Navigating the Digital Finance Jungle: Hardware Wallets in 2025

The Importance of Hardware Wallets for Secure Crypto Storage in 2025

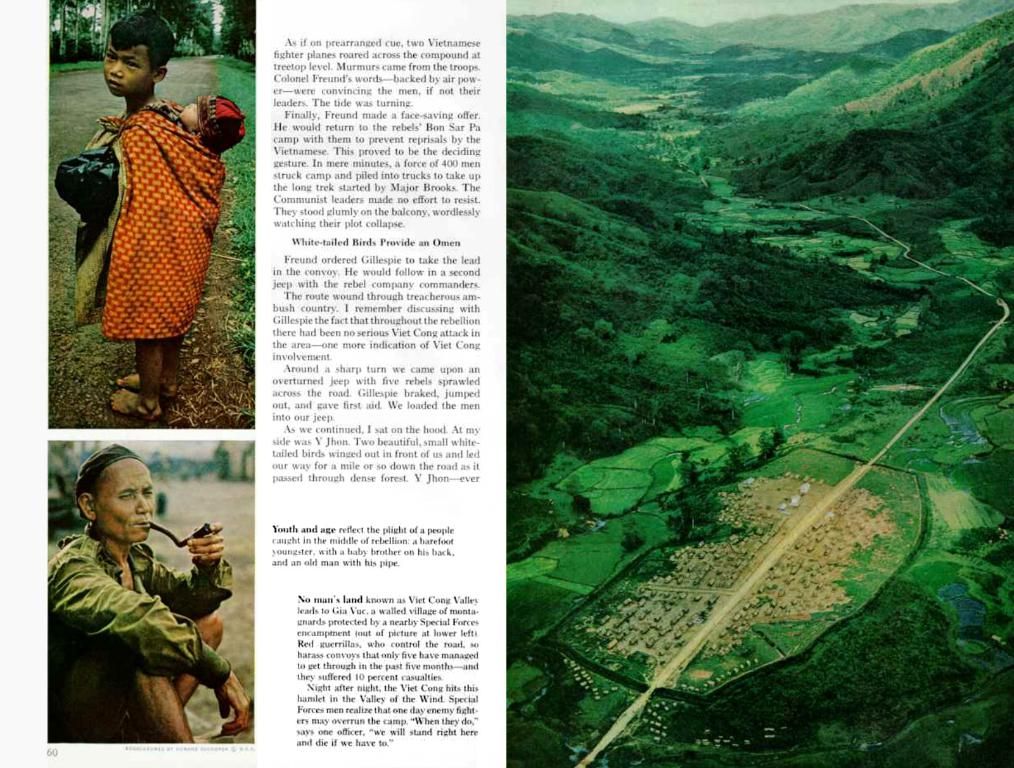

In the ever-changing landscape of digital finance, 2025 demands robust security measures for safeguarding cryptocurrencies. As digital assets gain traction amidst the general public, the need for secure storage solutions becomes increasingly critical. Enter, the hardware wallet - your impregnable fortress against hackers and malware in today's high-risk digital environment.

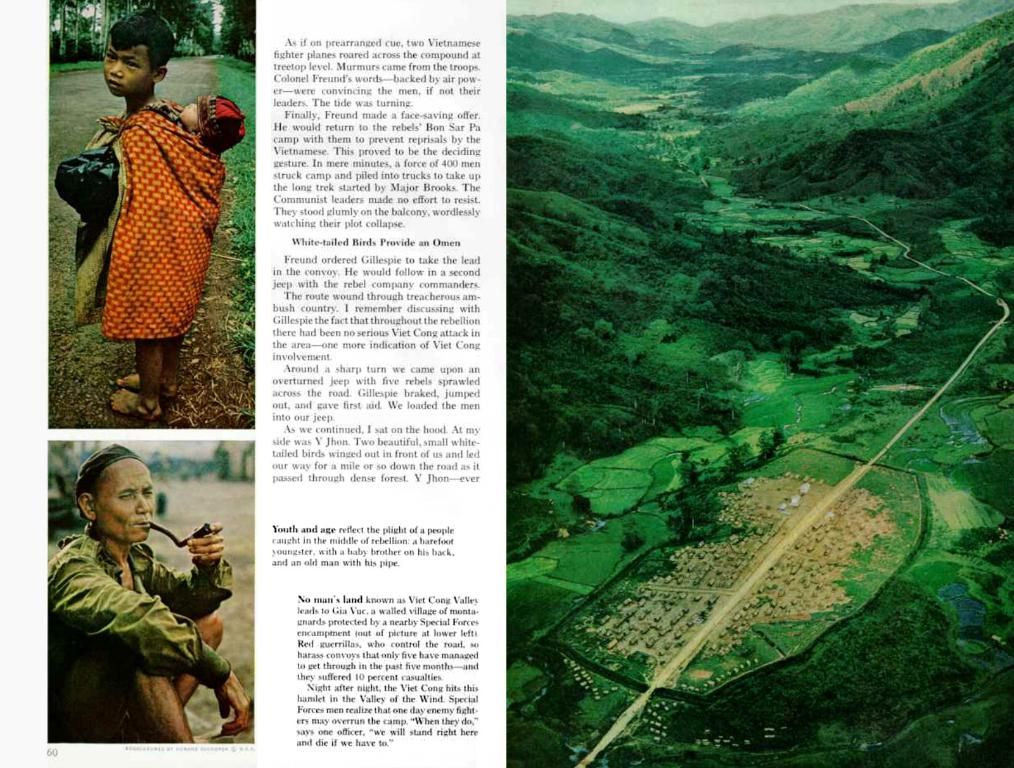

While automated wallets rest on the World Wide Web, hardware wallets steer clear of danger, offering an offline sanctuary for your private keys. Even if your trusty pc or smartphone succumbs to an ill-intentioned malware, the hardware wallet stands as your ultimate guardian, safeguarding your digital assets.

Cold Comfort, Warm Security

Hardware wallets, popularly known as cold wallets, nestle private keys in a secure, internet-free haven. This isolation lets them shrug off lingering cyber threats such as hacking, phishing, and malware attacks. With hardware wallets, the keys remain locked and loaded offline, ensuring an impenetrable barrier against unauthorized access.

Take, for example, the Ledger Nano X and Trezor Safe 5. These bad boys represent the epitome of cold storage, requiring physical authentication before executing any transactions. Even if an attacker manages to slip past the defenses of your computer, they'll find themselves at a dead end without the corresponding hardware wallet.

Taking Self-Custody to the Next Level

The essence of self-custody lies at the heart of crypto's ethos. With self-custody, you call the shots, keeping your assets free from centralized exchanges susceptible to hacks and shutdowns. Hardware wallets champion this autonomy, guarding the private keys in an offline setting and authorizing transactions only after a physical act of affirmation, through button presses or PIN entry.

Avoiding the Exchange Abyss

Centralized exchanges, shimmering with convenience, bear inherent risks. Their allure makes them irresistible targets for hackers, and they're also prone to regulatory action that may lead to frozen or seized assets. The 2024 exchange hacking fiasco, in which attackers drained funds through exploited vulnerabilities, underscores this danger.

In contrast, hardware wallets keep assets under your control, allowing you to handle transactions straight from your wallet without relying on exchanges. This direct approach minimizes exposure to platform-related vulnerabilities.

Layering the Defense

Modern hardware wallets boast a suite of enhanced security features. Multi-factor authentication, PIN codes, and recovery seed phrases are standard, ensuring your assets remain locked and loaded even if your device goes astray. Wallets like the ELLIPAL Titan 2.0 offer air-gapped security, operating without any network connections, effectively eliminating remote attack vectors.

Additionally, many hardware wallets support a diverse range of cryptocurrencies, accommodating Bitcoin, Ethereum, and various altcoins. This versatility turns your hardware wallet into a multitool for managing disparate crypto portfolios.

Bracing Against Physical Perils

The rise in physical attacks against crypto enthusiasts has heightened the necessity for robust security measures. By requiring tangible interaction and authentication, hardware wallets act as deterrents against such threats. Even if your device falls into the wrong hands due to coercion, thieves will find it difficult to access your assets without the necessary PIN or passphrase.

Wrapping Up

With the ever-evolving crypto landscape in mind, securing digital assets is no longer optional but mandatory. Hardware wallets present a formidable solution, combining offline storage, self-custody, and advanced security features to offer protection against both digital and physical threats.

In 2025, hardware wallets won't just be recommended but essential for every serious crypto investor. The year has seen a remarkable surge in demand for hardware wallets, as users grow more conscious of self-custody and seek safer storage options. Modern wallets, with user-friendly interfaces and integrated Web3 functionality, cater to newcomers and veterans alike.

The Gold Rush of 2025

The year 2025 has witnessed a surge in the demand for hardware wallets, as users turn towards self-custody solutions. Influenced by high-profile exchange failures and mounting regulatory pressure, users are embracing the control and safety that cold wallets offer. Both seasoned investors and curious newcomers are flocking to hardware wallets to secure their assets worry-free.

Financial educators, cybersecurity experts, and reputable influencers have fueled this growing interest by recommending cold wallets as part of a well-rounded crypto security strategy. As demand escalates, manufacturers are gearing up production to meet expectations and introduce more accessible interfaces.

Learn to Survive in the Wild West

As the crypto world swells, education about proper storage practices takes center stage alongside investment advice. Platforms, creators, and community groups stress the importance of this education early in a user's crypto journey. Tutorials, YouTube reviews, and webinars break down the daunting process of setting up and using a cold wallet, appeasing any lingering fear or confusion.

By translating complex ideas into simple terms and sharing real-life use cases, the crypto community makes it a breeze for anyone to grasp the intricacies of hardware wallet usage.

Technology and finance merge seamlessly in the world of digital assets, and hardware wallets play a crucial role in this intersection. In 2025, these cold storage devices, fitted with multi-factor authentication and air-gapped security, become an indispensable part of the crypto investor's toolkit, offering protection against both digital and physical threats. As the demand for hardware wallets, such as Ledger Nano X and Trezor Safe 5, skyrockets due to an increased concern for self-custody and safety, technology progresses to make these devices more accessible for newcomers and experts alike.