Stock prices for Sony's PlayStation (PSX) spike due to optimism surrounding the government's budget plans and the recently released economic survey.

Stock markets in Pakistan see an upswing after the Eid ul Adha break, driven by the anticipated federal budget announcement for the upcoming fiscal year. The KSE-100 Index, the benchmark of the Pakistan Stock Exchange (PSX), scaled to an intraday high of 122,611.53 points, reflecting a gain of 0.80%.

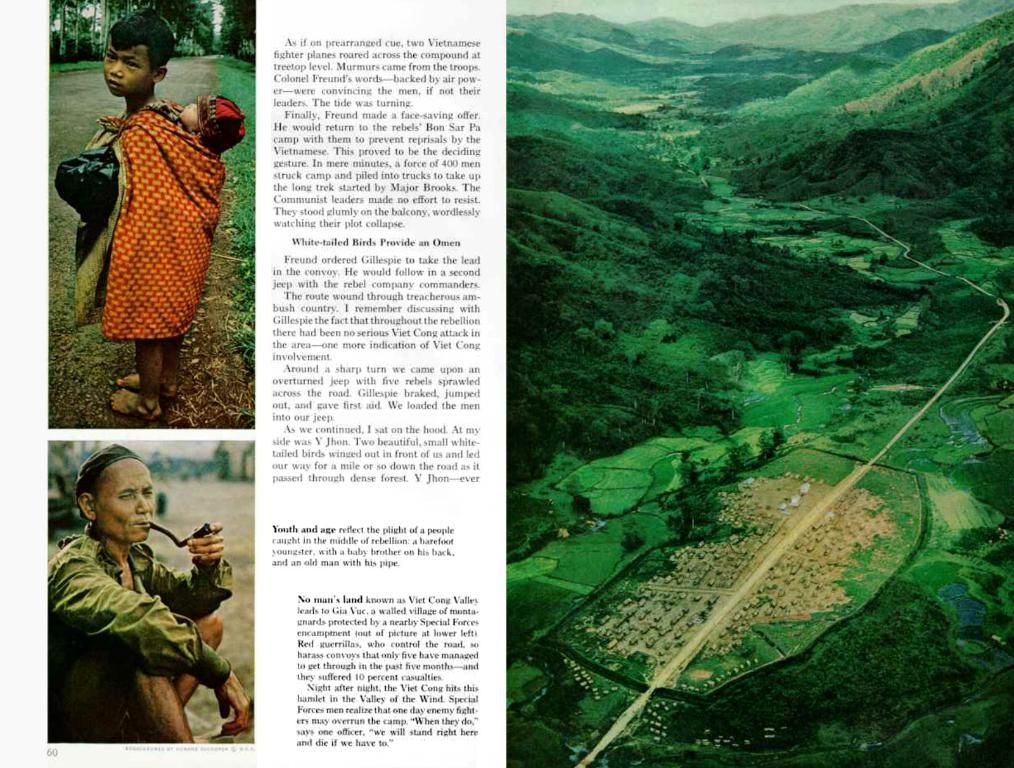

Ahsan Mehanti, the CEO of Arif Habib Commodities, attributes this bullish activity at PSX to a few key factors. These include the whopping Rs17.6 trillion budget outlay, the government's approval of PSDP at Rs800 billion for the next fiscal year, soaring global crude oil prices, and positive negotiations around resolving the over Rs2 trillion gas circular debt crisis. Furthermore, anticipation over rationalization in industrial power tariffs in the federal budget also played a pivotal role.

The federal budget 2025-26, to be tabled in parliament today, is expected to boost investor confidence due to lower tax rates on corporates, reduced super tax, stricter measures against non-filers, and the continuation of the IMF program. According to Samiullah Tariq, Head of Research at Pak-Kuwait Investment Company, these positive news flows are driving the market.

Recent economic indicators suggest the growth of Pakistan's economy to be 2.7% in the outgoing fiscal year, with inflation easing to 4.6%. Exports grew by 7%, and IT exports touched $2.8 billion, with freelancers contributing $400 million. The budget also reported a current account surplus of $1.9 billion for July-April and a 26% increase in revenue collection. Remittances rose by $10 billion over two years.

The surge in the KSE-100 Index, by over 50.2% during the fiscal year, can be attributed to factors such as macroeconomic stability, declining interest rates, robust corporate earnings, and a successful International Monetary Fund (IMF) review. Additionally, the PSX outperformed several major global bourses, with six new company listings bringing its total to 527 by March 2025.

In the previous session prior to the Eid holidays, the index closed at 121,641 points, marking a minor drop of -0.13%. However, the budget announcement has brought renewed optimism among investors, indicating a positive trajectory for Pakistan's stock market.

Investors' optimism in Pakistan's stock market is driven by the anticipated federal budget for the upcoming fiscal year, with lower tax rates on corporates, stricter measures against non-filers, and the continuation of the IMF program being primary factors. The anticipated federal budget also includes a whopping Rs17.6 trillion outlay, the government's approval of PSDP at Rs800 billion, soaring global crude oil prices, and positive negotiations around resolving the gas circular debt crisis, all contributing to a bullish activity in the stock market.