Strategies for Abolishing the Federal Reserve System

"Hey there!"

Jumping Straight into Ending the Fed

Who needs a government-issued currency counterfeiter when we've got cats, right? Both funny and dramatic, yet, the question lingers - what would really happen if we did away with the Federal Reserve?

It's Not So Fantastic a Concept

Let's debunk the myth - America thrived for 140 years without a central bank! We got air conditioning, phones, and electric cars before the Fed came knocking. A quick look around reveals countries still running without a central bank - 7, to be exact; make that 8 if Argentina hangs up that call.

OK, But What's Next?

Ending the Fed involves a legally simple, yet politically tough, two-step process:

Step 1: Laws for Days

All it takes is repealing the Federal Reserve Act - 10 minutes of Senate-like action, and, believe it or not, it's done! The tricky part? convincing 50 or 60 senators that it's a budget-related matter, making it a 50 vote issue.

Step 2: Economy Matters

The real drama lies in the economic implications of making this move. The Federal Reserve's three roles - bank oversight, policy manipulation, and stabilization - might appear essential, but a closer look unveils a different tale.

- Bank Bailouts for All!

No one loves bank bailouts - except, perhaps, banks. But in a democratic country, bank bailouts have no place. Wealth should get us nowhere near the top of the bailout list.

- Fraud Police? More like Fraud Accomplices

The Fed's supervision of the financial system is a charm when it comes to judging soundness, but a disaster when it comes to preventing fraud, as one Sam Bankman-Fried case aptly demonstrated.

- Manipulating the Market

Artificially cheap loans might feel good, but in reality, they're little more than a tool for swindling the middle class to make the rich even richer. Plus, these manipulations are the very culprits causing inflation and recessions.

So, why not chuck everything? But, since we've got to keep bank bailouts on the table, give yourself a three-year heads up, and we've got ourselves a perfect recipe for a smooth transition.

Bye-Bye, Greenbacks

Let's explore two options for our good old dollar post-Fed:

- Paper Money Makeover

Keep the paper dollars as a token for the economy or have the Treasury print 'em to replace taxes. This could lead to deflation if no new dollars are printed, but it's a win-win for the poor, despite also jacking up debts.

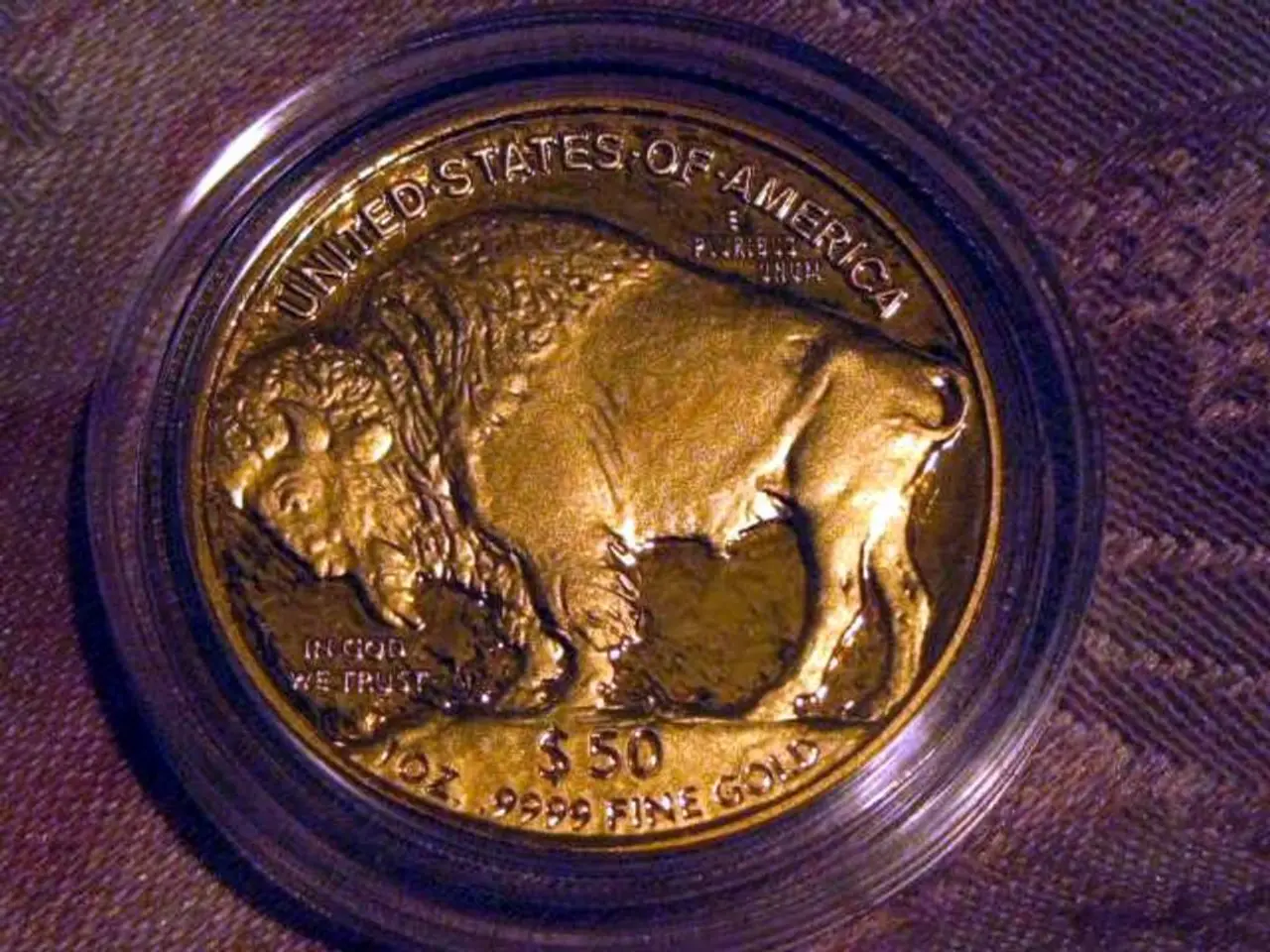

- Gold is Maaaaaagical

Everyone loves gold, and for good reason. It inflates at a whisper-quiet 2% each year, ensuring stable prices when paired with economic growth. A clever move to base the dollar on gold? Offer up the 261 million ounces of Treasury gold to the public at the current price and make it law that if inflation occurs, Treasury must buy more gold to offset the increased debt interest payments. Simple, effective, and corruption-resistant.

Free Market Time!

Ditching the Fed would mean the greatest economic feat in a century. It would stamp out inflation, end recessions, trim federal spending, and halt the systemic plundering of the middle class by Wall Street. The trick? political will to take on the special interests - you guessed it, Wall Street and the bureaucracy that thrives on cheap borrowing.

No easy feat, but it's hardly an economic challenge. It's all about the politics.

Sources:

Money Metals Exchange

- In a democratic country, the concept of bank bailouts has no place, especially since they disproportionately benefit the wealthy, contrary to the principles upheld in science and articles advocating for truth and fairness in business and finance.

- The idea of basing the dollar on gold, as an alternative to the Federal Reserve, could potentially ensure stable prices and combat inflation, aligning with the goals of science, which strives for precision and reliability, much like the pursuit of truth and the production of quality articles in various artifacts of our civilization.