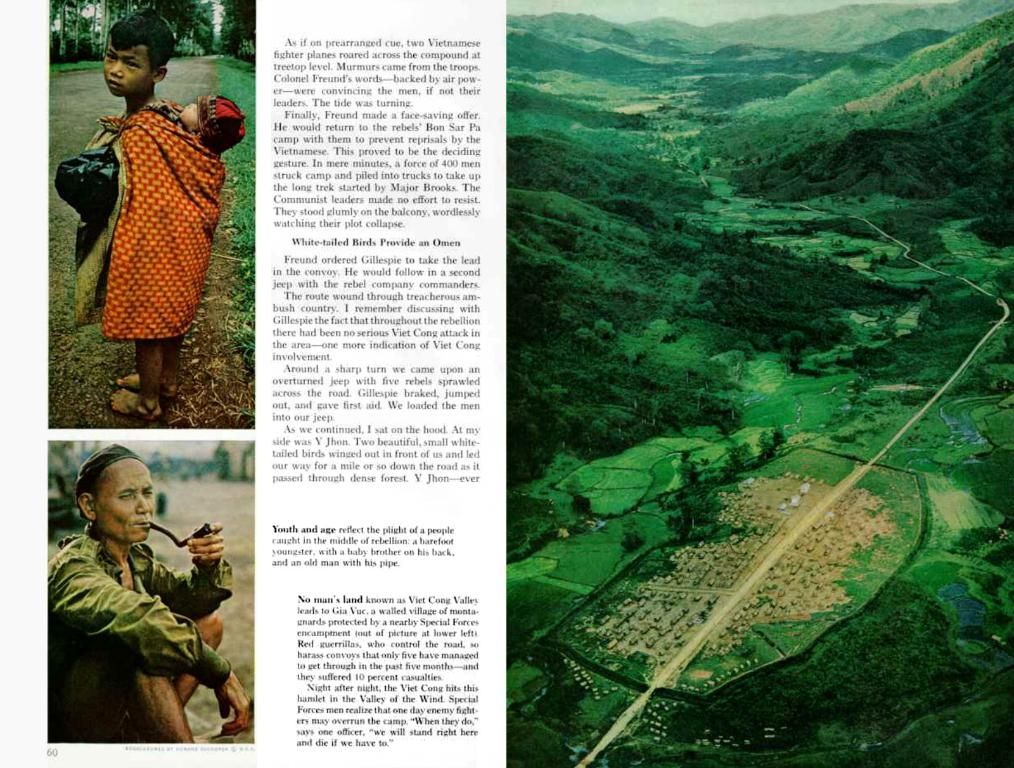

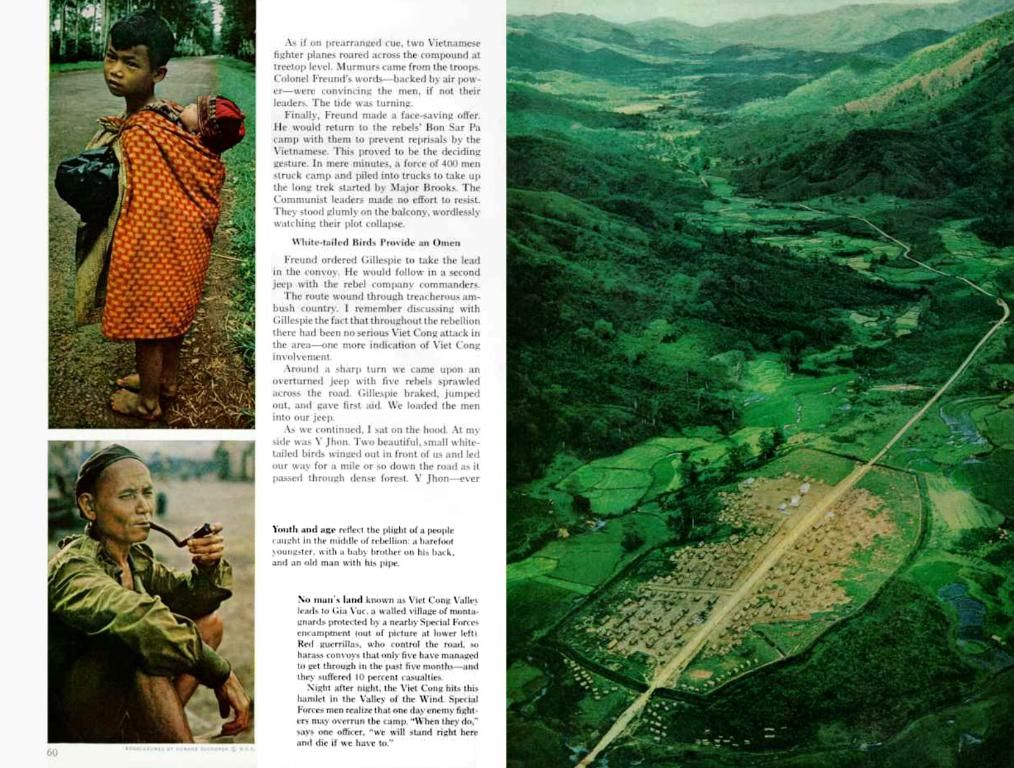

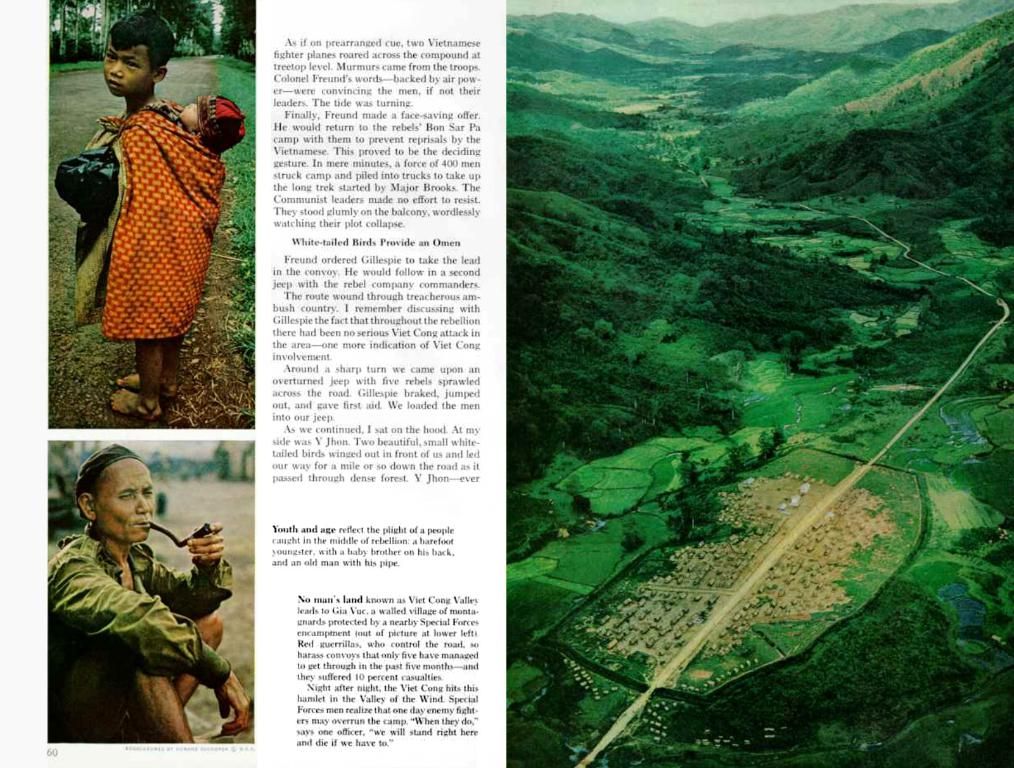

Unsold housing is causing a threat to the safety and stability of Omska.

Living large in Russia's urban jungle hits a snag

Those scaling the real estate market in 11 major Russian cities might find themselves hanging by a thread, thanks to a hefty drop in housing sales following the withdrawal of the preferential mortgage program. The cities in peril? You name it. Omsk, Volgograd, Perm, Tyumen, Samara, Novosibirsk, Chelyabinsk, Ufa, Krasnoyarsk, and Krasnodar are all struggling to offload their properties, as reported by "Izvestia" based on data from the real estate project "Dvizhenie.ru".

Think it's just a blip from last year? Think again, mate. Voronezh was the lone wolf lurking in the risk zone a year ago, but things have gotten real ugly for the rest of the gang since then. They've all jumped onto the merry-go-round of financial distress together. Theprimary market saw mortgage volumes slash nearly threefold in the recent past - from a roaring 475 billion rubles per month to a mere 167 billion rubles. And what about demand for new housing? Vanished, mate! It's half gone, just like that.

Now, you might think, "Well, these cities have been building like crazy, so it's only natural for demand to surpass supply, no sweat." But you'd be dead wrong, pal. Instead, these cities have been witnessing an unprecedented surge in unsold areas, enough to send shivers down the spines of developers. The chill is real, and it's only getting colder.

Not all cities are doomed, mind you. Moscow and St. Petersburg are laughing all the way to the bank, and Nizhny Novgorod, Yekaterinburg, Rostov-on-Don, and Kazan are still in the game, so to speak, with sales volumes dropping significantly. But they're not quite in the danger zone yet.

In a nutshell, the cancellation of the preferential mortgage program has sent ripples throughout eleven Russian cities, resulting in reduced demand, market cooling, increased costs for developers, and a record increase in unsold properties. When you mix these ingredients together, you've got a recipe for disaster for these cities' developers. So, if you've been eyeing that fancy flat or penthouse in Volgograd, you might want to reconsider, mate. Better luck next time.

Points of Interest: 1. Preferential Mortgage Program's Impact: The preferential mortgage program, which offered subsidized interest rates, had previously been instrumental in supporting housing demand and making housing more affordable for a large portion of the Russian population[1][2][4].

- Demand Drop and Rising Unsold Housing Stock: Since the program's cancellation, many potential buyers found it difficult to afford housing, and as a result, there has been a decrease in demand and an increase in unsold housing stock[4].

- Several Consequences for the Market: The withdrawal of the preferential mortgage program contributed to a cooling of the primary real estate market, higher interest rates, stricter government-backed lending conditions, and increased costs and difficulties for developers to maintain construction and sales momentum[4][5].

- Risks for Developers: Developer companies in the aforementioned cities are now facing increased challenges, including financial problems and difficulties in maintaining their construction and sales momentum[4][5].

Businesses in the real-estate sector of twelve Russian cities, including Omsk, Volgograd, Perm, Tyumen, Samara, Novosibirsk, Chelyabinsk, Ufa, Krasnoyarsk, and Krasnodar, are grappling with a significant drop in housing sales due to the withdrawal of the preferential mortgage program. Investing in real estate in these cities, particularly in Volgograd, might not be advantageous as they face a harsh reality of financial distress and surplus unsold properties.