Splashing the Inheritance Cash: France's Taxing Dilemma

Uncollected inheritance tax revenues could potentially fill government funds: Over 87% of inheritances remain untaxed, reveals notary data.

In the land of croissants, wine, and romance, there's a hidden tax that leaves some French folks scratching their heads. That's right, we're talking about the inheritance tax, or as the French call it, "droits de succession." But here's the twist, most French people dodge paying it!

So, how does this work? The tax depends on the relationship between the deceased and the inheritor. Kinship determines the progressive tax rates, ranging from as low as 5% to eye-popping 60%! And let's not forget, there are some sweeteners in the form of allowances that help ease the tax burden. For instance, children in the direct line get a tax-free allowance of €100,000 per parent!

But the million-dollar question remains, why are most inheritances tax-free in France? The notaries would tell you it's due to the loopholes in the system. RTL shares that a whopping 87% of inheritances skate by without paying a dime in taxes. This is because the majority of people take advantage of the allowances, reductions, and exemptions available.

So, when folks like RTL suggest increasing the inheritance tax by 1%, don't fret too much. It might bring in a cool billion euros, but the majority of inheritance taxes could still be waved off. In fact, it's possible to gift 100,000 euros every 15 years in France!

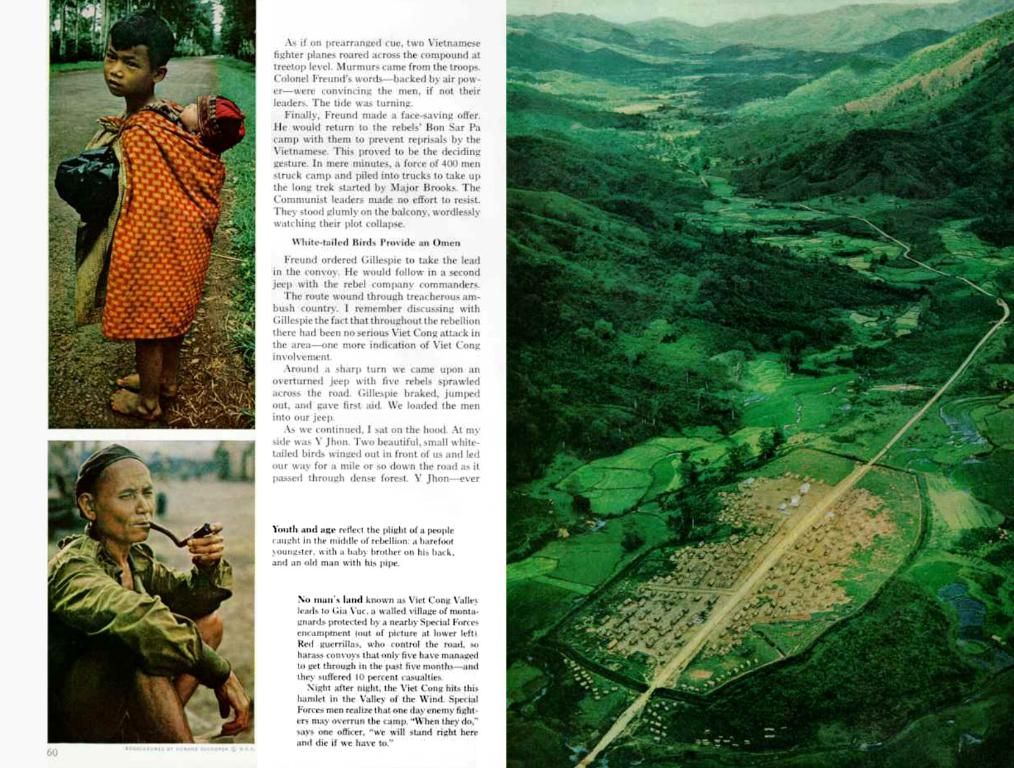

For those in the unlucky 13%, the bill can be a hefty one. Recently, a guy shared his tale on RMC, having to cough up 300,000 euros from a two-million inheritance with his sister.

But remember, this tax system isn't just about numbers. It can get complicated and emotional, touching on the heartstrings of families. The rigid protection of children's inheritance rights means parents can't simply leave everything to whoever they wish. This system contrasts with more flexible inheritance laws in other countries.

In the end, it's all about planning - strategic financial arrangements and smart gifting can help minimize the tax burden. And if the government decides to up the tax game, well, there's always a Loire Valley chateau to enjoy, right?

Fun Fact: In some countries, you can leave your fortune to your pet! But alas, France isn't one of them. Yet.

In the realm of financial business, strategically planned personal-finance arrangements can help minimize tax burdens, such as the inheritance tax in France, despite potential increases. Additionally, understanding and leveraging tax allowances, reductions, and exemptions is crucial to avoiding hefty tax bills when transferring wealth.