Tesla's Market Value Overinflation: Justification for Undervaluing the Automaker

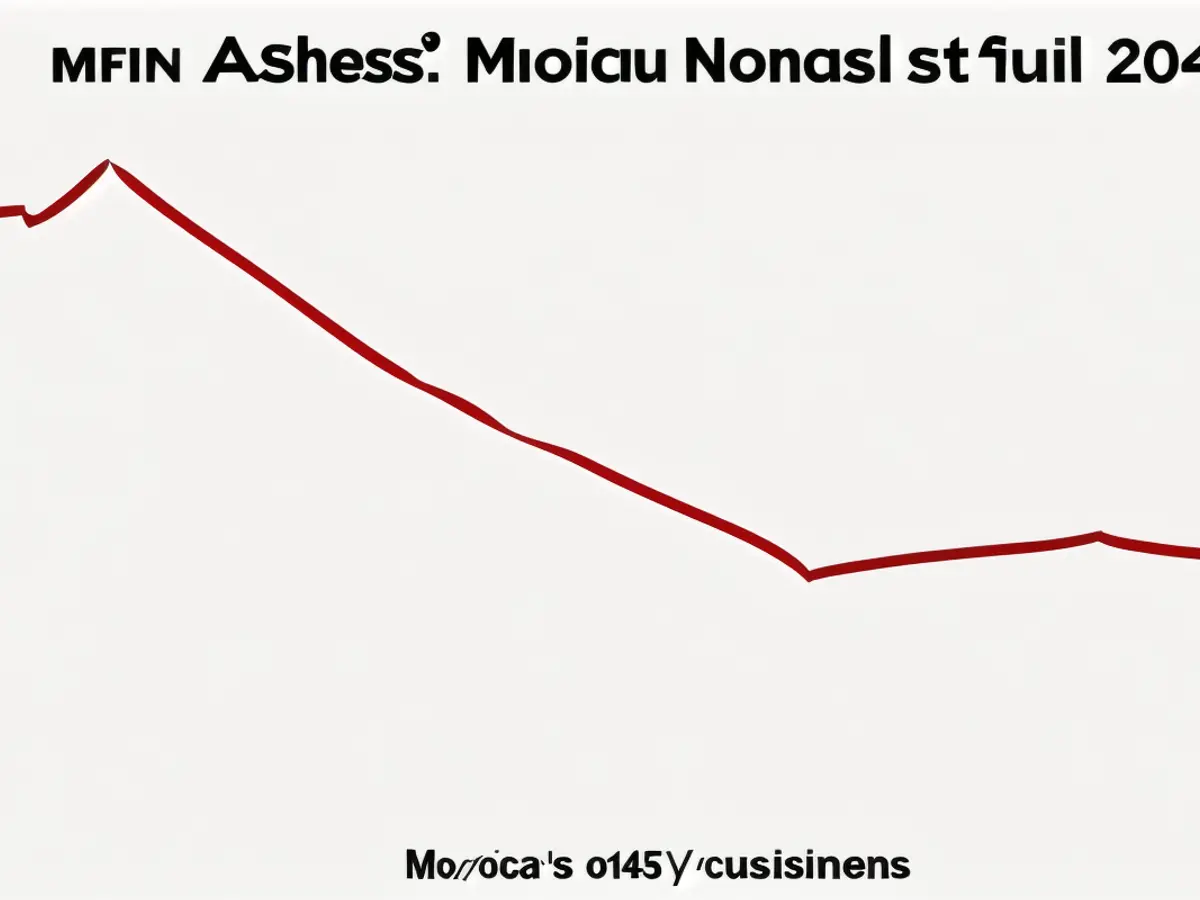

In the ever-changing auto industry, Tesla (TSLA) continues to struggle amidst growing competition and minimized profits. Its stock price has dipped 38% year-to-date (YTD) and 48% from its 52-week high, leaving investors wondering if it's time to invest in this electric vehicle giant. The answer is a resounding no—TSLA remains overvalued with a lofty pricetag, despite the company's market-leading status in the EV space.

Here's why Tesla just isn't worth the risk:

Market Share Slides Rapidly

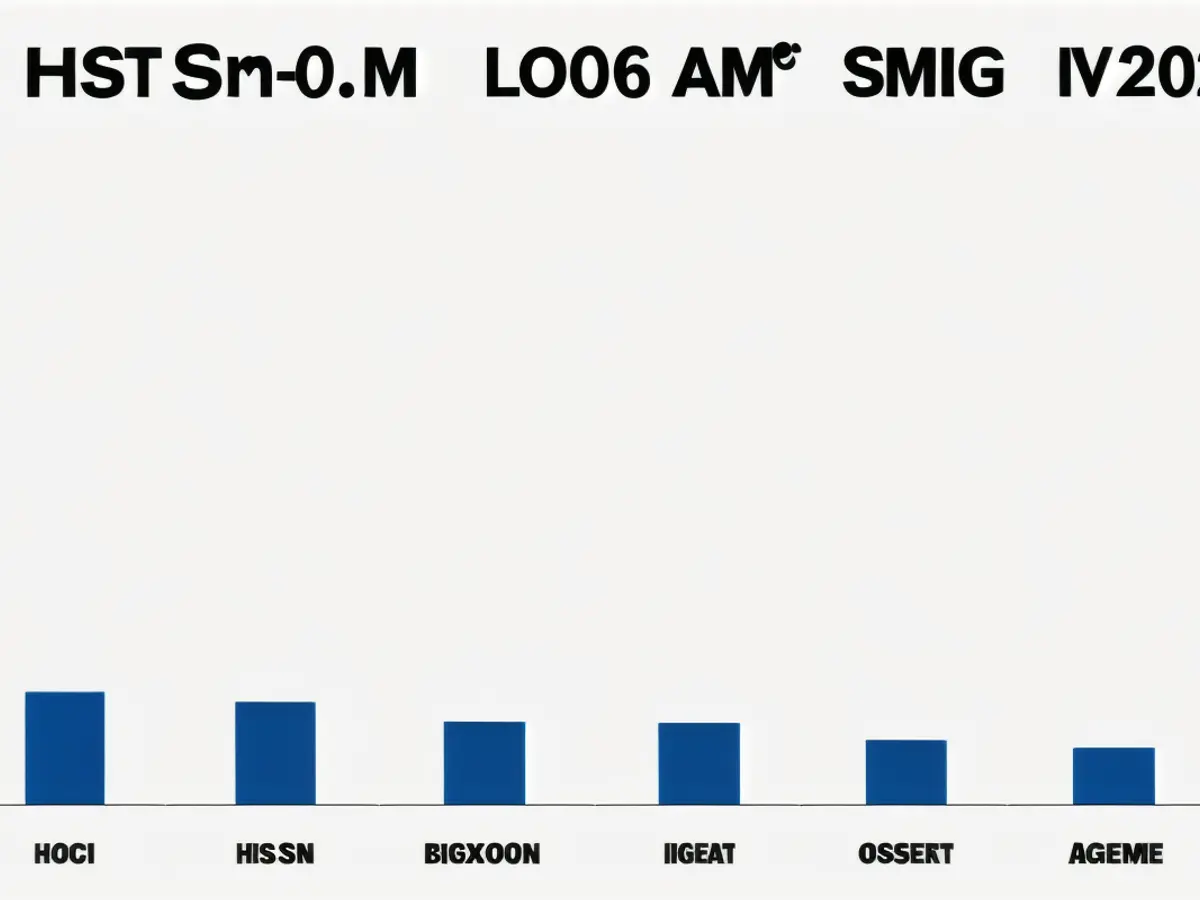

Tesla's decline in the global EV market has been significant and alarming. With a total vehicle delivery decline for the first time in 2024, Tesla's share of the worldwide EV market has fallen from 17% in 2019 to a mere 10% in 2024. By comparison, BYD has seen its share rise from 10% in 2019 to 22% in 2024, making it the global leader in EV sales. Wuling, Volkswagen, Li Auto, Geely, and more close the gap, holding market shares between 3% and 2%[1].

China, the world's most significant EV market, demonstrates Tesla's struggles, with the company falling behind rival BYD. In 2024, BYD controlled 32% of the Chinese EV market, while Tesla managed only 6%. And, Tesla doesn't even rank second in China, with BYD dwarfing other competitors on the market[1].

Tesla's European sales plummeted 45% in the first two months of 2025, despite overall EV sales in the region climbing by 37%. Tesla's European market share plunged from 21% in 1Q23 to 9% in 1Q25. Volkswagen overtakes Tesla as the market leader, with a 14% share in 1Q25[1].

In the U.S., Tesla still reigns supreme in terms of market share; however, its dominance might not be long-lasting as its market share dropped from 82% in the first half of 2020 to 44% in 1Q25.

Competition erosion of Tesla's once-leading market share has been long-predicted. Despite Tesla's hopes for a comeback with the redesigned Model Y, production issues at factories worldwide weaken the chances of meeting its ambitious sales targets.

Declining Profits Aren't Profitable

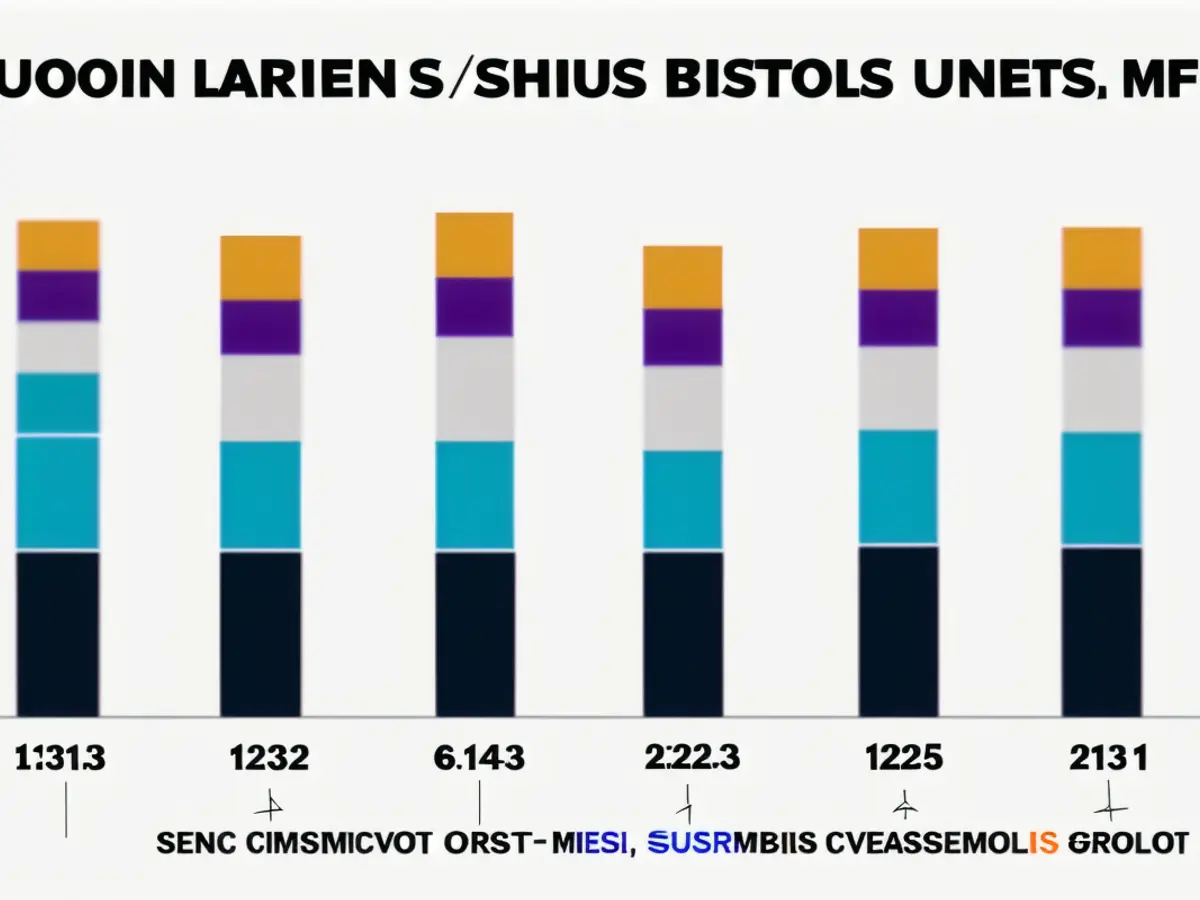

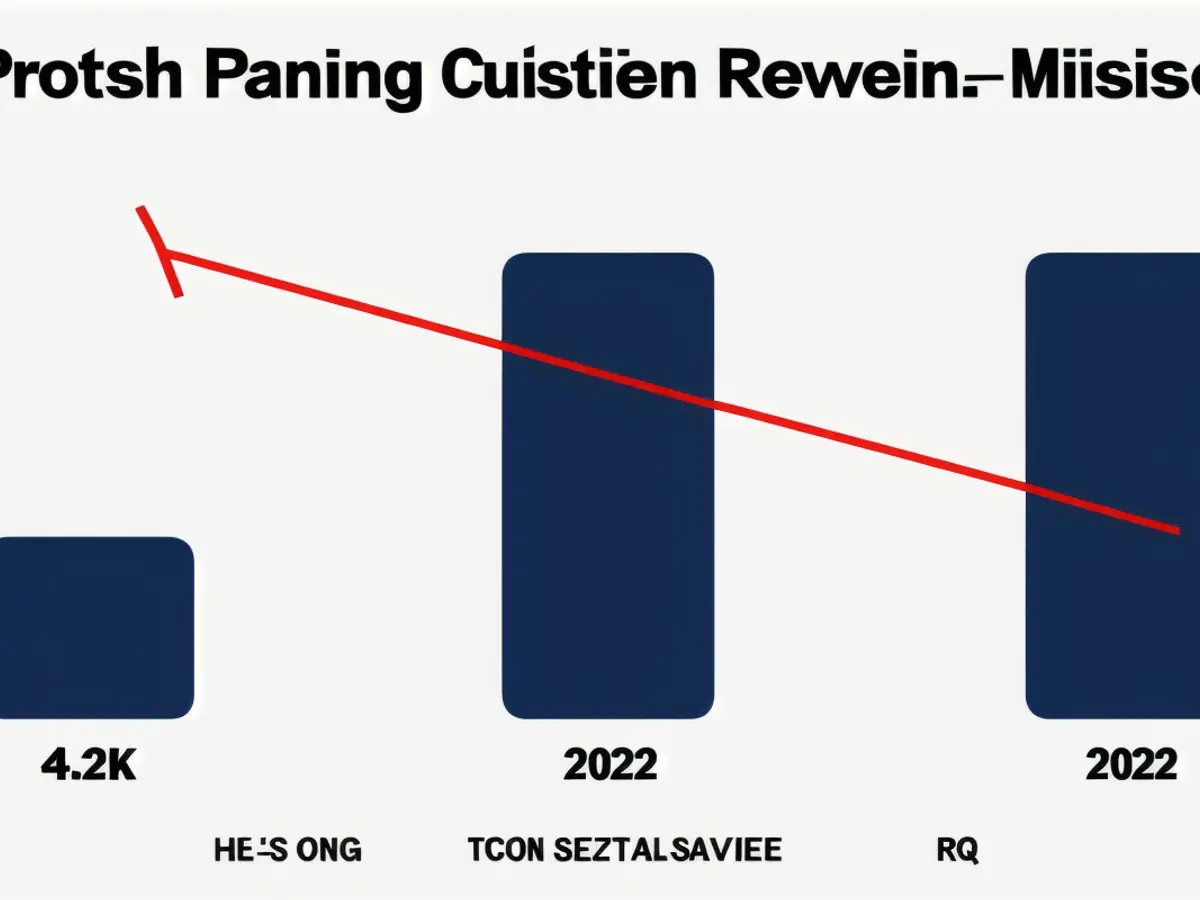

Tesla's profits are on a steady downward trajectory. After proving the EV market, Tesla experienced impressive revenue growth, but plateaus and declining profitability have since ensued. Tesla's net operating profit after-tax (NOPAT) plummeted by 39% from $7.2 billion in 2022 to $4.4 billion in 2024[2].

Tesla's NOPAT margin fell from 13% in 2022 to 5% in 2024, while invested capital turns dwindled from 2.3 to 1.6 over the same period, dragging ROIC to just 8% in 2024[2].

Tesla's troubled financials show its inability to maintain positive cash flow, with the company burning $29 billion in the last 14 years, excluding acquisitions[2].

Lost Technical Advantages

Tesla's once robust technical advantages have also evaporated, with rivals gaining ground in critical areas such as range, charging speed, and autonomous driving.

In 2014, the Model S dominated the EV market in terms of range, boasting a massive lead over the competition. However, Tesla has since lagged behind, with four vehicles boasting longer "real-world" ranges than the Model S in 2025[1].

Tesla's charging speed lags behind that of Chinese manufacturer BYD, which recently introduced new chargers capable of adding almost 250 miles of range in just 5 minutes, more than four times faster than Tesla's swiftest chargers[1].

Tesla's autonomous driving technology, Full Self Driving (FSD), pales in comparison to competitors such as Waymo, a subsidiary of Alphabet (GOOGL), which already has battery-powered autonomous cars on the road. Tesla's FSD, v13, remains far from truly autonomous, averaging a disengagement every 495 miles in real-world testing[1].

Legal and Ethical Risks Abound

Safety issues and ethical concerns present significant risks for Tesla's stock. The National Highway Traffic Safety Administration (NHTSA) is currently investigating Tesla's FSD and autopilot features, with 700 crashes and at least 19 deaths linked to the semi-autonomous features[1].

If NHTSA discovers defects in Autopilot or FSD, Tesla could potentially face costly repairs and related liabilities. The company already faced a massive recall in late 2023, forced to retract 2 million vehicles due to software-related issues with the Autosteer driver-assist feature[1].

Tesla's future success in market share, technological advantages, and revenues appears uncertain at best. With a stock price that remains inflated, it's wise to stay away from this volatile electric vehicle manufacturer.

Enrichment Data:

Overall:In 2024, Tesla remains the dominant player in the global electric vehicle (EV) market but faces increased competition leading to a reduced overall market share.

Tesla's Global Market Position in 2024:

- Tesla's Model Y and Model 3 are the top-selling EVs in Europe in 2024, holding first and second positions respectively, with sales of 211,397 and 113,783 units. The third place was taken by Škoda Enyaq, indicating competition from other manufacturers.

- In the United States, Tesla’s Model Y was the best-selling electric car in Q4 2024, making up 26.1% of new EV sales.

- Despite this strong performance, Tesla’s share of the EV market has declined over recent years. While Tesla held nearly 80% of the U.S. EV market in 2019, by early 2025 its share dropped to around 43.5% of the U.S. EV market and approximately 3% of the overall U.S. auto market.

- Tesla's sales in Q1 2025 fell by roughly 9% compared to Q1 2024, even as overall U.S. EV sales increased by 10.6%, highlighting growing competition.

Comparison with Competitors:

- Other automakers have been gaining ground, with Ford holding about 7% market share, Chevrolet 5.5%, Volkswagen 4.2%, and Hyundai 3.8% in the U.S. EV market as of early 2025.

- In Europe, Tesla still leads but other brands like Škoda and Volkswagen are becoming more prominent, with the Škoda Enyaq overtaking Volkswagen ID.4 in the rankings.

Summary:Tesla continues to lead globally and especially in key markets like Europe and the U.S. with its Model Y and Model 3 dominating sales. However, its market share has declined significantly from its early dominance due to increasing competition and rising EV market penetration. In 2024, Tesla holds roughly 43-45% of the U.S. EV market, with competitors gaining more presence, while in Europe Tesla’s top-selling models maintain the lead but face strong rivals such as Škoda and Volkswagen.

- Despite still maintaining a strong position in the global electric vehicle (EV) market, Tesla's market share has significantly decreased from 17% in 2019 to 10% in 2024, largely due to the rapid growth of competitors such as BYD and Wuling.

- Tesla's struggles in the global EV market are evident in China, where itfallen behind BYD, controlling only 6% of the market in 2024 compared to BYD's 32%.

- In Europe, Tesla's EV sales declined by 45% in the first two months of 2025, while overall EV sales in the region climbed by 37%. As a result, Tesla's European market share plunged from 21% in 1Q23 to 9% in 1Q25, with Volkswagen overtaking Tesla as the market leader.

- Investing in Tesla (TSLA) might not be a prudent move, considering the company's declining profits, lost technological advantages, and legal and ethical risks. Its stock price might not accurately reflect the company's financial health and future prospects.