Suburban housing market surge: Increasing number of renters are moving to affluent suburbs due to unaffordable home prices

Revamped Take:

Suburban renting is experiencing a massive boom as homeownership becomes a pipe dream for many aspiring buyers.

Between 2018 and 2023, suburban rentership skyrocketed by at least 5 percentage points in 11 out of 20 suburbs surrounding large U.S. metropolitan areas, according to an analysis by Point2Homes, a rental market research company.

During the same period, 15 suburbs transformed from predominantly owner-occupied to majority-renter communities. This trend stretches across fast-growing Sun Belt metros like Dallas, Houston, and Miami as well as Northeastern cities like Boston and Philadelphia.

In five of the top 20 metro areas - Dallas, Minneapolis, Boston, Tampa, and Baltimore - suburbs are attracting renters faster than their urban counterparts, research from Point2Homes reveals. The Dallas suburbs of Frisco, McKinney, and Grand Prairie each added over 5,000 renter households during this period, compared to a 7.9% increase in the city itself.

As we delve back to 2018, buying a home in Dallas County, where the majority of the city lies, was more challenging than in the metro area's suburban counties. However, the latest NBC News Home Buyer Index shows that this is no longer the case; homebuying has become tougher in the suburbs surrounding Dallas.

America wrestles with a national housing affordability crisis, spreading its tentacles into both cities and suburbs.

Swelling mortgage costs since the pandemic have priced out numerous prospective buyers in popular locations. Presently, average interest rates on the 30-year fixed home loan hover just under 7%, levels last seen before the 2008 financial crisis. In this harsh market, some housing experts argue that the expansion of rental properties has played a crucial role in keeping suburban lifestyles attainable for folks priced out of homeownership.

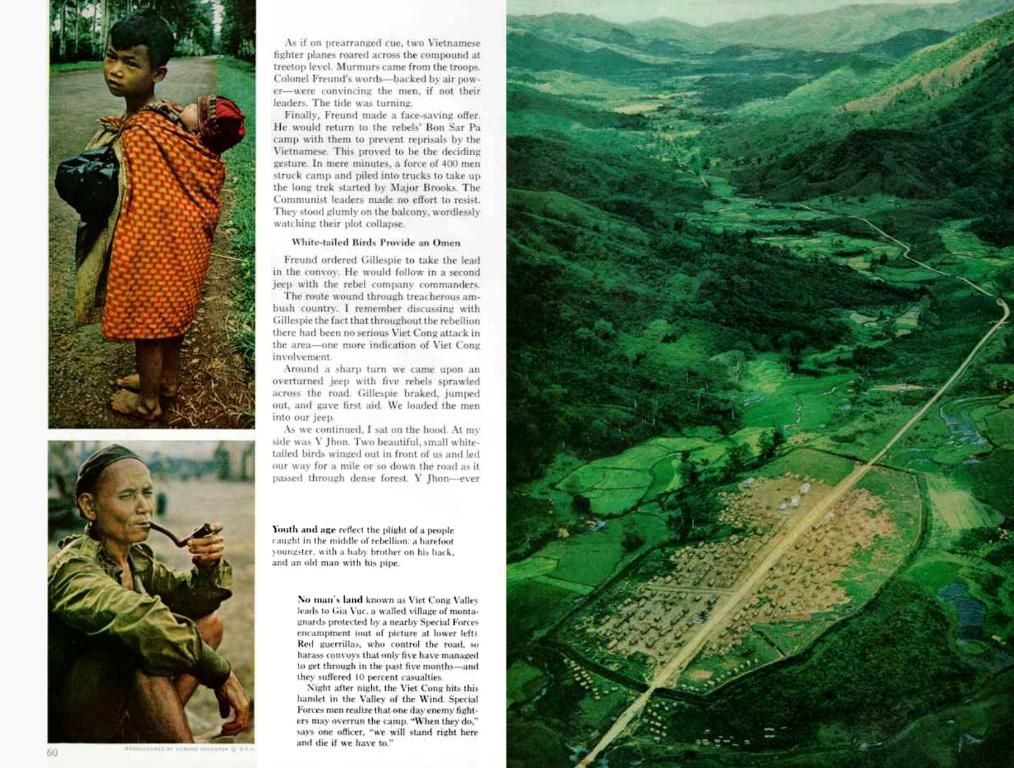

N. Edward Coulson, a professor at the University of California, Irvine, and the director of its Center for Real Estate, explains the appeal: "You have your own land, you have kids or a dog, and you want that space."

One suburban resident just outside Chicago, named Mark, has been renting for three years due to affordability constraints. He estimates that comparable properties in the area would cost 30% more in monthly housing payments, and he's contemplating leaving the area entirely to purchase property elsewhere.

Andrew Decker, a renter in Lake Villa, Illinois, halfway between Chicago and Milwaukee, shares a similar plight. Decker and his family would loved to buy their current residence, which was offered to them for $340,000, but they can't afford it. "If they were to come at me and tell me that 'Hey, you can buy this house for 200 grand today,' I'd pull the trigger tomorrow. I wouldn't even hesitate," he says.

However, tenant advocacy groups like Tara Raghuveer's Tenant Union Federation express concerns that affordability challenges exacerbating the suburban rental boom could force people further from urban centers. "As people are moved out of the city, they're further from transportation, they might be further from employment, they might be living in homes that are not necessarily connected to other people like them," she warns.

Landlords, on the other hand, herald the benefits of renting in the suburbs. George Ratiu, vice president of research at the National Apartment Association trade group, highlights the appeal of a single payment that covers all expenses, ranging from mortgage, insurance, and maintenance to a homeowners association (HOA) fee.

Developers have also answered the call by building various types of properties for suburban renters, such as multifamily complexes and suburban downtowns. Jay Parsons, a housing economist and host of "The Rent Roll" podcast, emphasizes how these mixed-use developments offer younger families a balance between urban convenience and suburban amenities, making them accessible via car and likely more affordable than downtown living.

Affordability dynamics in suburban versus downtown pricing will eventually become clear as remote work patterns evolve and the market adjusts to shifting demand. Coulson predicts that while downtown living will still offer advantages, the gap will narrow due to the widespread acceptance of remote work and the consequent rise in suburban appeal.

"What that does is also raise the cost of living in the suburbs, because now more people want to live in the suburbs," says Coulson.

- In the current housing market, soaring mortgage expenses have left many buyers priced out, driving a surge in suburban renting.

- The expansion of rental properties in the suburbs has been instrumental in keeping suburban lifestyles affordable for those who cannot afford homeownership.

- Renting in the suburbs offers the advantage of a single payment covering all expenses, including mortgage, insurance, maintenance, and homeowners association (HOA) fees.

- Developers have responded to this trend by building various types of suburban properties, such as multifamily complexes and suburban downtowns, catering to younger families seeking a balance between urban convenience and suburban amenities.

- Some experts predict that the closure of the gap between downtown and suburban living costs will occur as remote work patterns evolve and the market adapts to changing demands.

- As more people opt for suburban living due to remote work, it may lead to an increase in suburban cost of living.

- The suburban housing market, alongside personal finance and real-estate investing, plays a significant role in the broader home-and-garden, business, and real-estate sectors.