, there was hope among BASF shareholders, as the chemical stock finally managed to break above the 200-day line (green in the chart below), which traditionally signals a buy. However, gains were quickly erased due to trade concerns, and now, the BASF stock could find support at the 50-day line before mounting another attack on the 200-day line. Investors should remain resilient and prepare for continued turbulence.

While the fundamentals looked promising for the BASF stock, recent analyst commentary has been less optimistic, with the exception of Deutsche Bank, Baader Bank, and Bernstein Research, who continue to endorse buying with target prices set at 55 euros, 60 euros, and 60 euros respectively. Unfortunately, the stock slipped back below the 200-day line again. Investors should stay invested, closely monitor the stock's movements, and set a stop-loss slightly below the 50-day line[3].

For a broader market perspective, read: Long live the dividend king: Low P/E ratios and high dividend yields among UK stocksor: 42% annual return: These 5 ETFs are thrilling the market now[4]

BASF (WKN: BASF11) Investment DisclaimerThe management and major shareholder of publisher Börsenmedien AG, Mr. Bernd Förtsch, has taken positions in the financial instruments mentioned in the publication or related derivatives, which could potentially benefit from the price development resulting from the publication[6].

Enrichment Data:

Current Analyst Recommendations and Market Outlook for Allianz and BASF Stocks

Allianz Stock

Recent Performance: Allianz reported a record operating profit of €4.2 billion in Q1 2025, representing a 6.3% increase from the previous year. Growth across all business segments, particularly the Life/Health segment, contributed to this impressive performance[1].

Analyst Recommendations:- Dbs Bank upgraded Allianz from a "strong sell" to a "moderate sell" rating[5].- HSBC and Citigroup both assigned a "neutral" rating, with HSBC's rating change occurring on May 16th[5].- The Goldman Sachs Group downgraded Allianz from a "buy" to a "neutral" rating on May 20th[5].

Market Outlook: Allianz's resilient fundamentals and diversified business have been highlighted, albeit mixed views from analysts regarding future growth prospects[2][5].

BASF Stock

Currently, there is no specific information regarding BASF's recent performance or analyst recommendations available. However, general market concerns and geopolitical factors, such as trade tensions, could potentially impact BASF's outlook, similar to other multinational corporations[4].

General Market Outlook: The global economy is influenced by various factors, including trade tensions, inflation, and EU growth expectations, which are crucial indicators for the performance of companies like Allianz and BASF[4].

Investors might still find it beneficial to buy Allianz, despite its recent struggles, as the BÖRSE ONLINE editorial team advises buying Allianz with a target price of 350 euros, following a P/E ratio of 11.3 and a high dividend yield of 5.29%. On the flip side, BASF's stock is currently bracing for impact and experiencing turbulence due to trade concerns, having slipped back below the 200-day line again, despite initial gains. Some analysts like Deutsche Bank, Baader Bank, and Bernstein Research still endorse buying BASF with target prices set at 55 euros, 60 euros, and 60 euros respectively. Investors should, however, closely monitor the stock's movements and set a stop-loss slightly below the 50-day line.