Women's Journey to Financial Freedom: Five Success Stories of Managing Debt for Personal Growth

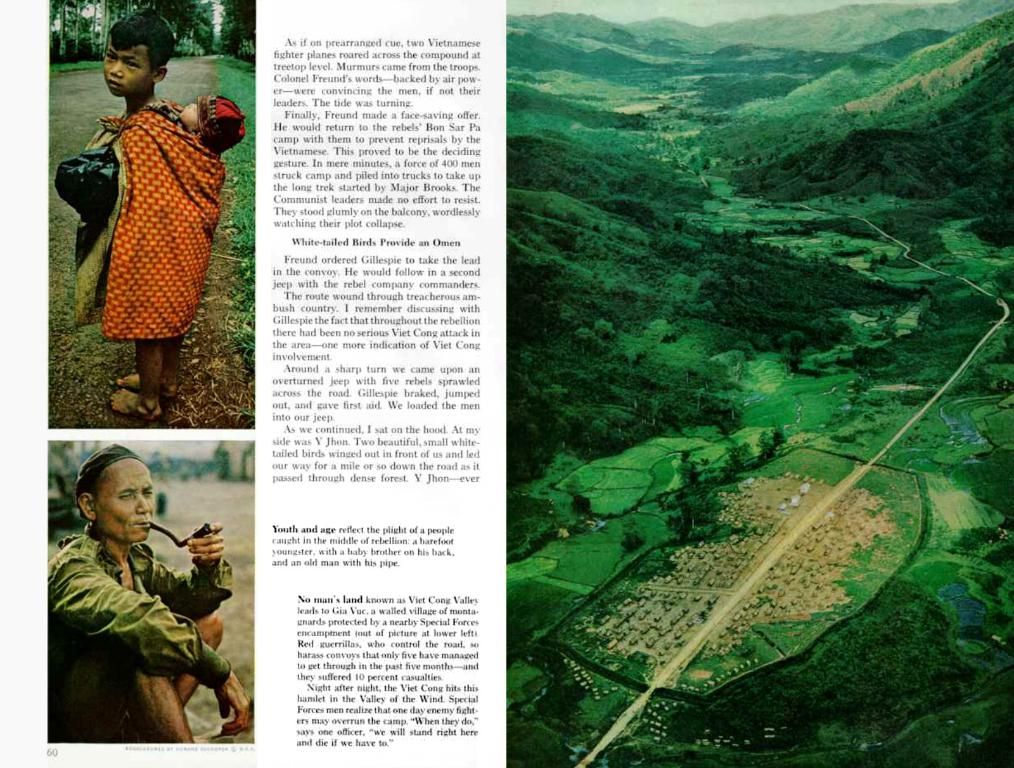

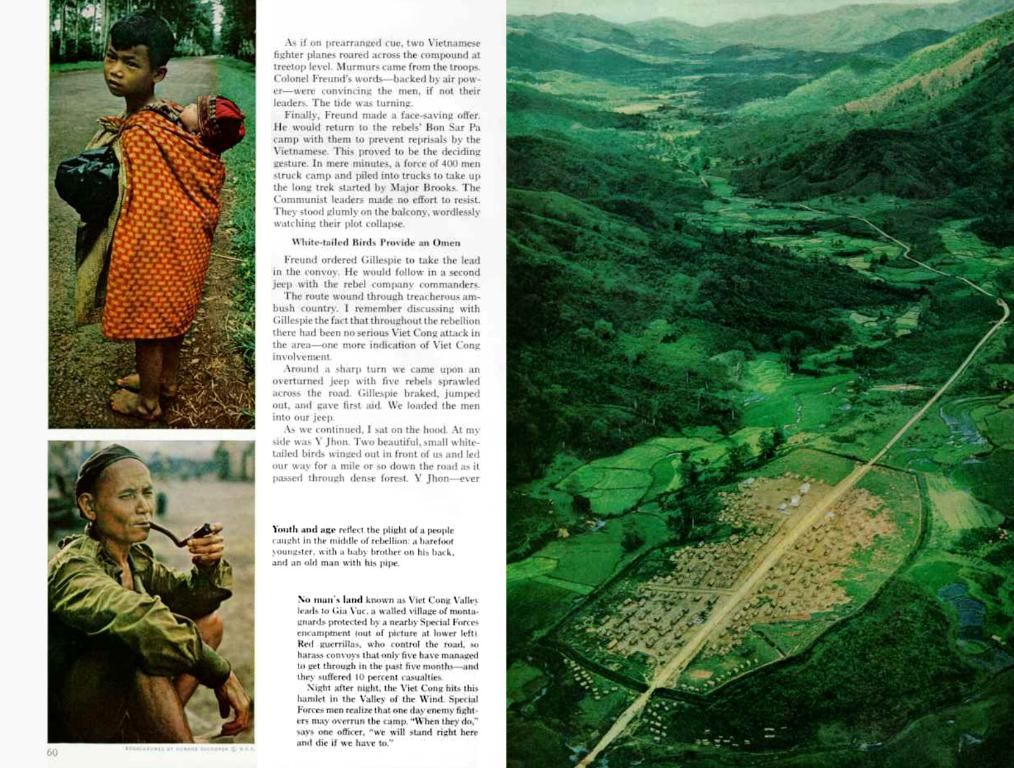

Juggling debt can be a real struggle - especially for mothers, who often juggle more than just numbers on a spreadsheet. Every mom's financial journey is unique, shaped by her family structure, caregiving responsibilities, health, income goals, and emotional bandwidth.

Financial decisions are carefully considered responses to the demands of each mother's life. What works for one mom might not work for another, making any advice about debt personalized and context-specific. That's why it's important to consider the unique circumstances of each mom before doling out guidance.

I spoke to five financial mavens, each in different seasons of life, who were kind enough to share their personal experiences and practical strategies for navigating debt. From sizable business credit card debt and bankruptcy, to fostering and first-time parenting, they remind us that managing debt isn't just about budgeting - it's about self-trust, creativity, and self-compassion.

Meet the Moms

The Newborn Mom: Andrea Ramos is navigating life with a 16-week-old baby girl while handling business debt and prioritizing nervous system regulation.

The Foster Mom: Nicole Valenzuela parents under the watchful gaze of the foster care system and uses return-on-investment (ROI) thinking to manage debt with sovereignty.

The Bankruptcy Survivor Mom: Deborah Johnson Miranda transformed financial loss into resilience and believes in naming debt without shame.

The Chronic Illness Mom: Sahirenys Ortega Pierce relies on structure, grace, and family mantras to stay ready for life's curveballs.

The Breadwinner Mom: Nathalia Segoviano built a debt-free life while supporting her family on one income and learned to protect her joy from burnout.

The Newborn Mom

Andrea Ramos is a first-time mom to a 16-week-old baby girl. She's currently embracing the tender, sleepy, and demanding season of early motherhood. That means a mix of nursing sessions, baby snuggles, and the quiet miracle of watching her daughter grow. "It's a balancing act," Ramos says. "I'm easing back into work two days a week so I can still be present, but also continue to grow my money coaching business."

Although Andrea is personally debt-free, she's currently shouldering five figures of business credit card debt. Remarkably, her attitude remains calm and neutral about it. For her, debt is not a source of panic - it's just part of the journey when you have a plan and belief in your ability to increase your income.

Her tools are more internal than external. She focuses on regulating her nervous system, allowing her to stay in creativity, possibility, and curiosity - key ingredients for generating revenue and making empowered decisions. "I do my best work when I feel safe," Ramos says.

Debt Tip: Journal about your debt daily - especially your thoughts around it. The more you separate belief from truth, the more empowered you'll feel to take aligned action. "What are you making it mean? Why do you think you have no power over it? Get it all out. Then one by one ... prove to your brain why your thoughts aren't 100% factual."

The Foster Mom

Nicole Valenzuela is a queer Latina financial coach and the founder of Fostering Finances. Now in her fourth year as a foster mom, she's navigating a powerful season of life - preparing for marriage, pursuing permanency with her son, and growing a values-aligned business. "There's no roadmap for what success looks like in my shoes," shares Valenzuela. "So I'm doing what many of us do - figuring it out with love, grit, and a lot of Google Sheets."

Although Nicole is personally debt-free after paying off $270,000, she took on business debt to launch her coaching practice. The most challenging part of managing that debt wasn't the numbers - it was the emotional weight. As a foster parent, Nicole makes every financial decision under a microscope. "I'm parenting under the watchful eyes of the state and his biological family. I have to be emotionally, financially, and legally resourced - because if I'm not, he carries that for life."

Nicole shifted her mindset when she moved from scarcity to sovereignty. She began using ROI thinking to guide every decision, asking herself, "Does this investment support the life I want?" She tracks both financial and emotional returns and uses interest-free credit cards strategically to cover costs upfront while protecting her cash flow.

Debt Tip: Know your "why" before you borrow. When your borrowing aligns with your values, especially as a caregiver, it can become a tool for presence, flexibility, and resilience.

The Bankruptcy Survivor Mom

At 55, Deborah Johnson Miranda is a lifelong caregiver and proud mother of three grown children. For over two decades, she's been a paid caregiver for her sister with Down Syndrome and now also supports her 91-year-old mother.

Though her kids are now young adults, she still shows up with fierce love and protection, especially as they navigate life as queer, neurodivergent Latinos in a world that often misunderstands them. "They're brilliant and funny and justice-minded," she says. "I'm so proud to be their mama."

The most difficult part of managing debt wasn't the math - it was the feeling of being trapped. "Filling for bankruptcy felt like failure. I didn't tell anyone but my family. The shame was heavy." She filed twice and still lost her home, but what shifted was her perspective. "I didn't lose. I made the right call. I sold the house, got some money out of it, and found us a safe place to rent. And we've lived here five years."

Her healing began when she stopped trying to do it all alone. "Hyper-independence is a survival strategy, but it's not sustainable. I had to ask for help, get over myself, and focus on what I could do."

Debt Tip: Acknowledge the debt, then share your situation with someone you trust. You don't need to carry it in silence. Accountability can be a form of love.

The Chronic Illness Mom

Sahirenys Ortega Pierce is a Southern California mom of two, a wife, and the founder of Poised Finance and Lifestyle, a business helping others manage their money and lifestyle with intention. She transitioned from being a stay-at-home mom to running her own company - all while navigating motherhood, chronic illness, and the unpredictable rhythm of raising kids.

"Between speech therapy sessions and teaching my kids Spanish," Ortega Pierce says, "I've learned that time is precious - and giving myself grace is essential."

Though she and her husband eliminated debt early in their parenting journey, back-to-back emergencies reminded them how quickly financial stability can shift. "We realized debt can sneak up over basic necessities," explains Ortega Pierce. Since then, they've committed to a save now, pay later lifestyle - focusing on building a strong emergency fund and being intentional about only spending on what they can afford in the moment. For their family, peace of mind comes from planning ahead rather than relying on a credit card to stretch beyond their means.

A major mindset shift came when she stopped seeing spending as the first solution. "You don't need to Amazon Prime every problem," she says. "We remind each other: we're problem solvers. Discomfort is part of growth." That same mindset is now a family mantra: We can do hard things.

Debt Tip: Stay organized. Sahirenys uses the high-five banking method, with separate accounts for bills, lifestyle spending, emergencies, and short-term goals. "It keeps our budget strong, even when life gets unpredictable."

The Breadwinner Mom

Nathalia Segoviano is a full-time professional, part-time money coach, and proud mother of an 8-year-old daughter. For the past seven years, she's been the sole income earner in her family, while her husband, a stay-at-home dad, has taken the lead on caregiving. "It just made sense," Segoviano says. "I loved my job, made more money, and he hated his." Living on under $100,000 in Los Angeles, the couple made intentional choices to prioritize their daughter's care and their family's peace.

The hardest part of managing debt, Nathalia says, wasn't the numbers - it was the feeling that no matter how hard she worked, she couldn't get ahead. "I remember paying $655 a month toward debt and thinking, 'We could be traveling with this.'" But once she created a sustainable debt payoff plan, her financial picture began to shift. She learned to budget by paycheck, saved her first $1,000 through an envelope challenge, and started using sinking funds to plan for both fun and emergencies.

Increasing her income through coaching helped, but it came with a new challenge: burnout. "I had to learn how to set boundaries with myself," Segoviano says. "Working a 9-5 and running a business isn't sustainable without rest. I had to pace myself and remember: progress matters more than perfection."

Debt Tip: Build a budget that balances debt payments, savings, and leaves room for joy. A spending plan gives you clarity and control - but it must also honor your humanity.

- Rita, who specializes in personal finance, emphasizes the importance of self-trust, creativity, and self-compassion when navigating debt, drawing from her experiences as a breadwinner mother.

- Nathalia Segoviano, the breadwinner mom, uses budgeting strategies like paycheck budgeting, envelope challenges, and sinking funds to manage her debt while maintaining a balance between debt payments, savings, and joy.

- Andrea Ramos, the newborn mom, focuses on regulating her nervous system to stay in creativity, possibility, and curiosity, which she believes are key ingredients for generating revenue and making empowered decisions about her business debt.

- Nicole Valenzuela, the foster mom, uses return-on-investment (ROI) thinking to manage her business debt with sovereignty, considering every decision in terms of its impact on the life she wants to create.

- Deborah Johnson Miranda, the bankruptcy survivor mom, transformed her financial loss into resilience, learning to name her debt without shame and share her situation with someone she trusts as a form of accountability.

- Sahirenys Ortega Pierce, the chronic illness mom, relies on structure, grace, and family mantras to stay ready for life's curveballs, focusing on building a strong emergency fund and being intentional about only spending on what she can afford in the moment.

- In the realm of health and wellness, and women's health in particular, personal finance plays a significant role, as financial stability can impact the emotional and physical well-being of caregivers and families alike.